For some time now, we’ve had a generally positive economic outlook. The occasional setback is assured, but on the whole we believe that the U.S. economy is still in the early stages of a multi-year recovery.

Investors often ask how such a broad macroeconomic view factors into the fundamental, bottom-up stock selection process we employ in managing the Heartland Select Value Fund and all of the Heartland portfolios. The simple answer is that we don’t use our macro perspective as a top-down driver in our decision-making. But because the companies we research must contend with the ever-changing macroeconomic backdrop, the trends we anticipate going forward inform our research as we seek out industries and companies that could benefit.

We Can’t Predict, But We Can Look Ahead

One of the reasons we’re optimistic about the economy is that we believe the U.S. consumer is strengthening, based on signs of continued improvement in employment data, rising household net worth, and a strong outlook for domestically produced energy, among other factors.

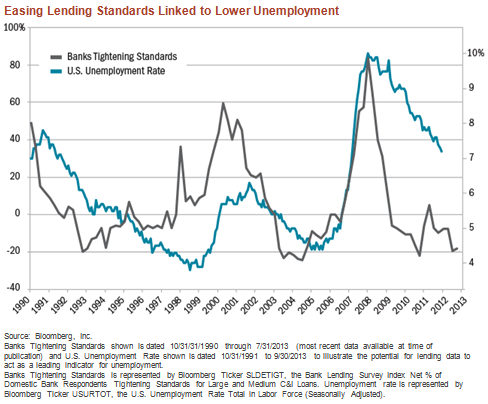

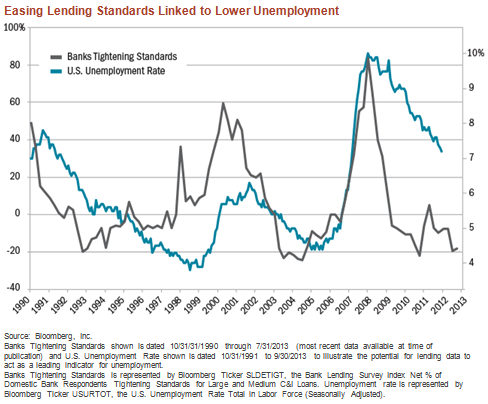

Just as we seek to identify companies before they’ve been noticed by the Wall Street crowd, we strive to be on top of macro developments before their impact has been fully revealed. We’re intrigued by the long-term relationship we’ve found between Bank Lending Surveys—a measure of easing or tightening credit standards from bank officers issuing loans—and unemployment. Over time, we have found easier lending standards to be a leading indicator of falling unemployment.

The graph below charts Bank Lending Survey results against unemployment data. (Declining lines indicate more lax lending policies and lower unemployment; rising lines show constrained lending and rising jobless numbers.) To reflect that lending data is a leading indicator of improved employment—and better illustrate the link between the two—we have shifted the time frame for the employment line back one year.

The results show a fairly tight correlation between the figures. We believe they also show that unemployment has room to fall even further, helping to support our view of gradual economic growth in the U.S.

Why People Are Feeling Better

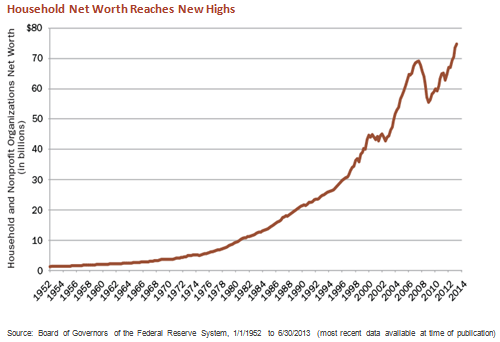

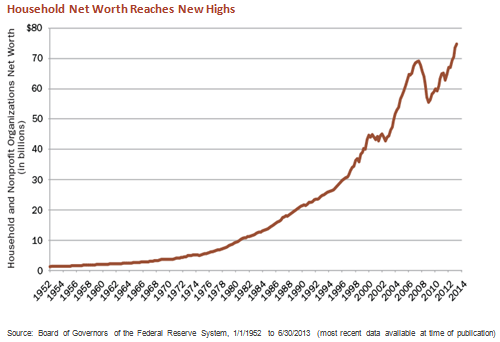

After a recession that saw both home prices and equity values plunge, it’s understandable that consumers have needed some time to regain their confidence. With substantial rebounds on both fronts, household net worth has risen once again to a new high. We believe this is a key building block to rebuilding confidence among consumers and investors, and it’s another of the broad factors we track.

