The ETF landscape is continuing to evolve to include more and more multi-asset strategies that give investors access to a wide range of investment options in a single fund. This ever expanding menu makes it easy to custom tailor your portfolio to suit your risk tolerance, give you instant diversification and provide complete transparency of the underlying holdings.

These multi-asset ETFs typically contain government bonds, preferred stocks, MLPs, REITs, high yield bonds, investment grade bonds and dividend paying stocks. Each of these securities offer their own unique risk and rewards, which is why it is important to select an ETF with an asset allocation that is suited to reach your personal goals.

Investors that are seeking both growth AND income for their portfolios should consider the First Trust Multi-Asset Diversified Income Fund (MDIV). This relatively new ETF was launched in August of 2012 and has quickly gained steam by gathering over $200 million in total assets. MDIV follows a unique asset allocation approach that appropriates 25% to dividend paying stocks, 20% to real estate investments trusts, 20% to preferred securities, 20% to master limited partnerships, and 15% to exchange-traded funds. All of these income securities combine to generate a respectable 30-day SEC yield of 5.53%.

This approach is different than the iShares Multi-Asset Income Fund (IYLD) and SPDR SSGA Income Allocation ETF (INKM) which both have exposure to traditional government and corporate bonds. The bond exposure in IYLD and INKM helps offset price volatility when dividend paying stocks head south, which may be more appropriate for conservative investors. However, they hinder the upside potential in a growth environment where stocks, REITs, MLPs, and preferred stocks thrive.

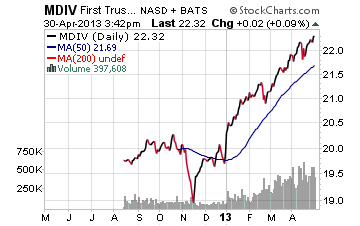

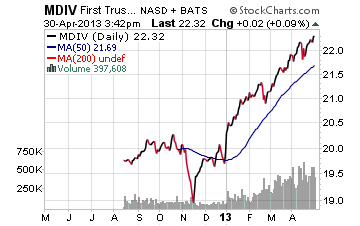

MDIV has enjoyed a very strong start to the year with the fund increasing more than 10% in 2013. In addition, the volume (overlaid on the bottom of the chart) has been increasing as well. This is a sign of strong demand for both yield and capital appreciation by income investors.

The only point of caution I would suggest is that with the fund being on its all-time highs, this is not the most opportune entry point for new money. I would wait for at least a 5% pullback in MDIV before I started to build any new positions in this ETF. With the seasonally weak May time frame upon us, we may get that opportunity sooner rather than later.

I like MDIV as an income and growth play for three reasons:

1. Its asset allocation is spread out (almost) equally among income generating sectors that are continuing to show strong demand and should perform well in the next growth phase of the economic cycle.

2. Its income is paid monthly which is a bonus for investors that desire regular dividends in their brokerage accounts. Oftentimes individual dividend paying stocks, MLPs, and REITs pay income on a quarterly basis which may not be as desirable.

3. The 123 underlying holdings of MDIV are diversified amongst individual securities that are well capitalized and highly liquid. This translates into a liquid market for the ETF that makes trade execution on the buy and sell side much tighter.

The Final Word

I believe that the asset allocation structure in MDIV is appropriate for both aggressive income investors or moderate growth investors. However, it is important to remember that trade location and risk management will be key to your long-term success when investing in this ETF.

These multi-asset ETFs typically contain government bonds, preferred stocks, MLPs, REITs, high yield bonds, investment grade bonds and dividend paying stocks. Each of these securities offer their own unique risk and rewards, which is why it is important to select an ETF with an asset allocation that is suited to reach your personal goals.

Investors that are seeking both growth AND income for their portfolios should consider the First Trust Multi-Asset Diversified Income Fund (MDIV). This relatively new ETF was launched in August of 2012 and has quickly gained steam by gathering over $200 million in total assets. MDIV follows a unique asset allocation approach that appropriates 25% to dividend paying stocks, 20% to real estate investments trusts, 20% to preferred securities, 20% to master limited partnerships, and 15% to exchange-traded funds. All of these income securities combine to generate a respectable 30-day SEC yield of 5.53%.

This approach is different than the iShares Multi-Asset Income Fund (IYLD) and SPDR SSGA Income Allocation ETF (INKM) which both have exposure to traditional government and corporate bonds. The bond exposure in IYLD and INKM helps offset price volatility when dividend paying stocks head south, which may be more appropriate for conservative investors. However, they hinder the upside potential in a growth environment where stocks, REITs, MLPs, and preferred stocks thrive.

MDIV has enjoyed a very strong start to the year with the fund increasing more than 10% in 2013. In addition, the volume (overlaid on the bottom of the chart) has been increasing as well. This is a sign of strong demand for both yield and capital appreciation by income investors.

The only point of caution I would suggest is that with the fund being on its all-time highs, this is not the most opportune entry point for new money. I would wait for at least a 5% pullback in MDIV before I started to build any new positions in this ETF. With the seasonally weak May time frame upon us, we may get that opportunity sooner rather than later.

I like MDIV as an income and growth play for three reasons:

1. Its asset allocation is spread out (almost) equally among income generating sectors that are continuing to show strong demand and should perform well in the next growth phase of the economic cycle.

2. Its income is paid monthly which is a bonus for investors that desire regular dividends in their brokerage accounts. Oftentimes individual dividend paying stocks, MLPs, and REITs pay income on a quarterly basis which may not be as desirable.

3. The 123 underlying holdings of MDIV are diversified amongst individual securities that are well capitalized and highly liquid. This translates into a liquid market for the ETF that makes trade execution on the buy and sell side much tighter.

The Final Word

I believe that the asset allocation structure in MDIV is appropriate for both aggressive income investors or moderate growth investors. However, it is important to remember that trade location and risk management will be key to your long-term success when investing in this ETF.