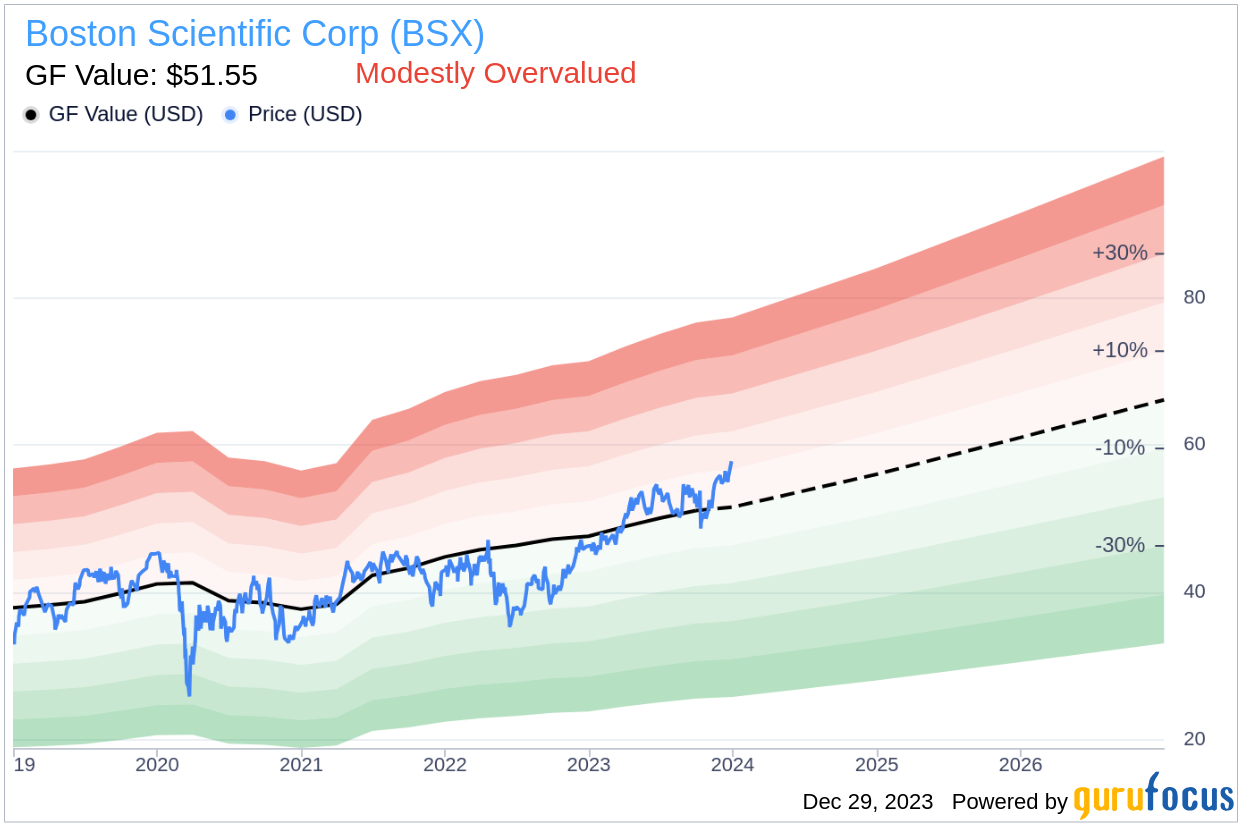

Boston Scientific Corp (BSX, Financial) has experienced a daily gain of 2.72%, and over the past three months, the company's value has appreciated by 9.55%. With an Earnings Per Share (EPS) of $0.82, investors are keen to understand whether the stock is modestly overvalued as per the current market price of $57.81. This article will delve into Boston Scientific's valuation to determine if the stock's market price aligns with its intrinsic value based on GuruFocus' comprehensive analysis.

