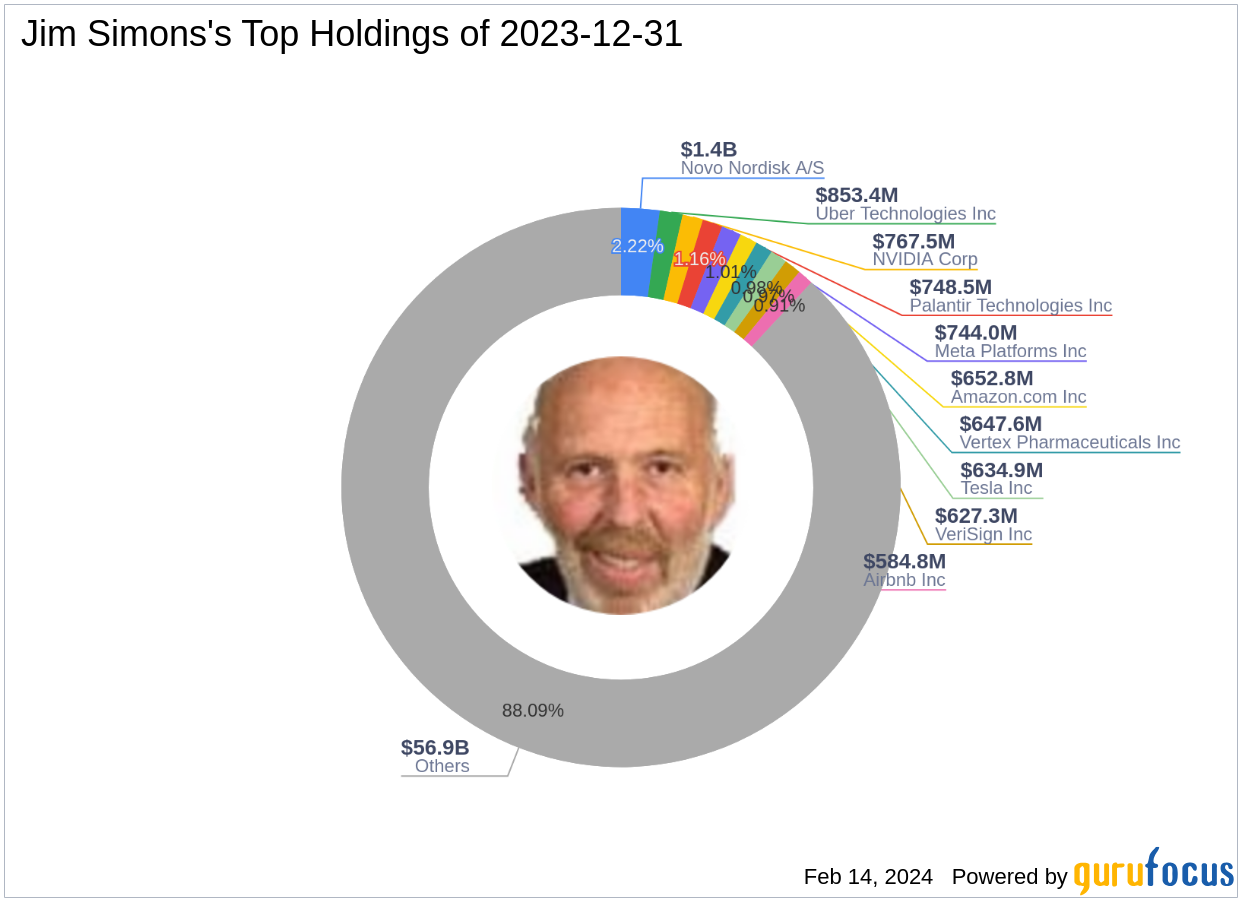

Renowned investment firm Renaissance Technologies, led by Jim Simons (Trades, Portfolio), has recently expanded its portfolio with the addition of Natural Health Trends Corp (NHTC, Financial). On December 29, 2023, the firm acquired 685,128 shares of NHTC at a trade price of $5.86. This transaction has increased the firm's stake in the company to 5.95%, representing a 0.01% position in the firm's portfolio.

Jim Simons (Trades, Portfolio): The Quantitative Investment Pioneer

Jim Simons (Trades, Portfolio), the founder of Renaissance Technologies, is a notable figure in the investment world, having established one of the most successful hedge funds globally. Since its inception in 1982, Renaissance Technologies has been at the forefront of employing advanced mathematical models to inform its trading strategies. The firm's approach is grounded in the belief that scientific thinking and extensive data analysis can uncover non-random price movements, leading to predictive trading advantages. Simons' philosophy emphasizes the importance of scientific scrutiny over statistical anomalies that may appear to be profitable strategies.

Natural Health Trends Corp: A Snapshot

Natural Health Trends Corp, based in Hong Kong, is a direct-selling and e-commerce company that has been operating since 1995. The company's diverse product range spans wellness, herbal, beauty, lifestyle, and home segments, with a significant revenue contribution from the Hong Kong market. As of the latest data, NHTC holds a market capitalization of $74.283 million, with a current stock price of $6.45. Despite being labeled as "Significantly Overvalued" by GuruFocus with a GF Value of $4.93, the stock has shown a 10.07% gain since the reported trade and a 9.41% year-to-date increase.

Impact of the Trade on Simons' Portfolio

The acquisition of NHTC shares by Jim Simons (Trades, Portfolio)' Renaissance Technologies is a strategic move that marginally diversifies the firm's holdings. Although the trade impact on the overall portfolio is minimal at 0.01%, the position size in NHTC is significant, with the firm now holding 5.95% of the company's shares. This addition aligns with the firm's data-driven investment approach, potentially identifying NHTC as a stock with patterns that Renaissance's models deem favorable.

