Company Background

General Dynamics (GD, Financial) manufactures submarines, armored vehicles, defense-oriented information technology systems and Gulfstream business jets. The company operates under a decentralized structure with four reporting segments: 1) Aerospace (22% of 2012 sales), 2) Combat (26%), 3) Marine (21%) and 4) Information Systems and Technology, or IS&T (31%) The firm gets around 66% of revenue from the U.S. government.

Financial State

General Dynamics has a total debt of $9.6 billion ($5.7 billion in retirement liabilities, $3.9 billion of long-term debt) and $3.7 billion in cash. The company generates around $3 billion in operating cash flow annually and needs around $1.3 billion to fund its dividend and capital expenditure needs. The company has ample financial flexibility even after reducing its share count by 10% during the last five years.

Key highlights as follows:

Competitive Advantages

Financial strength suggests the existence of sustainable competitive advantages. The following are what I believe to be the key to GD's performance.

Management

Executive compensation is not excessive and has averaged 0.12% of revenue, 1.26% of EBITDA and 1.54% of FCF for the last five years. I find the CEO, Phebe Novakovic, to be refreshingly direct, honest and clear in what she wants to focus on. The following few quotes sum up how she thinks about the business, where she thinks it's going, what they do best and she does not try to spin the bad news (emphasis added).

"...What you're going to see us do is pursue, and I can't say this enough, pursue margin expansion and generate cash and earnings. We are not going to chase revenue. We're going to stick to our knitting and do what we know how to do.This Company has a long history of operating excellence, and it's perform, perform, perform..."

"...With respect to the fourth quarter, I'd focus you on the revenue drop versus the same quarter a year ago, the single largest cause of which is the revenue decline at European Land Systems. This is the salient fourth quarter impact that carries over into 2013..."

"...The opportunities for upside and they are significant, are margin improvement, cash generation and driving performance via the equation. We will focus this year on operations, drive cost out of our businesses and improve performance and I do not intend to guide you to higher operating margins that are currently embedded in our plan because we have yet to earn them..."

"...let me give you a little bit on cash, and you've seen this in 2012 and you're going to see it again in 2013. Our cash generation in the underlying business continues to be superb. We have considerable CapEx in 2012, and again in 2013. In 2013 we have planned at about $618 million, that's primarily at Gulfstream and I can tell you we're going to work that number very, very hard. We also have some headwinds in cash with respect to pension, and as I mentioned, higher CapEx. But let me talk to you a minute about a subject that's near and dear to my heart, and that's capital deployment. I think it should be clear from what I've told you is that I'm going to remain, and as is our management team, focused on operations in 2013. I can tell you there is almost no acquisition candidates in the current pipeline. I also believe that the acquisition process at GD is somewhat broken, and I will not venture back into that market until we have re-established the discipline in this process. I can give you a little bit more color on this. If you consider the acquisitions that were made in Combat, Force Protection in particular, and the repair businesses in Marine, they were excellent. The recent IS&T acquisitions haven't been so far. Regarding dividend and share repurchases, I'm just not going to get ahead of my board..."

"...It ought to be clear from the charges that in some respects we took our eye off the ball. Some of our business units performed superbly, but that benefit hasn't accrued to the benefit, or that value hasn't accrued to the benefit of our shareholders, and you can better believe that we're going to be focused like a laser beam on that. I can tell you that I have – I'm very close to our business unit presidents, I know their business, they know their business, and we are completely aligned with the prime directive. That prime directive is, drive costs out of our business, generate earnings in cash, expand our margins, and reassure our shareholders that we're wise stewards of their capital. We are going to be focused on operations and you're going to see that across every single one of our business group. Let me tell you something else, too, as I think about our business. One of our key jobs is to manage and mitigate risk, and classical risk there (you argue) through diversification. And one of the things that I think we need to understand about GD is we have diversification in two respects. First and clearly, we have diversification in counter-cyclicality with Aerospace and defense businesses, right, it’s pretty axiomatic. Second, however, within our defense businesses we are somewhat counter-cyclical with the Navy and the Army, our exposure to the Army and the offsetting exposure to the Navy portfolio. So, while I see some contraction in our Army market, the Navy tends to be – as a result of tactical changes in the budget, the Navy tends to be more strategically driven and vary depending on whether we're in hot war; that balance between the Navy and the Army. So, when you look at that, even within the defense portfolio, I like our balance..."

Valuation

Looking over a 10-year period, FCF has gone from $1.5 billion to $2.2 billion at a CAGR of 5% and an average FCF per year of $2.2 billion. Meanwhile, shares outstanding have gone from 398 million to 353 million, a buyback of about 1.2% per year.

Considering this is a company with sustainable competitive advantage, assuming that FCF stays at the 10-year average and no additional share buyback FCF per share at around $6.2, which at a 15 multiple, makes it equal to about $93 per share.

On an EBITDA basis, 10-year average EBITDA = $3.1 billion which at 8x should make GD worth at least $24.8 billion in value. Add back $3.7 billion in cash, back out $3.9 billion of debt and you have an equity valuation of $24.6 billion or $24.6 billion per 353 million at around $70. So the market is valuing a company with a history of good capital allocation that has increased dividends at 15% per year over the last 10 years, with a management that is focused on generating cash and increasing margins at 8x 10-year average EBITDA, a bargain in my view.

Key Risks

So why is the market offering such a good and consistent company at such a bargain valuation?

There are three reasons for this:

Summary

The key to the valuation and holding the stock is that GD continues to generate free cashflow at $2.2 billion per year or better and EBITDA of $3.1 billion or better.

When that changes for the worse, it will be time to re-evaluate the analysis.

Disclosure:

I own shares in General Dynamics and may add more to my position.

General Dynamics (GD, Financial) manufactures submarines, armored vehicles, defense-oriented information technology systems and Gulfstream business jets. The company operates under a decentralized structure with four reporting segments: 1) Aerospace (22% of 2012 sales), 2) Combat (26%), 3) Marine (21%) and 4) Information Systems and Technology, or IS&T (31%) The firm gets around 66% of revenue from the U.S. government.

Financial State

General Dynamics has a total debt of $9.6 billion ($5.7 billion in retirement liabilities, $3.9 billion of long-term debt) and $3.7 billion in cash. The company generates around $3 billion in operating cash flow annually and needs around $1.3 billion to fund its dividend and capital expenditure needs. The company has ample financial flexibility even after reducing its share count by 10% during the last five years.

Key highlights as follows:

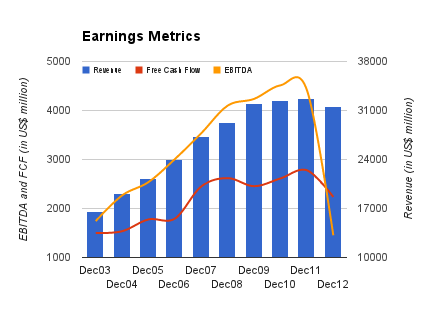

- Revenues have grown from $19 billion in 2003 to $31.5

billion in 2012 - CAGR of ~ 6% - Free cashflow has grown from $1.5

billion in 2003 to $2.2 billion in 2012 - CAGR of 4% - Shares outstanding have reduced from 399 million in 2003 to 353 million now buying back at about 1.2% per year

- Dividend has increased from $0.72 per share in 2003 to $2.52 per share in 2012 - CAGR of 13%

Financial strength suggests the existence of sustainable competitive advantages. The following are what I believe to be the key to GD's performance.

- Large market share and incumbent provider in an industry with high barriers to entry

- Economies of scale

- Culture and history of good allocation of capital

Executive compensation is not excessive and has averaged 0.12% of revenue, 1.26% of EBITDA and 1.54% of FCF for the last five years. I find the CEO, Phebe Novakovic, to be refreshingly direct, honest and clear in what she wants to focus on. The following few quotes sum up how she thinks about the business, where she thinks it's going, what they do best and she does not try to spin the bad news (emphasis added).

"...What you're going to see us do is pursue, and I can't say this enough, pursue margin expansion and generate cash and earnings. We are not going to chase revenue. We're going to stick to our knitting and do what we know how to do.This Company has a long history of operating excellence, and it's perform, perform, perform..."

"...With respect to the fourth quarter, I'd focus you on the revenue drop versus the same quarter a year ago, the single largest cause of which is the revenue decline at European Land Systems. This is the salient fourth quarter impact that carries over into 2013..."

"...The opportunities for upside and they are significant, are margin improvement, cash generation and driving performance via the equation. We will focus this year on operations, drive cost out of our businesses and improve performance and I do not intend to guide you to higher operating margins that are currently embedded in our plan because we have yet to earn them..."

"...let me give you a little bit on cash, and you've seen this in 2012 and you're going to see it again in 2013. Our cash generation in the underlying business continues to be superb. We have considerable CapEx in 2012, and again in 2013. In 2013 we have planned at about $618 million, that's primarily at Gulfstream and I can tell you we're going to work that number very, very hard. We also have some headwinds in cash with respect to pension, and as I mentioned, higher CapEx. But let me talk to you a minute about a subject that's near and dear to my heart, and that's capital deployment. I think it should be clear from what I've told you is that I'm going to remain, and as is our management team, focused on operations in 2013. I can tell you there is almost no acquisition candidates in the current pipeline. I also believe that the acquisition process at GD is somewhat broken, and I will not venture back into that market until we have re-established the discipline in this process. I can give you a little bit more color on this. If you consider the acquisitions that were made in Combat, Force Protection in particular, and the repair businesses in Marine, they were excellent. The recent IS&T acquisitions haven't been so far. Regarding dividend and share repurchases, I'm just not going to get ahead of my board..."