Company Introduction

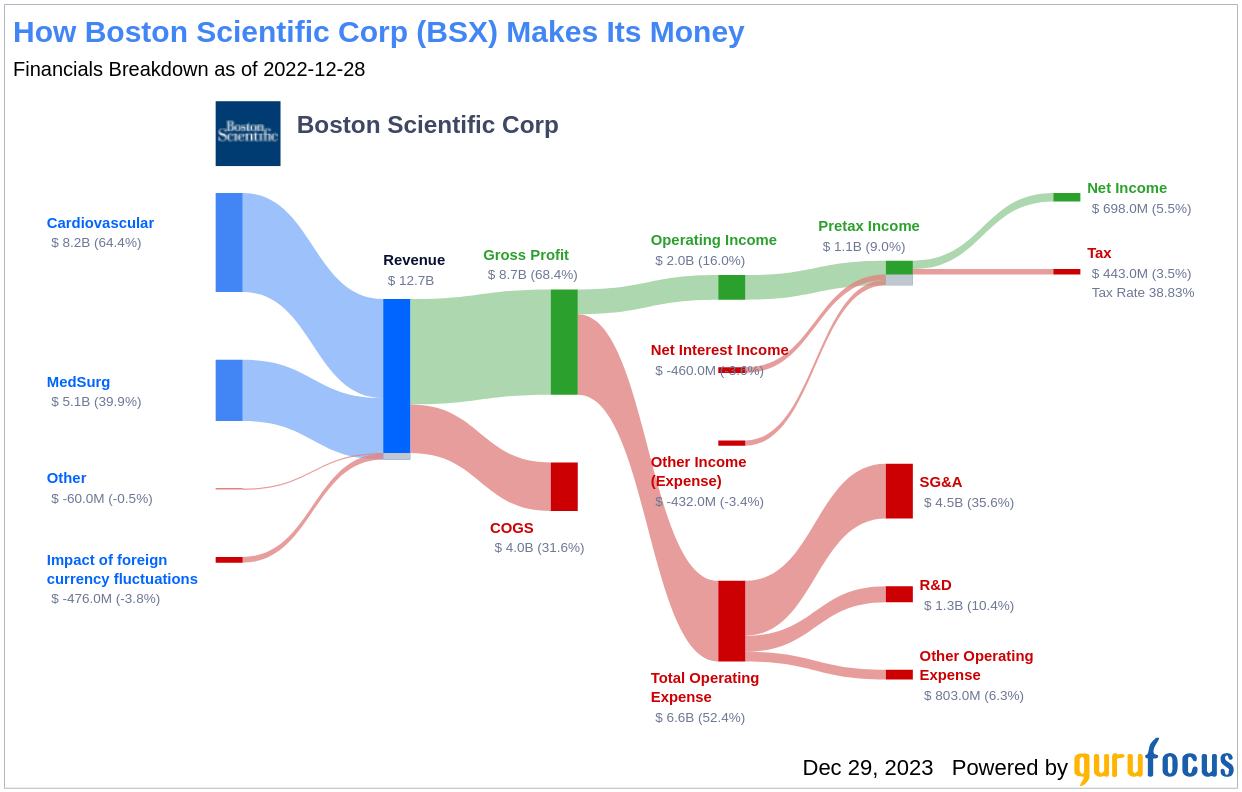

Boston Scientific is a pioneering manufacturer of less invasive medical devices, which are critical in numerous medical procedures such as angioplasty, blood clot filtration, and cardiac rhythm management, among others. With a significant global presence, nearly half of the company's sales are generated from international markets. The stock's current price of $57.81 is set against the backdrop of a market cap of $84.70 billion, which prompts a comparison with the GF Value—an estimation of the stock's fair value.

Summarize GF Value

The GF Value is a proprietary measure that reflects the intrinsic value of a stock, based on historical trading multiples, a GuruFocus adjustment factor, and projected business performance. Boston Scientific's current GF Value stands at $51.55, suggesting that the stock is modestly overvalued. This assessment is critical for investors, as it indicates that the stock's long-term return may not align with the company's business growth.

Link: These companies may deliver higher future returns at reduced risk.

