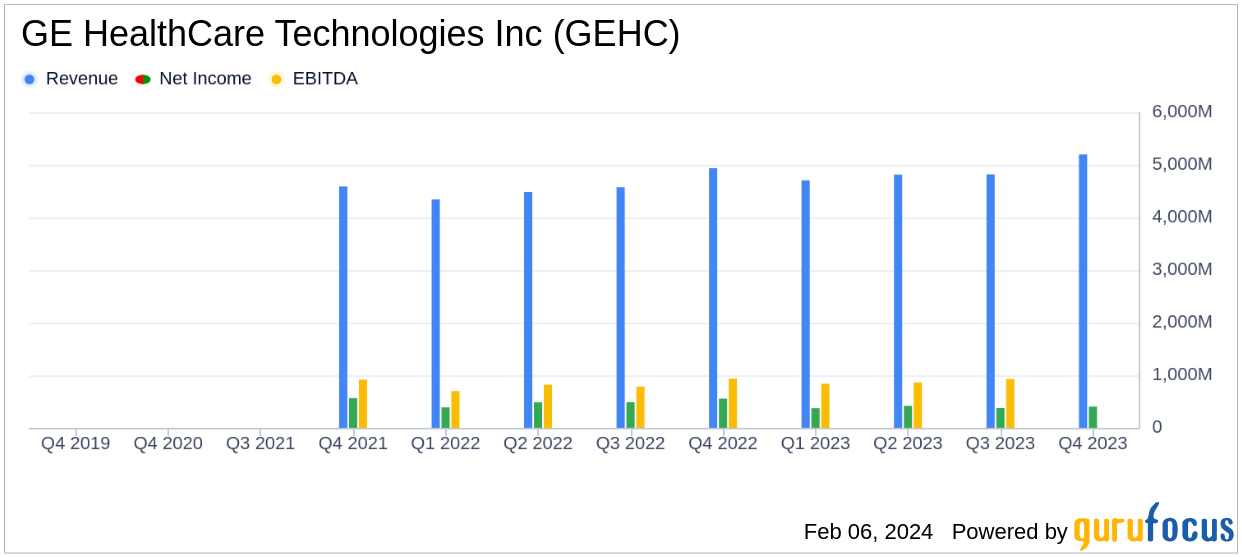

On February 6, 2024, GE HealthCare Technologies Inc (GEHC, Financial) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. GEHC, a leading medical technology and diagnostics company, operates through four segments: Imaging, Ultrasound, Patient Care Solutions (PCS), and Pharmaceutical Diagnostics (PDx), with the majority of its revenue stemming from the Imaging segment.

Despite facing challenges such as increased standalone interest expenses and investments, GEHC delivered a solid financial performance in its first year as a public company. The company's revenue growth was driven by price and volume, with organic growth also standing at 5% for the quarter and 8% for the year. However, net income margins contracted due to the impact of standalone interest expenses and other factors.

Financial Performance Highlights

GEHC's financial achievements in 2023 reflect its resilience and strategic focus. The company's revenue growth is significant in the healthcare providers and services industry, where consistent revenue streams are critical for ongoing investment in innovation and technology. The adjusted EBIT margin's stability and slight year-over-year improvement demonstrate effective cost management and the ability to translate revenue growth into profitability.

Key financial details from the income statement show that total revenues for 2023 reached $19.6 billion, a 7% increase from the previous year. The balance sheet reflects a strong liquidity position with $2.5 billion in cash and cash equivalents. The cash flow statement indicates a robust cash flow from operating activities at $2.1 billion for the year, although slightly down from the previous year due to standalone interest and postretirement benefit payments.

Important metrics such as free cash flow conversion, which ended at 95% for 2023, are crucial for understanding the company's efficiency in turning profit into cash, a key indicator of financial health for investors.

"After our first year as a publicly traded company, I’m pleased to announce robust fourth quarter and full year results. This strong financial performance is a testament to our dedicated team and successful execution of our precision care strategy," said GE HealthCare President and CEO Peter Arduini.

Segment Performance and Future Outlook

Examining segment performance, the Imaging segment saw a 4% revenue increase, while the PDx segment experienced a notable 25% jump, driven by strong organic growth. The Ultrasound and PCS segments faced some headwinds, with the Ultrasound segment's revenue declining slightly and the PCS segment's EBIT margin contracting.

Looking ahead, GEHC has provided optimistic guidance for 2024, expecting organic revenue growth of approximately 4% and an adjusted EBIT margin expansion. The company's focus on innovation, evidenced by over $1 billion invested in R&D and more than 40 innovations launched in 2023, positions it well for future growth in the evolving healthcare landscape.

GEHC's performance analysis suggests that while the company navigates challenges such as margin pressures and debt repayment, its strategic investments and market positioning bode well for its medium-term financial targets. The company's commitment to innovation and precision care, along with its robust product pipeline and strategic acquisitions, are likely to support its growth trajectory and enhance shareholder value.

For a detailed breakdown of GE HealthCare Technologies Inc's financial results and forward-looking guidance, investors and interested parties can access the full 8-K filing.

Explore the complete 8-K earnings release (here) from GE HealthCare Technologies Inc for further details.