Insights from the Latest 13F Filing Highlight Major Portfolio Adjustments

In the first quarter of 2024, Hotchkis & Wiley, a distinguished investment firm established in 1980 in Los Angeles, continued to apply its value investing philosophy, focusing on undervalued companies with strong potential for appreciation. The firm assesses key investment parameters such as tangible assets, sustainable cash flow, and business performance improvement potential to guide their investment decisions.

Summary of New Buys

HOTCHKIS & WILEY (Trades, Portfolio) added a total of 55 stocks to its portfolio this quarter. Noteworthy new additions include:

- Humana Inc (HUM, Financial), with 518,405 shares, making up 0.6% of the portfolio and valued at $179.74 million.

- Marriott Vacations Worldwide Corp (VAC, Financial), comprising 824,044 shares, which represent about 0.3% of the portfolio, with a total value of $88.77 million.

- General Mills Inc (GIS, Financial), with 723,695 shares, accounting for 0.17% of the portfolio and a total value of $50.64 million.

Key Position Increases

HOTCHKIS & WILEY (Trades, Portfolio) also increased stakes in a total of 180 stocks, with significant increases in:

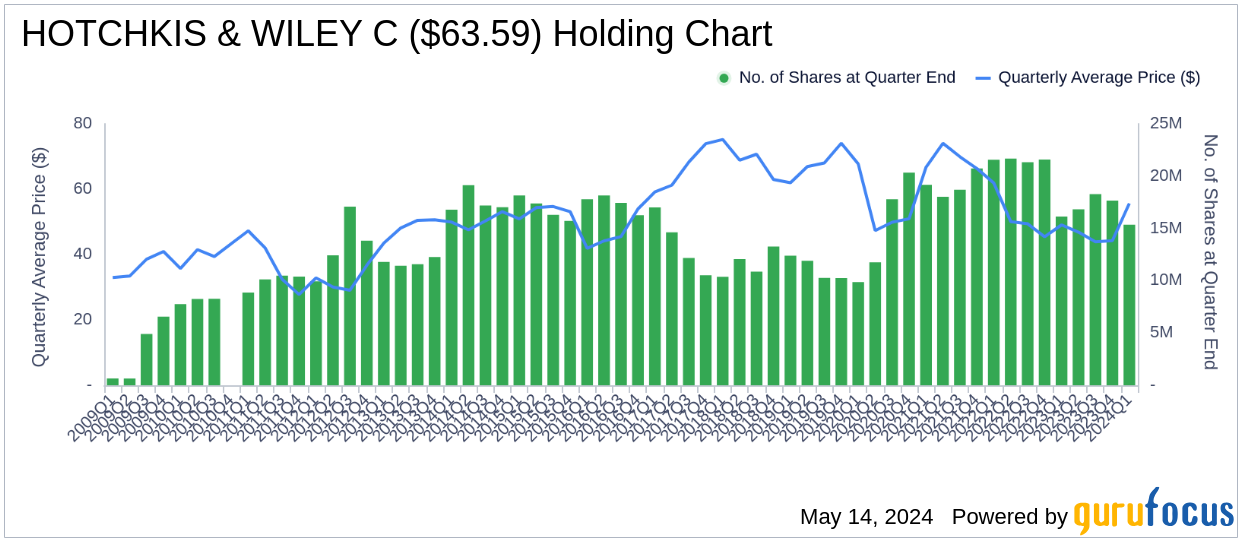

- APA Corp (APA, Financial), with an additional 4,131,107 shares, bringing the total to 24,430,645 shares. This adjustment represents a significant 20.35% increase in share count, a 0.47% impact on the current portfolio, and a total value of $839.93 million.

- Conagra Brands Inc (CAG, Financial), with an additional 4,726,280 shares, bringing the total to 4,961,080. This adjustment represents a significant 2012.9% increase in share count, with a total value of $147.05 million.

Summary of Sold Out Positions

HOTCHKIS & WILEY (Trades, Portfolio) completely exited 48 holdings in the first quarter of 2024, including:

- iShares Broad USD High Yield Corporate Bond ETF (USHY, Financial), selling all 583,650 shares, resulting in a -0.08% impact on the portfolio.

- Ironwood Pharmaceuticals Inc (IRWD, Financial), liquidating all 1,140,470 shares, causing a -0.05% impact on the portfolio.

