Insight into CaixaBank SA's Upcoming Dividend and Historical Performance

CaixaBank SA (CAIXY, Financial) recently announced a dividend of $0.14 per share, payable on 2024-04-18, with the ex-dividend date set for 2024-04-03. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into CaixaBank SA's dividend performance and assess its sustainability.

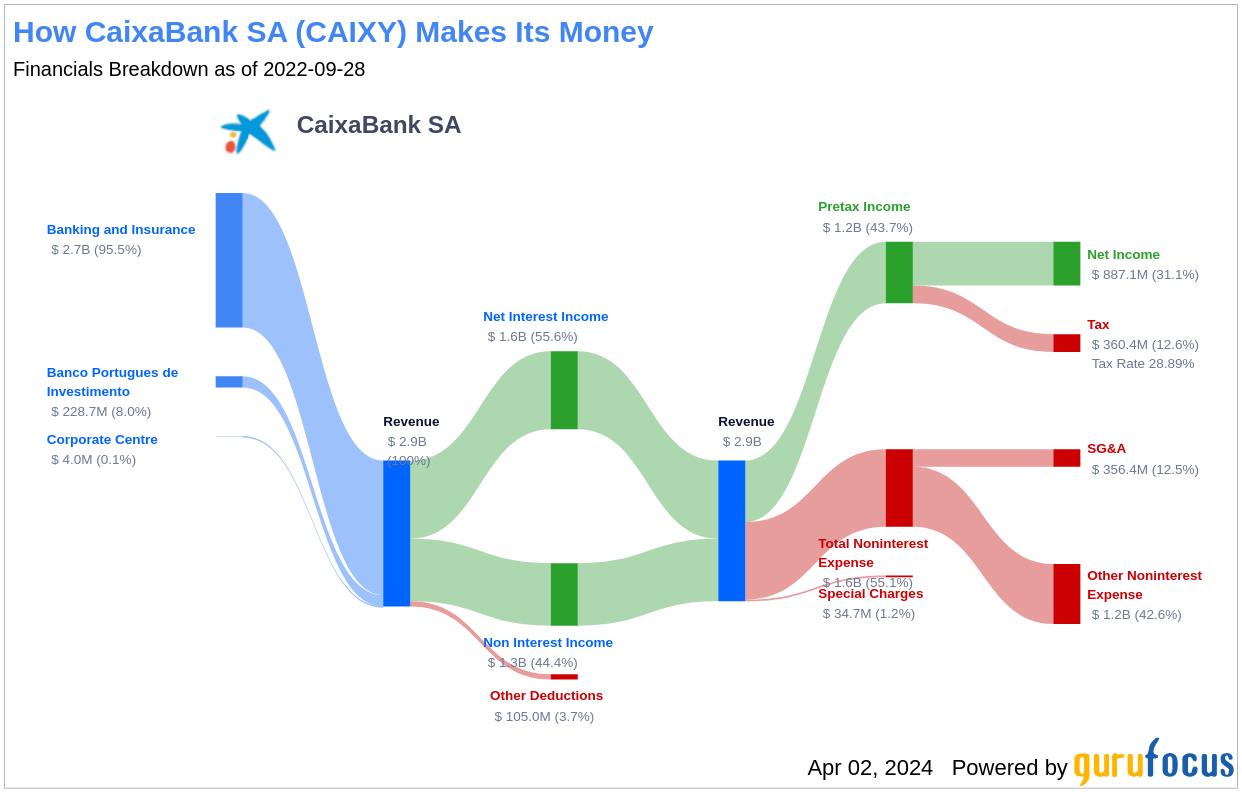

What Does CaixaBank SA Do?

CaixaBank SA is a Spanish bank that integrates banking, insurance, and equity investment services. Its operations span retail banking, corporate banking, cash management, surplus management, and the allocation of income from financing the equity investment business. It is organized into business segments: Banking and insurance business, BPI, and Corporate center, with the majority of its revenue stemming from the Banking and insurance segment. CaixaBank SA has a significant presence in Spain, Portugal, America, the Rest of the European Union, and other global markets, with Spain being its largest revenue generator.

