Equifax Inc (EFX, Financial), a prominent player in the credit bureau sector, has recently experienced a notable daily loss of 5.58%, contributing to a 3-month decline of 7.5%. With an Earnings Per Share (EPS) standing at 4.49, investors and analysts are keen to determine whether Equifax is fairly valued at its current market price. This article dives deep into the valuation metrics to provide a clearer picture.

Company Overview

Equifax Inc (EFX, Financial) is one of the leading credit bureaus in the United States, alongside Experian and TransUnion. The company plays a critical role in the financial ecosystem by providing detailed credit reports and histories on millions of consumers, which are essential for lenders' credit decisions. Notably, over 40% of Equifax's revenue is derived from workforce solutions, including income verification and employer human resources services, with just over 20% of its revenue coming from international markets.

At the current price of $237.64 per share and a market cap of $29.40 billion, the question arises: is Equifax fairly valued? This analysis aims to shed light on this query by comparing the stock price to the GF Value, an estimation of its fair value.

Understanding the GF Value

The GF Value is a proprietary measure calculated to represent the intrinsic value of a stock. It is derived from three main components: historical trading multiples such as PE Ratio and PS Ratio, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. According to this measure, Equifax is currently fairly valued, suggesting that the stock is priced closely to its estimated fair market value of $232.18.

Financial Strength and Stability

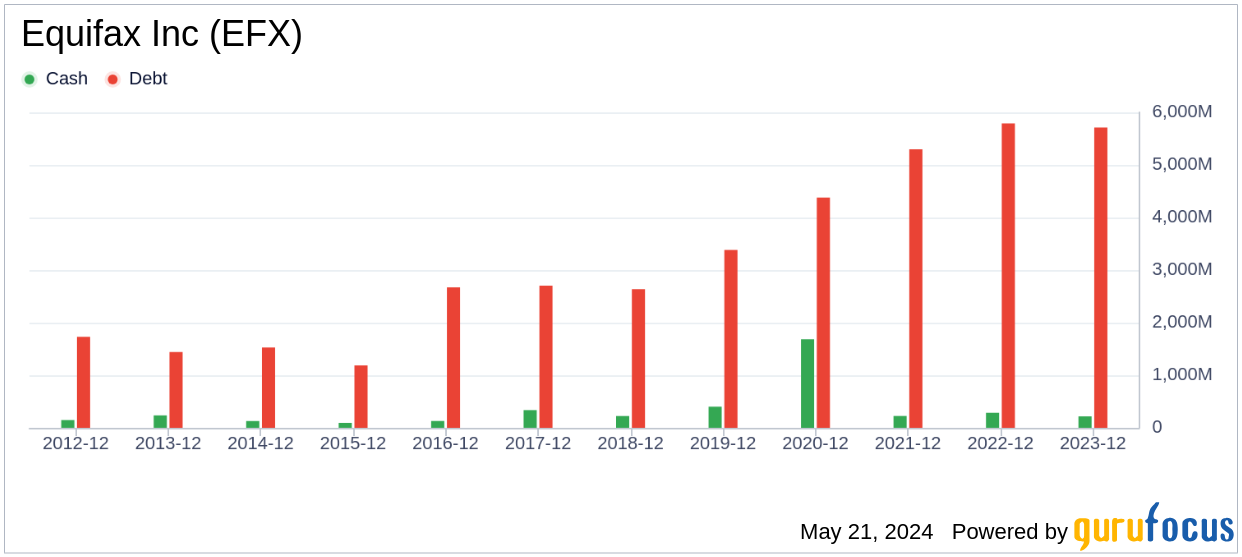

When considering an investment, it's crucial to assess the company's financial strength. Equifax's cash-to-debt ratio is relatively low at 0.04, ranking worse than 93.32% of its peers in the business services industry. This metric, along with a financial strength rating of 5 out of 10 from GuruFocus, suggests that Equifax has a fair balance sheet, albeit with room for improvement.

Profitability and Growth Prospects

Equifax has demonstrated consistent profitability, with a commendable operating margin of 17.81%, which ranks better than 83.19% of its industry counterparts. The company's average annual revenue growth rate stands at 8.1%, showcasing a stable expansion trajectory. However, its 3-year average EBITDA growth rate of 8.5% indicates a performance that is slightly below industry average.

Return on Invested Capital vs. Weighted Average Cost of Capital

A critical aspect of evaluating a company's profitability is comparing its Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC). For Equifax, the ROIC over the past year was 6.28, while the WACC was higher at 12.71. This indicates that the company may not be creating sufficient value relative to the capital costs.

Conclusion

In summary, Equifax (EFX, Financial) appears to be fairly valued based on current assessments. While the company boasts solid profitability metrics, its financial strength and value creation compared to capital costs could be areas of concern. For investors considering Equifax stock, it is advisable to weigh these factors carefully. For more detailed financial insights on Equifax, you can view its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns at reduced risk, consider exploring the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.