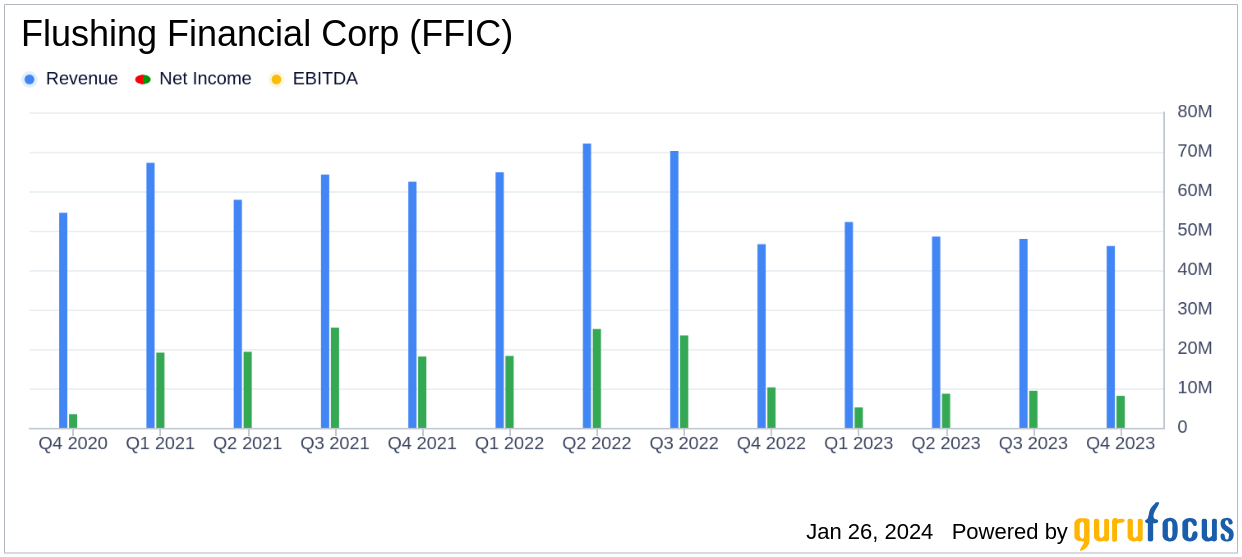

On January 25, 2024, Flushing Financial Corp (FFIC, Financial) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, a bank holding entity providing banking and financial services, reported a GAAP EPS of $0.27 for the fourth quarter and $0.96 for the full year. Core EPS, which excludes certain non-recurring items, stood at $0.25 for Q4 and $0.83 for the year.

Financial Performance and Strategic Execution

President and CEO John R. Buran highlighted the bank's strategic execution amidst a challenging environment, noting the expansion of GAAP and Core Net Interest Margin (NIM) in the fourth quarter by 7 and 18 basis points, respectively. The bank's focus on maintaining credit discipline and preserving strong liquidity and capital was evident in its performance. Buran emphasized the importance of these areas, stating:

"Continuing to advance these priorities will enable us to navigate the current environment while positioning the Company for long-term profitable growth."

The bank's loan portfolio remained resilient, with 89% secured by real estate and exhibiting strong debt service coverage ratios and low average loan to values. Despite a slight uptick in nonperforming assets (NPAs), the credit quality was a strength for the company, with less than one basis point of net charge-offs in the fourth quarter.

Financial Highlights and Challenges

Flushing Financial's net interest income decreased year-over-year but showed an increase quarter-over-quarter. The provision for credit losses saw an uptick both YoY and QoQ, reflecting a cautious approach to potential credit risks. Noninterest income and noninterest expense both increased compared to the previous year and the preceding quarter.

The bank's balance sheet showed average loans slightly decreasing YoY but increasing QoQ, while average total deposits grew both YoY and QoQ. The capital ratios remained stable, with book value per common share and tangible book value per common share both increasing modestly.

Looking Ahead

Flushing Financial Corp plans to release its first quarter 2024 financial results after the market close on April 23, 2024, with a conference call scheduled for the following morning. The company continues to focus on strategic initiatives to enhance shareholder value and maintain its strong position in the market.

Investors and stakeholders can access more detailed financial information and the earnings presentation on the company's website under the Investor Relations section.

For a comprehensive analysis of Flushing Financial Corp's financial results and strategic outlook, visit GuruFocus.com for in-depth coverage and expert insights.

Explore the complete 8-K earnings release (here) from Flushing Financial Corp for further details.