Key Position Reductions

HOTCHKIS & WILEY (Trades, Portfolio) also reduced positions in 238 stocks. The most significant changes include:

- GE Aerospace (GE, Financial), reduced by 2,015,189 shares, resulting in a -54.68% decrease in shares and a -0.91% impact on the portfolio. The stock traded at an average price of $117.76 during the quarter and has returned 37.31% over the past 3 months and 57.61% year-to-date.

- Microsoft Corp (MSFT, Financial), reduced by 555,594 shares, resulting in a -56.51% reduction in shares and a -0.75% impact on the portfolio. The stock traded at an average price of $404.82 during the quarter and has returned 1.84% over the past 3 months and 11.11% year-to-date.

Portfolio Overview

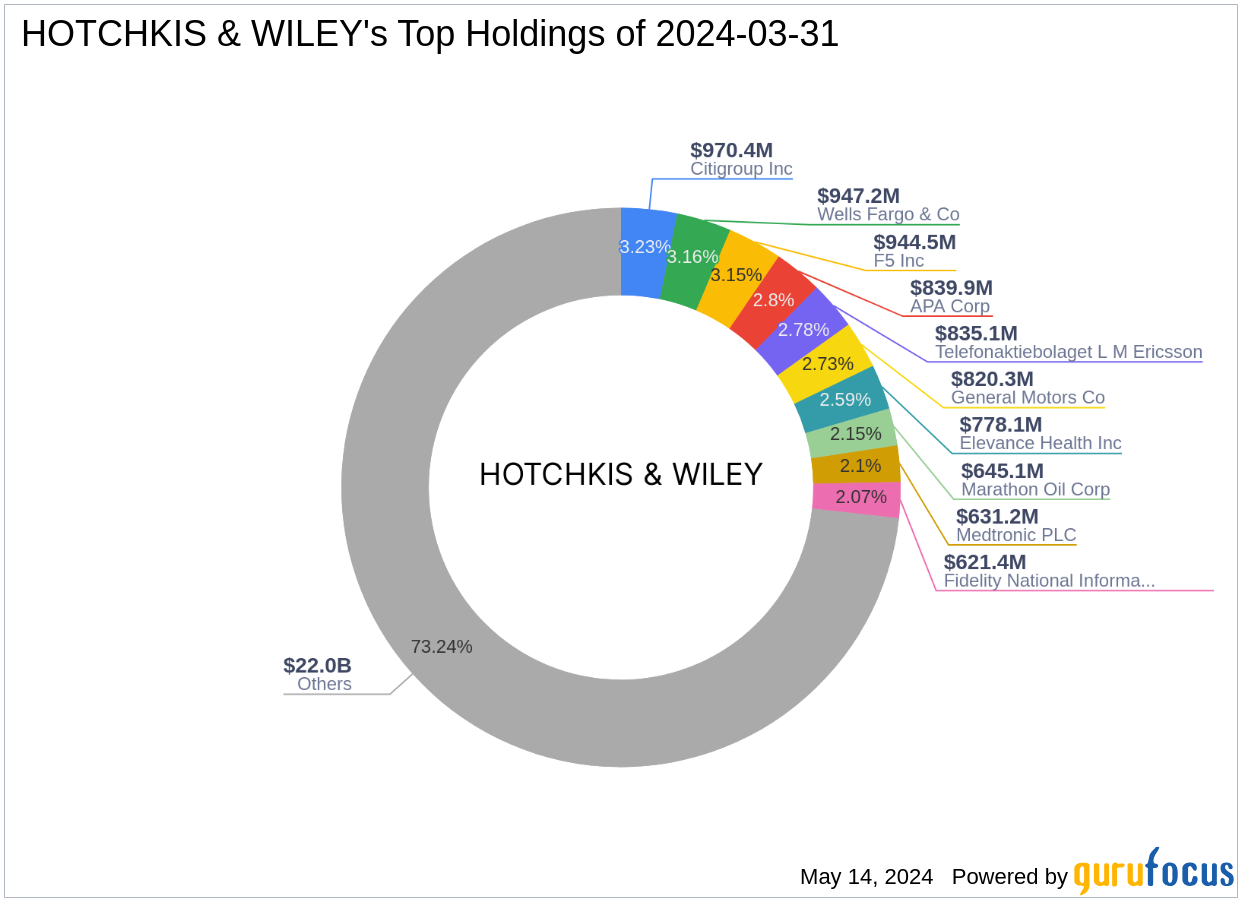

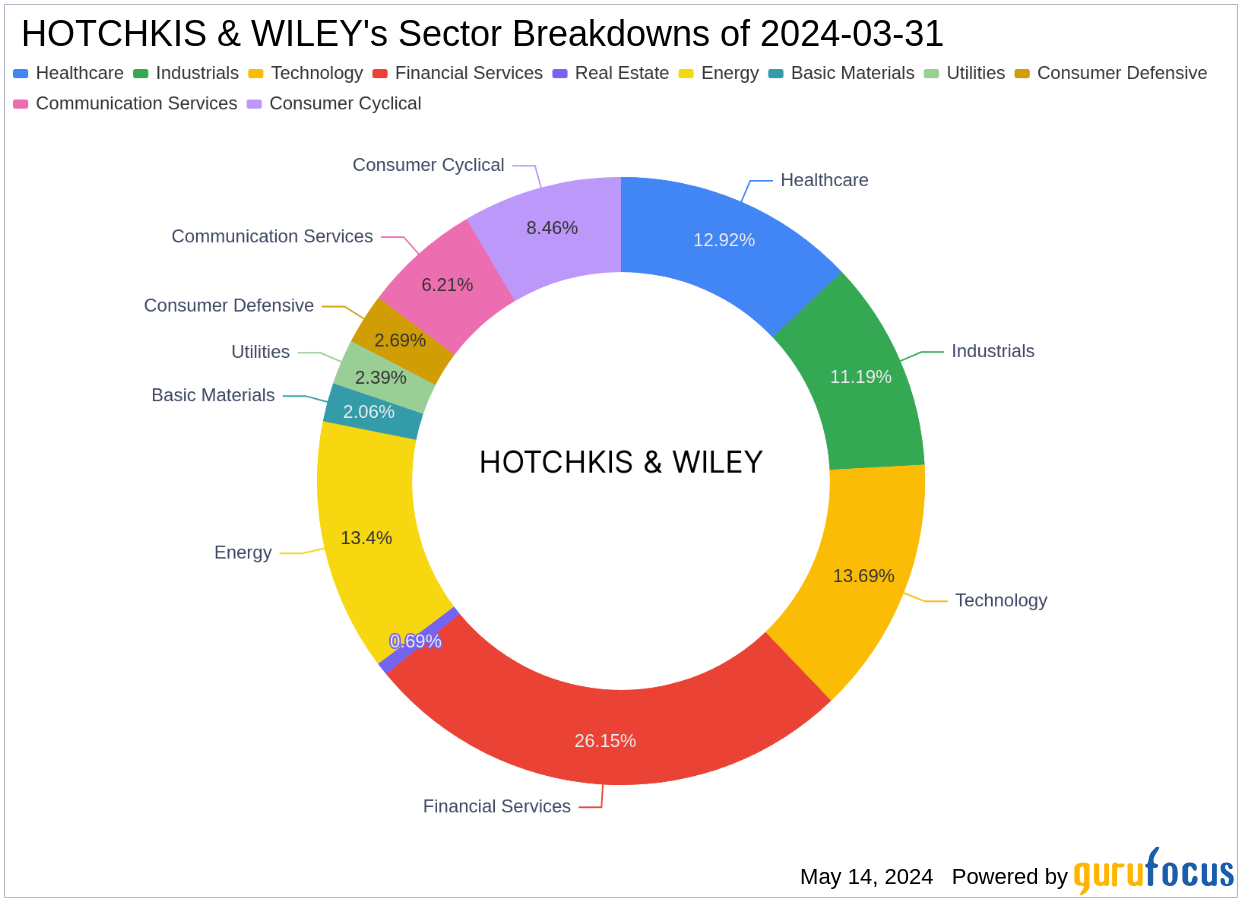

At the end of the first quarter of 2024, HOTCHKIS & WILEY (Trades, Portfolio)'s portfolio included 484 stocks. The top holdings were 3.23% in Citigroup Inc (C, Financial), 3.16% in Wells Fargo & Co (WFC, Financial), 3.15% in F5 Inc (FFIV, Financial), 2.8% in APA Corp (APA, Financial), and 2.78% in Telefonaktiebolaget L M Ericsson (ERIC, Financial). The holdings are mainly concentrated across all 11 industries: Financial Services, Technology, Energy, Healthcare, Industrials, Consumer Cyclical, Communication Services, Consumer Defensive, Utilities, Basic Materials, and Real Estate.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.