On its own, this wealth effect doesn’t cause us to buy or sell any particular stock. But such a clear tailwind can influence the decision-making process.

Bringing Some Energy to the Table

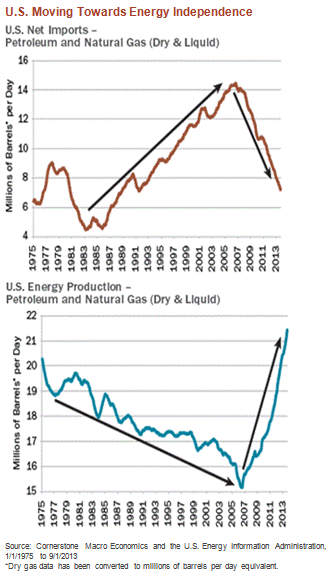

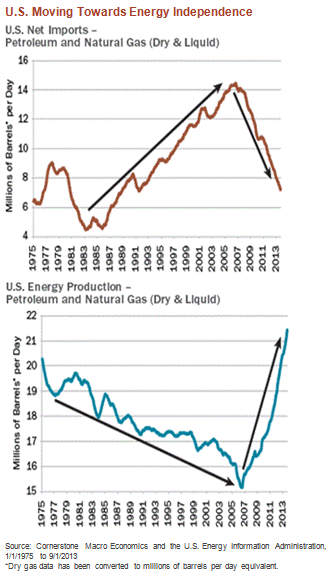

The uptick in economic activity we anticipate appears almost certain to spark higher energy demand. Not too long ago, that could be problematic: The U.S. was more dependent on foreign sources of energy, and thus had little control over costs. Now, thanks to progress in extracting oil and natural gas from shale, the U.S. is making great strides toward energy independence.

Further, the rise in U.S. energy production is not only a beneficiary of the improving economy; it’s also helping to fuel it. Cheaper energy is driving a U.S. industrial renaissance, as manufacturers of a wide range of products are finding it less expensive to operate closer to home than it is to farm work out overseas. We believe this can be a driving force to help many of the stocks in the Select Value Fund attain their full intrinsic value.

What About Stock Picking?

Given our positive view for the U.S. consumer, Consumer Discretionary stocks might seem like an obvious hunting ground for stocks positioned to gain from the positive macroeconomic backdrop we see. Indeed, the sector as a whole was an early beneficiary of the economy’s recovery. While we have held some strong-performing stocks in the sector, overall our contrarian, value-driven approach keeps us from following the herd, and leads us to look for opportunities in different parts of the marketplace. Fortunately, in an economy that by many estimates is 70% driven by consumer spending, there are many other places to look for the consumer’s influence.

In the Industrials sector, for example, Universal Forest Products Inc. (UFPI) has benefited from a turnaround in homebuilding, and in homeowners’ renewed willingness to pay for additions and improvements to their homes. We saw the value in this stock before the recovery in homebuilding and home improvement firmly took hold. The wealth effect we described earlier is a crucial element in making homeowners ready to sink larger sums of money into their homes—whether through upgrading to a new one or improving the one they have. Universal can benefit in either case. We didn’t buy Universal solely because of positive conditions in the housing market, but we recognized that those conditions could in time help more investors recognize its intrinsic value.

Similarly, the prospect of rising energy demand creates opportunities among companies that explore for and produce oil and gas. In keeping with our tendency to look beyond the obvious, we’ve paid attention to other companies positioned to benefit. These include engineering and construction companies like KBR Incorporated (KBR). KBR constructs Liquefied Natural Gas (LNG) facilities, which are used to convert natural gas into a liquid form that facilitates export into global markets that cannot be reached by pipeline. The company has a project backlog in LNG and other hydrocarbon processing facilities that help give them pricing power, which could drive higher earnings going forward. One benefit of the Select Value Fund’s multi-cap approach is that we can seek out companies with attractive valuations wherever they fall on the market-cap spectrum. When we see solid opportunities in mid-cap companies like KBR, for example, we’re able to pursue them without facing a market-cap limitation.

Steeling for Growth

The economic impact of cheaper domestic energy extends beyond energy related industries. For example, Nucor Corporation (NUE) is a steel company positioned to benefit from improving commercial construction—the end market for much of what it makes. That’s one macro factor in its favor. And because steel production is an energy-intensive process, U.S. producers like Nucor can gain a competitive advantage when the cost of one of their major inputs—in this case, natural gas—is cheaper than that available in foreign markets.

When we first identified Nucor, we were drawn by more than its attractive valuation. The company’s A-rated credit—unusual in its industry—also attracted us*. The financial flexibility the company gains from its strong credit can provide a desirable cushion should the business experience an unexpected reversal, or give the company resources to pursue strategic partnerships that can pay off in the long run. A favorable macro environment—in the form of cheaper energy and improving commercial construction—has given support to the company’s own intrinsic strengths. And once again, we believe the result is a compelling opportunity.

A Process that has Produced Results

The trends shaping our positive outlook for the economy don’t determine our investment decisions for the Select Value Fund—or any Heartland portfolio. But they can play a meaningful role as we apply our 10 Principles of Value Investing™ in selecting stocks. Economic recovery, and the specific factors contributing to it, can help bring to fruition the catalysts that allow undervalued companies to be recognized in the marketplace. This approach does not wed us to one sector or set of sectors, but helps us to scan the broader landscape for areas where our research may prove fertile.

This marriage of bottom-up investing with careful attention to emerging macro trends has produced an attractive record of results for the Select Value Fund. For each rolling five-year period since 1997, it has outperformed its benchmark. We find this measure instructive, as we’re not interested in chasing short-term market trends, but remain focused on long-term potential in selecting stocks. Indeed, the macro backdrop will change over time—but our fundamental approach to investing will not.

Just as our investment process depends on identifying companies before they are widely recognized in the marketplace, so too do we strive to understand broader macro trends before they fully take hold. Looking at data this way helps us to anticipate changes in the economy while they’re still in their early stages—and to identify the companies that could benefit before the rest of the market has driven up their prices.

http://www.heartlandfunds.com/Portal.htm

Investors often ask how such a broad macroeconomic view factors into the fundamental, bottom-up stock selection process we employ in managing the Heartland Select Value Fund and all of the Heartland portfolios. The simple answer is that we don’t use our macro perspective as a top-down driver in our decision-making. But because the companies we research must contend with the ever-changing macroeconomic backdrop, the trends we anticipate going forward inform our research as we seek out industries and companies that could benefit.

We Can’t Predict, But We Can Look Ahead

One of the reasons we’re optimistic about the economy is that we believe the U.S. consumer is strengthening, based on signs of continued improvement in employment data, rising household net worth, and a strong outlook for domestically produced energy, among other factors.

Just as we seek to identify companies before they’ve been noticed by the Wall Street crowd, we strive to be on top of macro developments before their impact has been fully revealed. We’re intrigued by the long-term relationship we’ve found between Bank Lending Surveys—a measure of easing or tightening credit standards from bank officers issuing loans—and unemployment. Over time, we have found easier lending standards to be a leading indicator of falling unemployment.

The graph below charts Bank Lending Survey results against unemployment data. (Declining lines indicate more lax lending policies and lower unemployment; rising lines show constrained lending and rising jobless numbers.) To reflect that lending data is a leading indicator of improved employment—and better illustrate the link between the two—we have shifted the time frame for the employment line back one year.

The results show a fairly tight correlation between the figures. We believe they also show that unemployment has room to fall even further, helping to support our view of gradual economic growth in the U.S.

Why People Are Feeling Better

After a recession that saw both home prices and equity values plunge, it’s understandable that consumers have needed some time to regain their confidence. With substantial rebounds on both fronts, household net worth has risen once again to a new high. We believe this is a key building block to rebuilding confidence among consumers and investors, and it’s another of the broad factors we track.

On its own, this wealth effect doesn’t cause us to buy or sell any particular stock. But such a clear tailwind can influence the decision-making process.

Bringing Some Energy to the Table

The uptick in economic activity we anticipate appears almost certain to spark higher energy demand. Not too long ago, that could be problematic: The U.S. was more dependent on foreign sources of energy, and thus had little control over costs. Now, thanks to progress in extracting oil and natural gas from shale, the U.S. is making great strides toward energy independence.

