Delving into Sunoco LP's Dividend Profile

Sunoco LP (SUN, Financial) recently announced a dividend of $0.84 per share, payable on 2024-02-20, with the ex-dividend date set for 2024-02-06. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Sunoco LP's dividend performance and assess its sustainability.

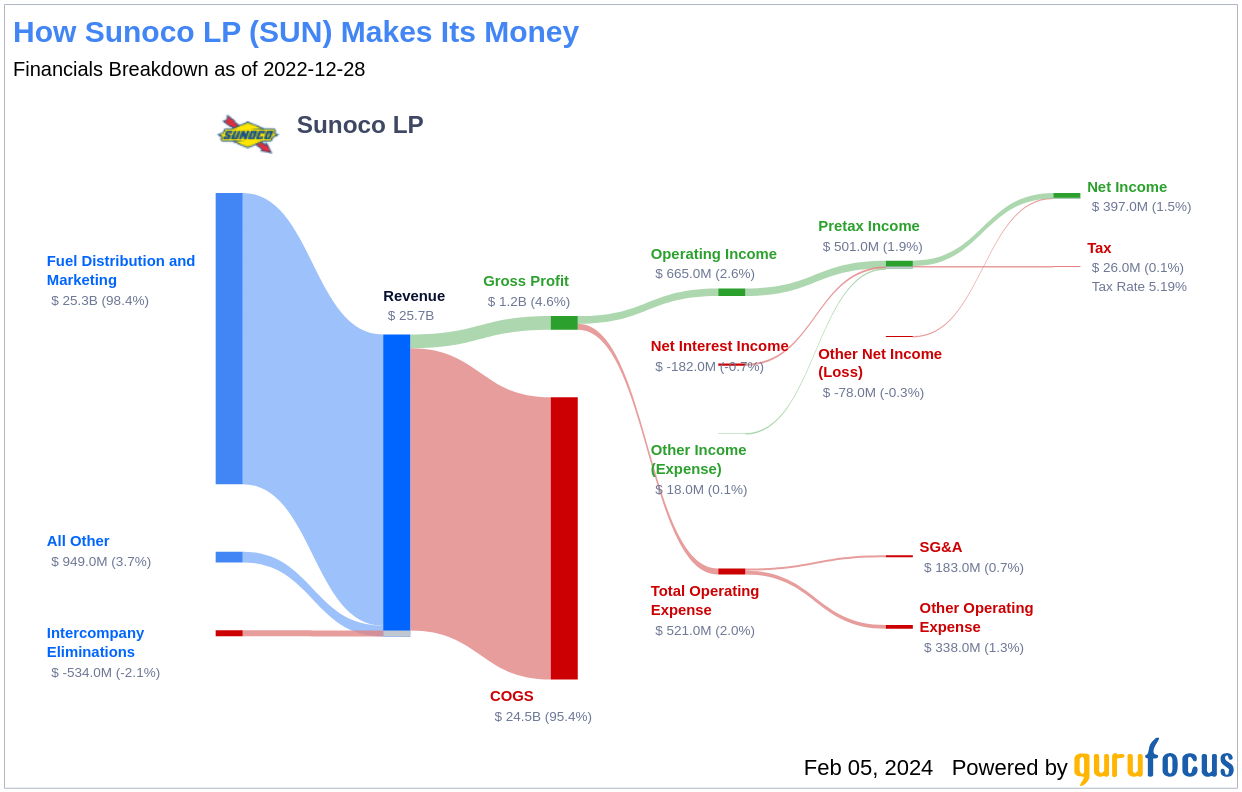

What Does Sunoco LP Do?

Sunoco LP is a master limited partnership specializing in the distribution of motor fuel. It operates a vast network in Texas and extends its reach to Louisiana, New Mexico, and Oklahoma. The company's business model is not just confined to fuel distribution; it also earns rental income from leasing real estate. With environmental regulations shaping the industry landscape, Sunoco LP navigates through these with compliance, ensuring sustainable operations. The company's role as a significant distributor for prominent brands like Valero and Chevron underscores its competitive position in the fuel distribution sector.