Performance and Valuation Metrics of NHTC

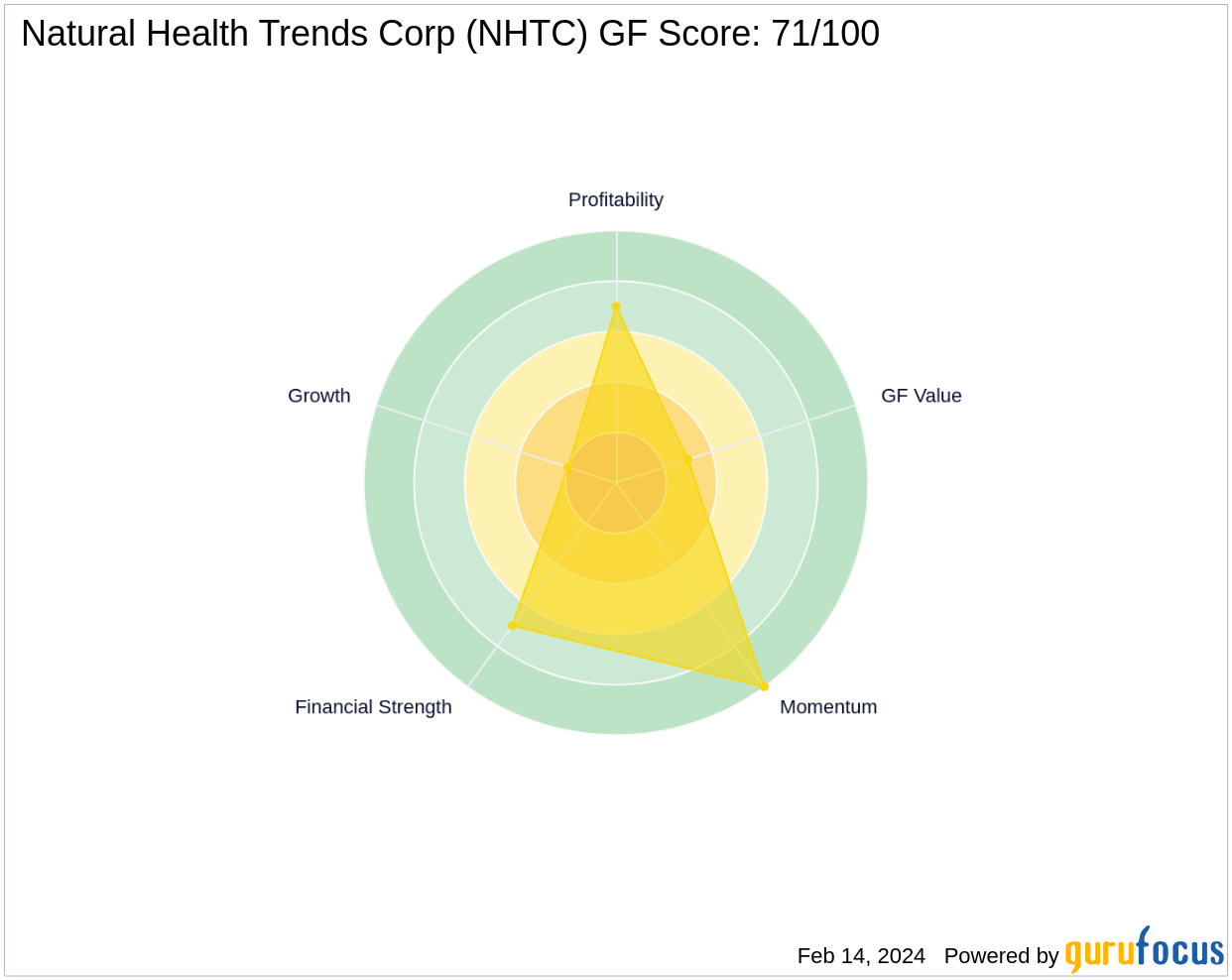

NHTC's current PE ratio stands at 129.00, indicating a company with earnings, albeit with a high valuation. The stock's performance has been positive since the trade, with a 10.07% gain, and it maintains a GF Score of 71/100, suggesting a likelihood of average performance. However, the stock's valuation rank is low at 3/10, reflecting its overvaluation status in comparison to the intrinsic value calculated by GuruFocus.

Financial Health and Growth Prospects of NHTC

NHTC's financial health is robust, with a Financial Strength rank of 7/10 and a Piotroski F-Score of 5, indicating a stable situation. However, the company's Growth Rank is low at 2/10, with a three-year revenue growth rate of -11.00%. This suggests that while the company is financially stable, its growth prospects are currently limited.

Market Sentiment and Technical Indicators

The market sentiment towards NHTC appears positive, with a high Momentum Rank of 10/10. Technical indicators such as the RSI (Relative Strength Index) also reflect strong momentum, with a 14-day RSI of 67.19. These indicators suggest that the stock is currently experiencing a bullish trend.

Conclusion

The recent acquisition of Natural Health Trends Corp by Jim Simons (Trades, Portfolio)' Renaissance Technologies is a calculated addition to the firm's diverse portfolio. While the trade's impact on the portfolio is modest, it reflects the firm's confidence in NHTC's stock, despite its high valuation and limited growth prospects. For value investors, this move by a seasoned investment firm warrants attention, as it may signal underlying value recognized by Renaissance's sophisticated trading models.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.