On May 8, 2024, Lesaka Technologies Inc. (LSAK, Financial) disclosed its financial results for the third quarter ended March 31, 2024, through an 8-K filing. The company, a prominent player in the fintech sector in Southern Africa, reported a revenue increase and a reduction in net loss, indicating a mixed financial performance amidst operational adjustments and market challenges.

Company Overview

Lesaka Technologies Inc provides innovative payment and financial technology solutions primarily in South Africa, operating through two segments: Merchant and Consumer. The Merchant segment, which is the major revenue contributor, offers goods and services to corporate entities and earns fees through processing activities. The Consumer segment provides financial services like bank accounts and loans to individual customers, generating revenue through service fees.

Financial Performance Insights

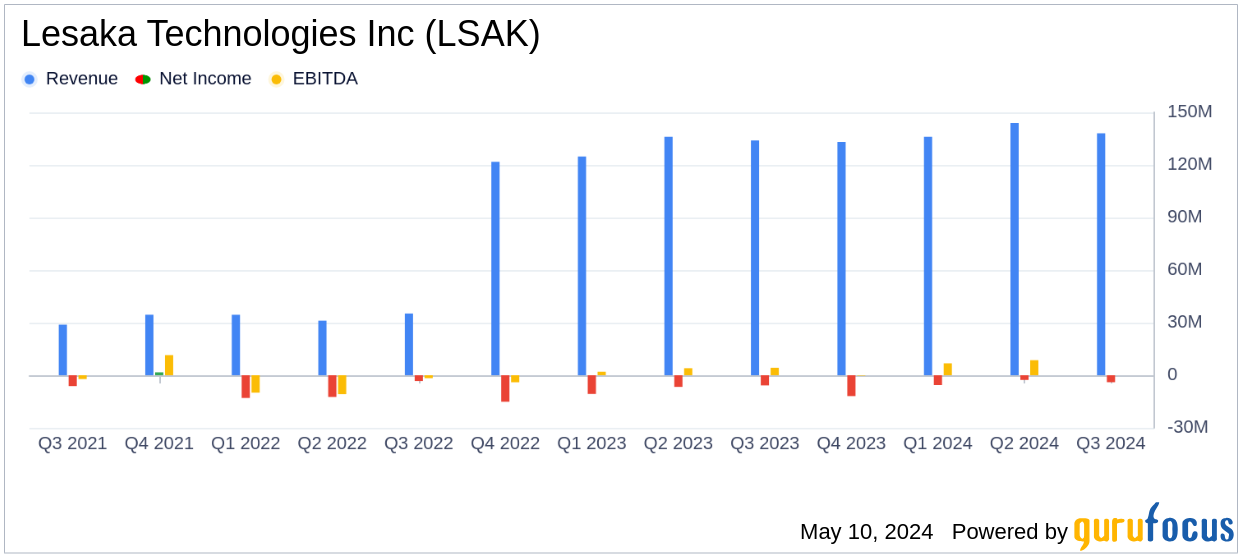

For Q3 2024, Lesaka Technologies reported a revenue of $138.2 million, marking a 3% increase from $134.0 million in the same quarter the previous year. This growth reflects stronger transaction volumes and increased service offerings. However, the company recorded a net loss of $4.0 million, an improvement from a $5.8 million loss in Q3 2023, showing a 27% betterment in net losses year-over-year.

Operational Highlights and Challenges

The Merchant Division's revenue rose to $121.0 million, up 8% from the prior year, driven by higher sales of prepaid airtime and other value-added services. The Consumer Division also saw a significant revenue increase of 19% to $17.9 million, attributed to higher transaction fees and lending revenues. Despite these gains, the company's profitability is still under pressure due to ongoing operational costs and competitive market conditions.

Lesaka's adjusted EBITDA, a non-GAAP measure, was $9.7 million, up 47% from $7.0 million in Q3 2023, surpassing the upper end of the company's guidance. This increase is a positive indicator of operational efficiency and cost management. However, the net debt to adjusted EBITDA ratio, although improved to 2.6 from 4.2 a year ago, remains a point of concern, highlighting the company's ongoing leverage issues.

Strategic Movements and Outlook

Lesaka's management remains optimistic about future growth, particularly with the anticipated completion of the Adumo acquisition, which is expected to accelerate organic growth and strengthen the company's market position in Southern Africa. The company has reaffirmed its revenue guidance for fiscal 2024 and raised its adjusted EBITDA outlook, reflecting confidence in its operational strategies and market opportunities.

Conclusion

While Lesaka Technologies Inc. shows promising improvements in revenue and operational efficiency, the persistent net losses and debt levels pose challenges. Investors and stakeholders will likely watch closely how the company navigates these challenges and capitalizes on its strategic initiatives in the coming quarters. For more detailed financial analysis and future updates on Lesaka Technologies, stay tuned to GuruFocus.com.

For further information, please refer to the company's detailed earnings presentation on the Investor Relations page of Lesaka's website, and join the upcoming webcast and conference call to discuss these results.

Explore the complete 8-K earnings release (here) from Lesaka Technologies Inc for further details.