A Glimpse at Sunoco LP's Dividend History

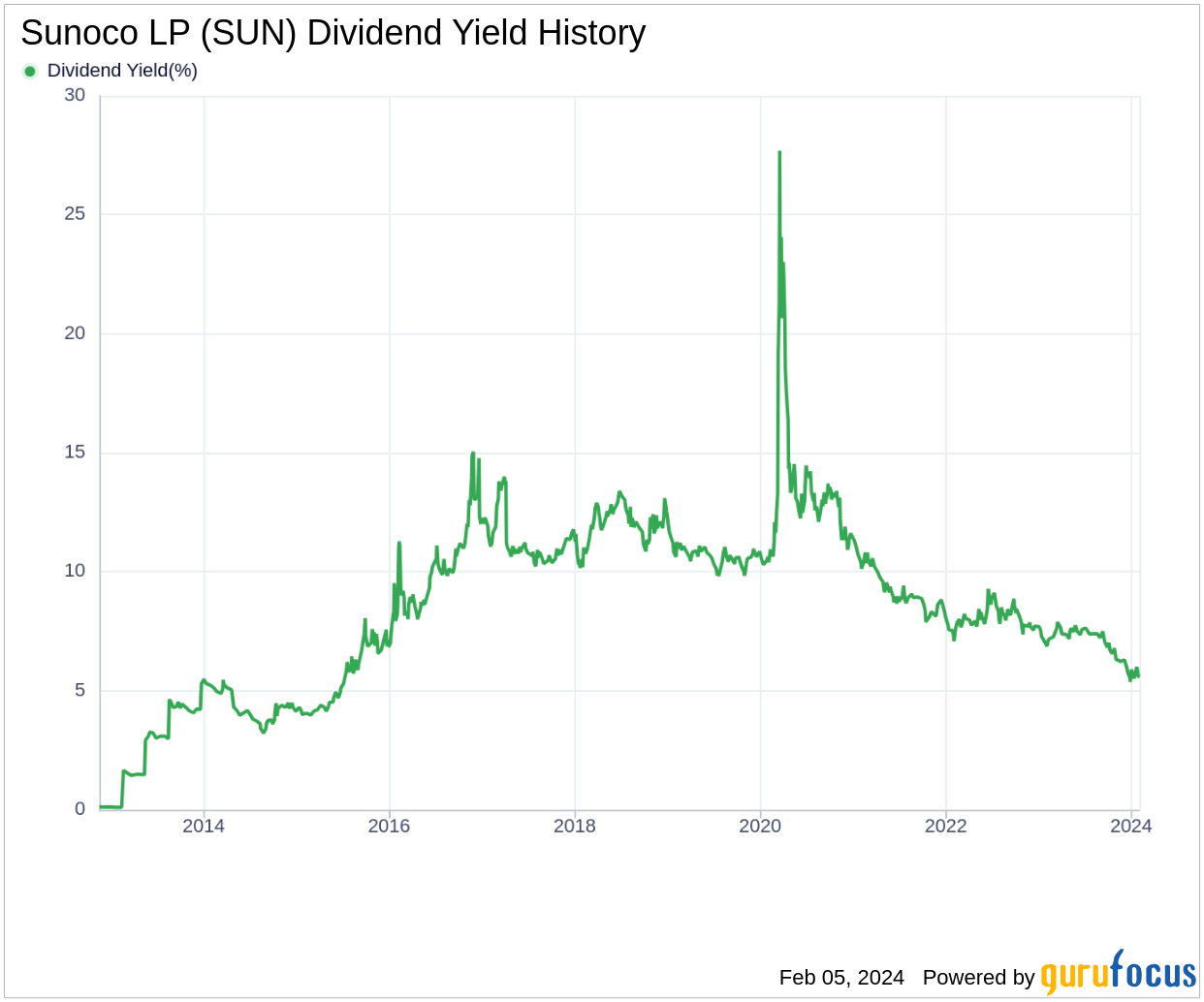

Sunoco LP has maintained a consistent dividend payment record since 2012, distributing dividends on a quarterly basis. The company's commitment to increasing dividends annually has earned it the status of a dividend achiever—a testament to its financial stability and shareholder value focus. The historical dividends per share chart reflects this upward trend, demonstrating Sunoco LP's reliability as an income-generating investment.

Breaking Down Sunoco LP's Dividend Yield and Growth

Sunoco LP currently boasts a 12-month trailing dividend yield of 5.56% and a forward dividend yield of 5.59%, indicating investor optimism for continued dividend growth. With an impressive annual dividends per share growth rate of 28.90% over the past decade, Sunoco LP stands out as a robust dividend payer. Additionally, its 5-year yield on cost at 5.56% further solidifies its appeal to dividend-seeking investors.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of Sunoco LP's dividends can be gauged by examining its payout ratio, which currently stands at 0.61. This indicates a balanced approach to dividend distribution and earnings retention. Sunoco LP's profitability rank of 7 out of 10, coupled with consistent net profits in 7 out of the past 10 years, suggests a strong financial foundation that underpins its dividend payments.

Growth Metrics: The Future Outlook

Sunoco LP's growth rank of 7 out of 10 reflects positively on its future prospects. The company's revenue per share has grown at an average annual rate of 15.20%, outperforming 58.33% of global competitors. Its 3-year EPS growth rate, averaging 9.90%, and a 5-year EBITDA growth rate of 25.50%, which outperforms 74.7% of global competitors, both indicate a robust potential for sustained dividend payments and overall financial health.

Investing in Sunoco LP's Dividend Future

For value investors seeking stable dividend income, Sunoco LP presents a compelling case. With a strong dividend growth rate, a prudent payout ratio, and solid profitability and growth metrics, Sunoco LP stands as a potentially attractive addition to income-focused portfolios. As the company continues to navigate the dynamic fuel distribution industry, its strategic initiatives and competitive position may well support the continuation of its dividend achiever status. Will Sunoco LP's dividends continue to fuel investor returns in the years to come? It's a question that keeps income investors tuned in to this energy sector player.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: (Free Trial)