A Glimpse at CaixaBank SA's Dividend History

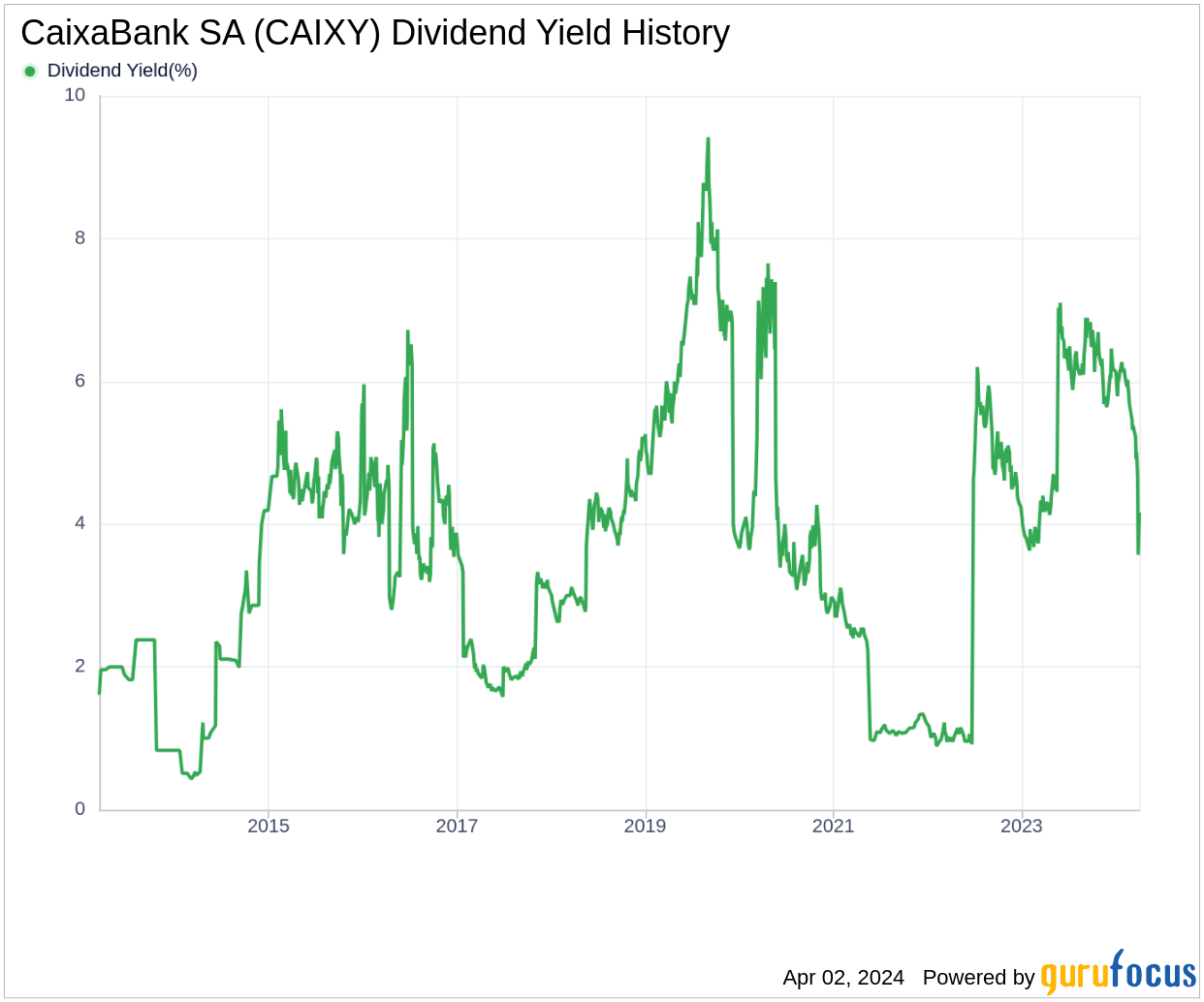

CaixaBank SA has maintained a reliable dividend payment track record since 2013, distributing dividends annually. Below is a chart showing the annual Dividends Per Share to illustrate historical trends.

Breaking Down CaixaBank SA's Dividend Yield and Growth

As of today, CaixaBank SA boasts a 12-month trailing dividend yield of 4.17% and a 12-month forward dividend yield of 7.04%, indicating anticipated dividend increases over the next year. Over the past three years, CaixaBank SA's annual dividend growth rate was an impressive 48.90%. However, the five-year average annual growth rate moderated to 6.90%. Looking at the past decade, the annual dividends per share growth rate was -6.90%. Reflecting on these figures, the 5-year yield on cost for CaixaBank SA stock is approximately 5.82%.

The Sustainability Question: Payout Ratio and Profitability

The dividend sustainability can be gauged by analyzing CaixaBank SA's payout ratio. With a dividend payout ratio of 0.35 as of December 31, 2023, a substantial portion of earnings is retained for future growth and to cushion against downturns. The company's profitability rank is 6 out of 10, indicating fair profitability. Consistent positive net income over the past decade underscores CaixaBank SA's strong earnings capability.

Growth Metrics: The Future Outlook

For dividend sustainability, robust growth metrics are crucial. CaixaBank SA's growth rank of 6 out of 10 suggests a fair growth outlook. The company's revenue per share and 3-year revenue growth rate, which stands at an average of 11.90% per year, outperforms approximately 70.48% of global competitors. Additionally, the 3-year EPS growth rate of 41.20% per year and the 5-year EBITDA growth rate of 7.30% outperform approximately 86.99% and 51.75% of global competitors, respectively.

Next Steps

In conclusion, CaixaBank SA's upcoming dividend, historical dividend growth, moderate payout ratio, and fair profitability and growth metrics paint a positive picture for investors seeking income through dividends. The company's ability to sustain and grow its dividends is supported by a solid financial foundation and growth prospects. As such, CaixaBank SA remains an interesting prospect for value investors focused on dividend income. For more investment opportunities, GuruFocus Premium users can utilize the High Dividend Yield Screener to discover high-yielding stocks.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.