Further, the rise in U.S. energy production is not only a beneficiary of the improving economy; it’s also helping to fuel it. Cheaper energy is driving a U.S. industrial renaissance, as manufacturers of a wide range of products are finding it less expensive to operate closer to home than it is to farm work out overseas. We believe this can be a driving force to help many of the stocks in the Select Value Fund attain their full intrinsic value.

What About Stock Picking?

Given our positive view for the U.S. consumer, Consumer Discretionary stocks might seem like an obvious hunting ground for stocks positioned to gain from the positive macroeconomic backdrop we see. Indeed, the sector as a whole was an early beneficiary of the economy’s recovery. While we have held some strong-performing stocks in the sector, overall our contrarian, value-driven approach keeps us from following the herd, and leads us to look for opportunities in different parts of the marketplace. Fortunately, in an economy that by many estimates is 70% driven by consumer spending, there are many other places to look for the consumer’s influence.

In the Industrials sector, for example, Universal Forest Products Inc. (UFPI) has benefited from a turnaround in homebuilding, and in homeowners’ renewed willingness to pay for additions and improvements to their homes. We saw the value in this stock before the recovery in homebuilding and home improvement firmly took hold. The wealth effect we described earlier is a crucial element in making homeowners ready to sink larger sums of money into their homes—whether through upgrading to a new one or improving the one they have. Universal can benefit in either case. We didn’t buy Universal solely because of positive conditions in the housing market, but we recognized that those conditions could in time help more investors recognize its intrinsic value.

Similarly, the prospect of rising energy demand creates opportunities among companies that explore for and produce oil and gas. In keeping with our tendency to look beyond the obvious, we’ve paid attention to other companies positioned to benefit. These include engineering and construction companies like KBR Incorporated (KBR). KBR constructs Liquefied Natural Gas (LNG) facilities, which are used to convert natural gas into a liquid form that facilitates export into global markets that cannot be reached by pipeline. The company has a project backlog in LNG and other hydrocarbon processing facilities that help give them pricing power, which could drive higher earnings going forward. One benefit of the Select Value Fund’s multi-cap approach is that we can seek out companies with attractive valuations wherever they fall on the market-cap spectrum. When we see solid opportunities in mid-cap companies like KBR, for example, we’re able to pursue them without facing a market-cap limitation.

Steeling for Growth

The economic impact of cheaper domestic energy extends beyond energy related industries. For example, Nucor Corporation (NUE) is a steel company positioned to benefit from improving commercial construction—the end market for much of what it makes. That’s one macro factor in its favor. And because steel production is an energy-intensive process, U.S. producers like Nucor can gain a competitive advantage when the cost of one of their major inputs—in this case, natural gas—is cheaper than that available in foreign markets.

When we first identified Nucor, we were drawn by more than its attractive valuation. The company’s A-rated credit—unusual in its industry—also attracted us*. The financial flexibility the company gains from its strong credit can provide a desirable cushion should the business experience an unexpected reversal, or give the company resources to pursue strategic partnerships that can pay off in the long run. A favorable macro environment—in the form of cheaper energy and improving commercial construction—has given support to the company’s own intrinsic strengths. And once again, we believe the result is a compelling opportunity.

A Process that has Produced Results

The trends shaping our positive outlook for the economy don’t determine our investment decisions for the Select Value Fund—or any Heartland portfolio. But they can play a meaningful role as we apply our 10 Principles of Value Investing™ in selecting stocks. Economic recovery, and the specific factors contributing to it, can help bring to fruition the catalysts that allow undervalued companies to be recognized in the marketplace. This approach does not wed us to one sector or set of sectors, but helps us to scan the broader landscape for areas where our research may prove fertile.

This marriage of bottom-up investing with careful attention to emerging macro trends has produced an attractive record of results for the Select Value Fund. For each rolling five-year period since 1997, it has outperformed its benchmark. We find this measure instructive, as we’re not interested in chasing short-term market trends, but remain focused on long-term potential in selecting stocks. Indeed, the macro backdrop will change over time—but our fundamental approach to investing will not.

Just as our investment process depends on identifying companies before they are widely recognized in the marketplace, so too do we strive to understand broader macro trends before they fully take hold. Looking at data this way helps us to anticipate changes in the economy while they’re still in their early stages—and to identify the companies that could benefit before the rest of the market has driven up their prices.

http://www.heartlandfunds.com/Portal.htm