"...It ought to be clear from the charges that in some respects we took our eye off the ball. Some of our business units performed superbly, but that benefit hasn't accrued to the benefit, or that value hasn't accrued to the benefit of our shareholders, and you can better believe that we're going to be focused like a laser beam on that. I can tell you that I have – I'm very close to our business unit presidents, I know their business, they know their business, and we are completely aligned with the prime directive. That prime directive is, drive costs out of our business, generate earnings in cash, expand our margins, and reassure our shareholders that we're wise stewards of their capital. We are going to be focused on operations and you're going to see that across every single one of our business group. Let me tell you something else, too, as I think about our business. One of our key jobs is to manage and mitigate risk, and classical risk there (you argue) through diversification. And one of the things that I think we need to understand about GD is we have diversification in two respects. First and clearly, we have diversification in counter-cyclicality with Aerospace and defense businesses, right, it’s pretty axiomatic. Second, however, within our defense businesses we are somewhat counter-cyclical with the Navy and the Army, our exposure to the Army and the offsetting exposure to the Navy portfolio. So, while I see some contraction in our Army market, the Navy tends to be – as a result of tactical changes in the budget, the Navy tends to be more strategically driven and vary depending on whether we're in hot war; that balance between the Navy and the Army. So, when you look at that, even within the defense portfolio, I like our balance..."

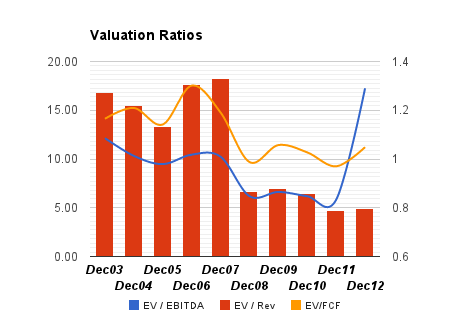

Looking over a 10-year period, FCF has gone from $1.5 billion to $2.2 billion at a CAGR of 5% and an average FCF per year of $2.2 billion. Meanwhile, shares outstanding have gone from 398 million to 353 million, a buyback of about 1.2% per year.

Considering this is a company with sustainable competitive advantage, assuming that FCF stays at the 10-year average and no additional share buyback FCF per share at around $6.2, which at a 15 multiple, makes it equal to about $93 per share.

On an EBITDA basis, 10-year average EBITDA = $3.1 billion which at 8x should make GD worth at least $24.8 billion in value. Add back $3.7 billion in cash, back out $3.9 billion of debt and you have an equity valuation of $24.6 billion or $24.6 billion per 353 million at around $70. So the market is valuing a company with a history of good capital allocation that has increased dividends at 15% per year over the last 10 years, with a management that is focused on generating cash and increasing margins at 8x 10-year average EBITDA, a bargain in my view.

So why is the market offering such a good and consistent company at such a bargain valuation?

There are three reasons for this:

- Dependence on government for revenues (66% of revenues come from the U.S. government) means sequestration and any budget cuts could have a negative impact on revenues.

- A large charge in fourth quarter that resulted in an earnings loss.

- Pension obligations underfunded to the tune of just over $4.9 billion - and that number may actually be understated and is closer to $5.5 billion.

- We are living in a world where there is constant threat of war, I don't see the defense spending coming down any time soon but if it did, it will still take a little while to show up due to the backlog on the books.

- The quarterly charge was a one-time accounting charge - the FCF for the year 2012 was still $2.2 billion.

- Reported status of a pension plan has a lot to do with assumptions - especially, the discount rate and expected long-term return on assets. The company used 5.22% for discount rate and 8.24% for expected rate of return. I think both those are aggressive - certainly with the run up in the market the expected rate of return should probably be closer to 2.5% (expected 10-year return from market per total Market Cap per GDP metric) and a discount rate closer to 3% (10-year high grade corporate bond). The foot notes show a sensitivity to 25bp of change to discount rate ($31 million) and an expected rate of return ($16 million). If we make the adjustments, then the pension obligations are actually understated by $650 million. So the total pension obligation is underfunded by closer to $5.5 billion. To put into perspective as to why I don't think it's that big of a deal, the company could easily borrow that amount today and pay a 3% interest rate and its pension obligation would be funded even under my conservative scenario. Or it could simply use $700 million of annual FCF and cover its obligations in seven years time with current assumptions. That would still leave $1.5 billion in cash for dividends and buybacks.

The key to the valuation and holding the stock is that GD continues to generate free cashflow at $2.2 billion per year or better and EBITDA of $3.1 billion or better.

When that changes for the worse, it will be time to re-evaluate the analysis.

Disclosure:

I own shares in General Dynamics and may add more to my position.