LyondellBasell Industries NV (LYB, Financial) recently showcased a daily gain of 2.04% and a 3-month gain of 7.68%, with an Earnings Per Share (EPS) of 6.47. These figures prompt an intriguing question: is the stock modestly overvalued? This article delves into the valuation of LyondellBasell Industries NV, providing a detailed analysis to guide potential investors and value seekers.

Company Overview

LyondellBasell Industries NV operates as a leading petrochemical producer with extensive operations across the United States, Europe, and Asia. As the world's largest producer of polypropylene and a major producer of polyethylene and propylene oxide, its chemicals are integral to various consumer and industrial products. A significant portion of its production is based in North America. Currently, the stock stands at a market price of $103.52 per share with a market capitalization of $33.70 billion, contrasted against a GF Value of $90.91, suggesting a potential overvaluation.

Understanding GF Value

The GF Value is a unique measure used to estimate the intrinsic value of a stock. It is derived from historical trading multiples such as PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow, adjusted by GuruFocus based on past returns and growth, alongside future business performance estimates. According to our analysis, LyondellBasell Industries NV appears modestly overvalued. This assessment is based on its current price which stands above its GF Value, suggesting that the stock may offer limited future returns relative to its business growth.

Financial Strength and Risk

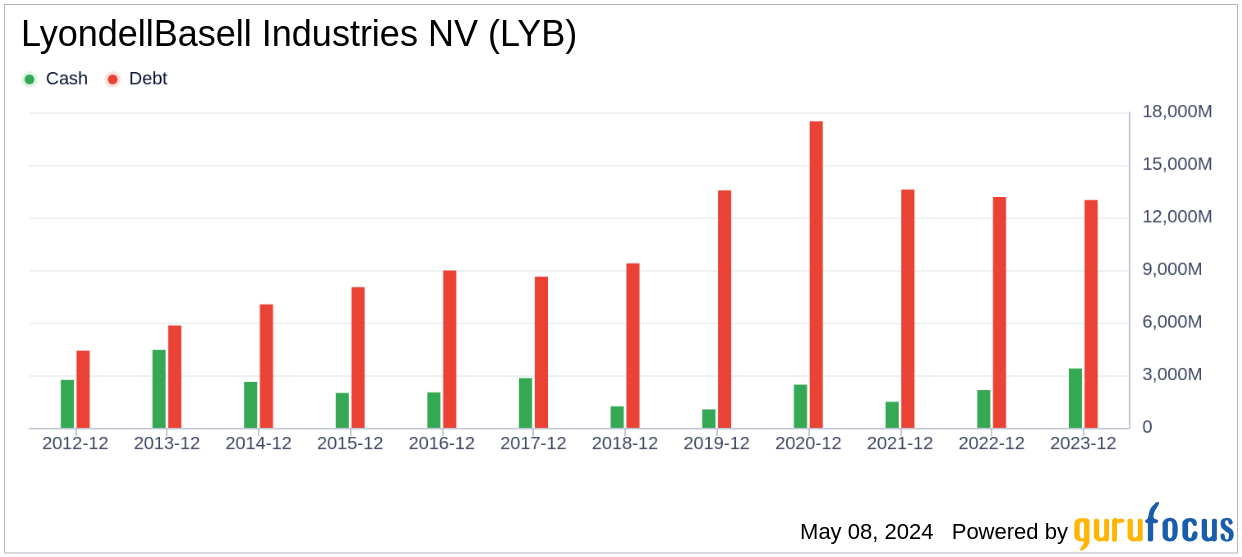

Investigating the financial strength of LyondellBasell Industries NV, it's crucial to consider metrics like the cash-to-debt ratio, which currently stands at 0.18. This figure places the company in a less favorable position compared to 80.77% of its peers in the Chemicals industry. The company's financial strength is rated 6 out of 10, indicating a fair status but highlighting potential risks in capital loss.

Profitability and Growth Prospects

LyondellBasell Industries NV has demonstrated strong profitability, maintaining a consistent positive earnings record over the past decade. With a revenue of $40.80 billion and an operating margin of 8.12%, its profitability is ranked 8 out of 10. The company's growth metrics are also robust, with a 3-year average EBITDA growth rate of 13%, outpacing 63.04% of competitors in the industry. These factors are essential for assessing the long-term value creation potential of LyondellBasell Industries NV.

Investment Considerations

Comparing the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) provides further insights into the company's profitability. LyondellBasell's ROIC stands at 9.59, surpassing its WACC of 7.01, indicating efficient cash flow generation relative to capital costs.

Conclusion

While LyondellBasell Industries NV displays signs of being modestly overvalued based on its current market price and GF Value, its strong financial fundamentals and growth prospects may still appeal to long-term investors. To explore further details about LyondellBasell Industries NV, consider examining its 30-Year Financials.

To discover other high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.