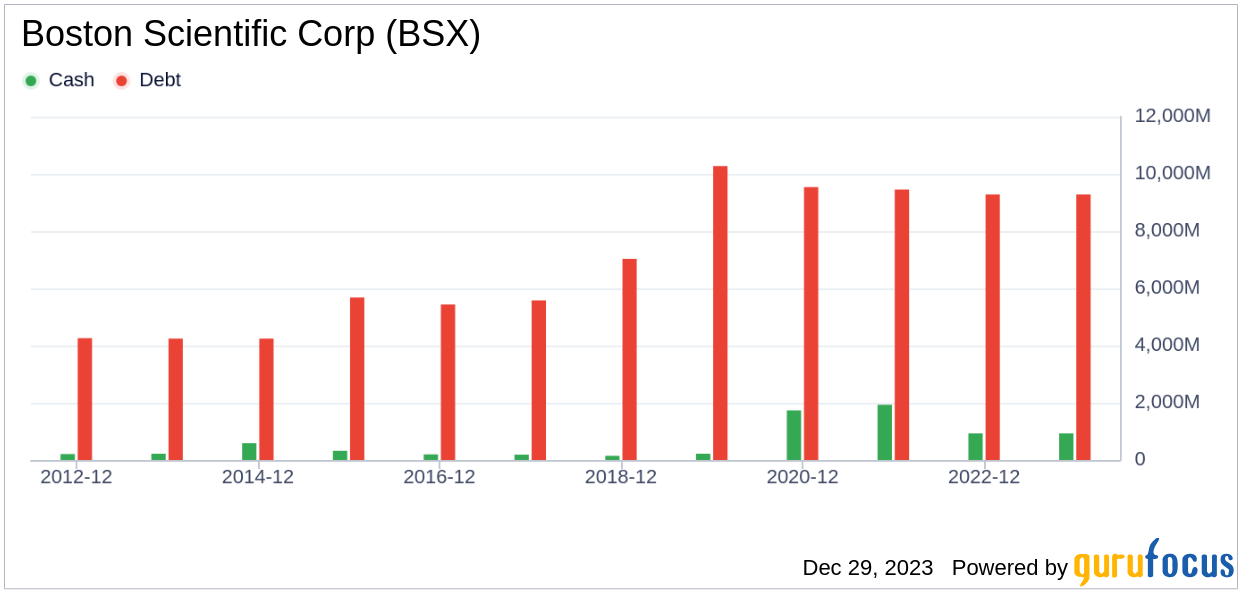

Financial Strength

Investing in companies with robust financial strength is essential to mitigate the risk of capital loss. A key indicator of this strength is the cash-to-debt ratio. Boston Scientific's ratio of 0.1 is lower than much of its industry, positioning its financial strength at a fair level. This is further illustrated by the company's debt and cash trends over recent years.

Profitability and Growth

Boston Scientific's profitability is a key component of its valuation, with a consistent track record over the past decade. The company's operating margin outperforms the majority of its peers. However, when it comes to growth, Boston Scientific ranks below average in its industry, which could impact investor expectations for long-term value creation.

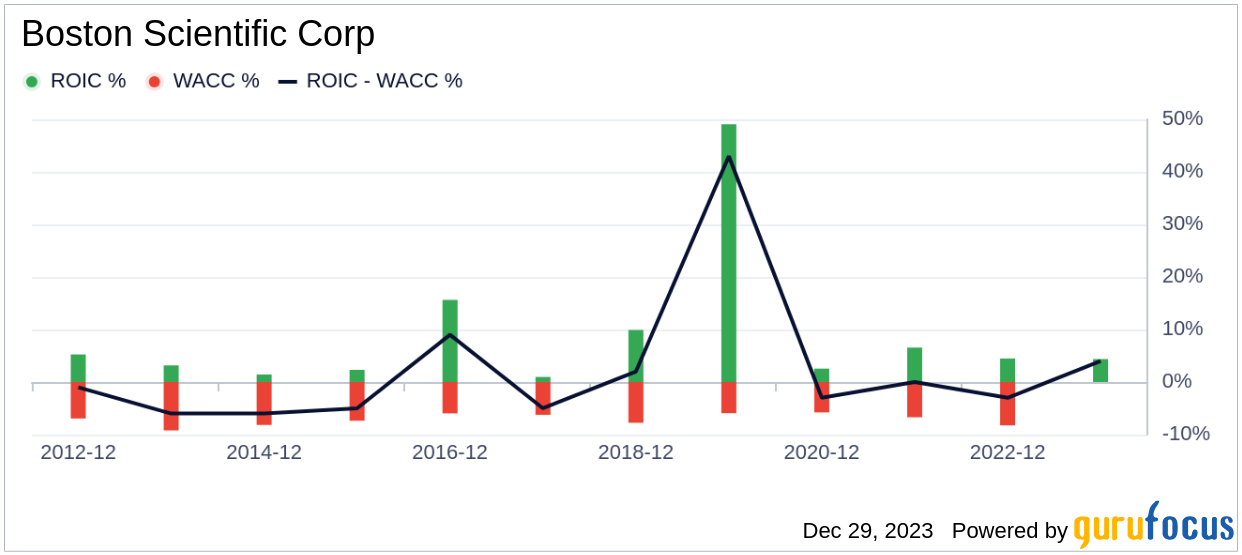

ROIC vs WACC

The comparison between Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) is crucial for evaluating profitability. Boston Scientific's ROIC is currently lower than its WACC, suggesting that the company may not be generating sufficient value for its shareholders. The historical comparison of ROIC vs WACC is depicted below.

Conclusion

In summary, Boston Scientific (BSX, Financial) appears to be modestly overvalued based on its current market price. While the company maintains fair financial strength and profitability, its growth and value creation potential as indicated by ROIC vs WACC metrics may not justify the premium in its stock price. For a more detailed financial understanding of Boston Scientific, investors can explore the company's 30-Year Financials here.

To discover high-quality companies that may offer above-average returns, consider using the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.