Tandem Diabetes Care Inc (TNDM, Financial) has experienced a remarkable surge in its stock price, with a 19.29% gain over the past week and an impressive 52.99% gain over the past three months. The company's market capitalization now stands at $1.91 billion, with the current stock price at $29.13. Despite this upward trajectory, the GF Value suggests a valuation of $55.5, significantly higher than the current price, indicating that the stock may be undervalued. However, it's worth noting that the GF Value has decreased from a past valuation of $125.33, and the current GF Valuation status remains a "Possible Value Trap, Think Twice," unchanged from the past valuation.

Understanding Tandem Diabetes Care Inc

Tandem Diabetes Care Inc, operating within the Medical Devices & Instruments industry, is a specialized manufacturer and marketer of durable insulin pumps. The company's flagship product, the t:slim X2 device, has been a significant contributor to its market presence, primarily in the U.S. Tandem's business model includes sales of the pumps and disposable infusion sets, which together account for the majority of its revenue. The company's focus on innovation and meeting the needs of diabetes patients has been central to its growth strategy.

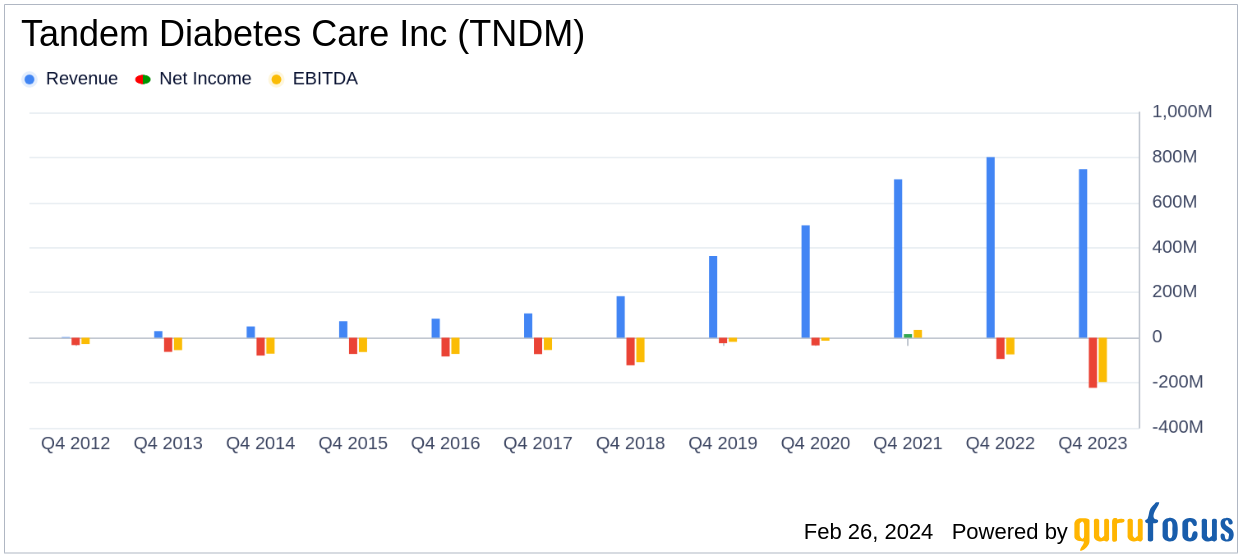

Profitability Concerns

Despite its growth, Tandem's Profitability Rank is low at 3/10. The company's Operating Margin is currently at -31.19%, which, while better than 33.7% of 822 companies in the industry, is still negative. Similarly, Tandem's ROE stands at a concerning -64.13%, and its ROA at -22.97%. The ROIC is also in the negative territory at -61.62%. These figures suggest that Tandem has struggled to convert its investments into profitable returns, having achieved profitability in only one of the past ten years.

Impressive Growth Trajectory

Contrasting its profitability challenges, Tandem's Growth Rank is high at 9/10. The company has demonstrated a solid 12.10% 3-Year Revenue Growth Rate per Share, outperforming 62.74% of 722 companies in the industry. Its 5-Year Revenue Growth Rate per Share is even more impressive at 25.40%, surpassing 85.02% of its peers. The estimated Total Revenue Growth Rate (Future 3Y To 5Y Est) is 7.00%, indicating potential for continued expansion. However, the 3-Year EPS without NRI Growth Rate is at a staggering -103.10%, which is a point of concern for investors.

Investor Confidence

Notable investors have taken positions in Tandem, with Steven Cohen (Trades, Portfolio) leading the pack holding 990,336 shares, representing 1.52% of the company. Baillie Gifford (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) follow with 0.4% and 0.36% shareholdings, respectively. These investments by prominent figures may signal confidence in Tandem's market strategy and future prospects.

Competitive Landscape

Tandem faces competition from companies like UFP Technologies Inc (UFPT, Financial) with a market cap of $1.61 billion, TransMedics Group Inc (TMDX, Financial) at $2.71 billion, and Alphatec Holdings Inc (ATEC, Financial) with a market cap of $2.08 billion. These competitors, with market capitalizations close to Tandem's, highlight the competitive nature of the Medical Devices & Instruments industry.

Conclusion: A Mixed Bag for Value Investors

In conclusion, Tandem Diabetes Care Inc's recent stock performance has been impressive, but the company's valuation according to GF Value suggests caution. The profitability metrics raise concerns, particularly the negative operating margin and ROE. However, the company's strong growth rates in revenue per share and the backing of significant investors may offer some reassurance. When considering Tandem's market position and competition, value investors should weigh the potential risks and opportunities carefully. The company's financial health and investor holdings present a complex picture, one that requires a nuanced approach to investment decision-making.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: