Powell Industries Inc (POWL, Financial) recently experienced a significant daily gain of 11.81%, contributing to a 3-month gain of 19.5%. With an Earnings Per Share (EPS) of 8.42, investors might wonder if the stock is significantly overvalued. This article delves into the intrinsic valuation of Powell Industries, encouraging readers to explore the detailed analysis that follows.

Company Introduction

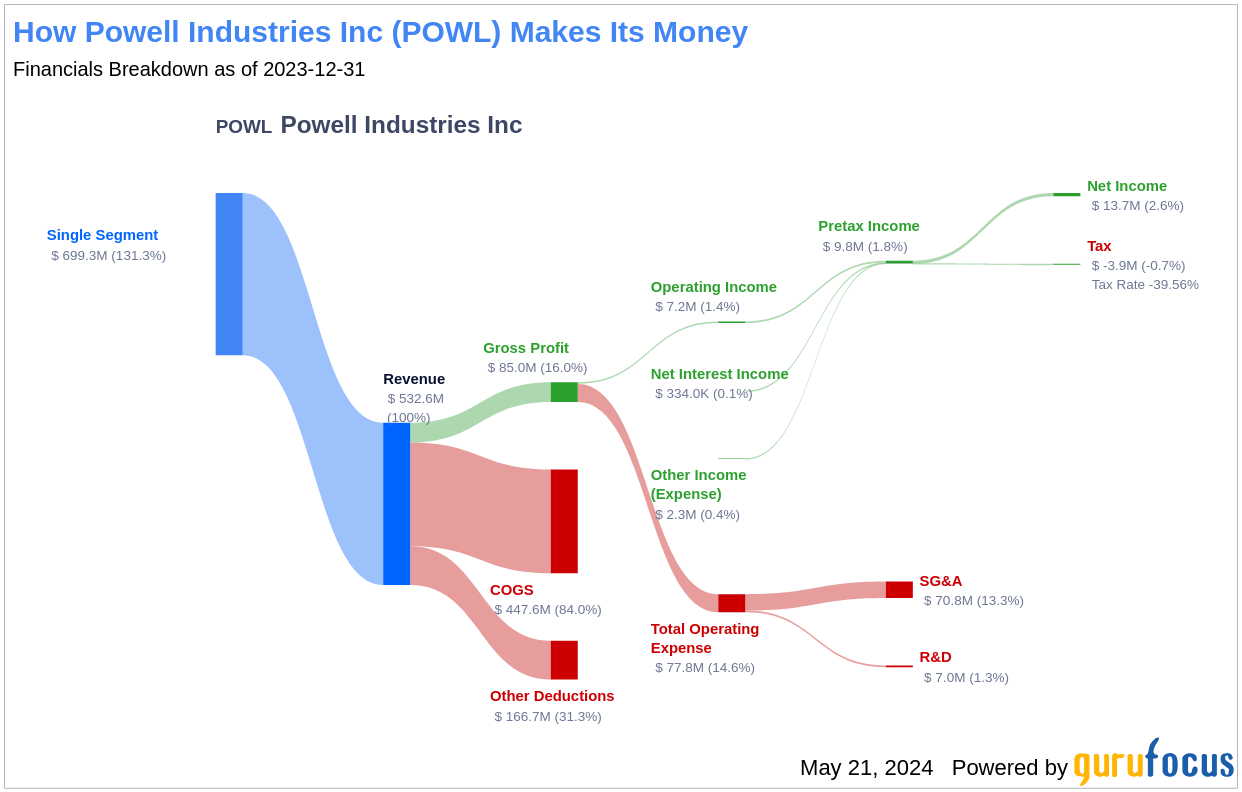

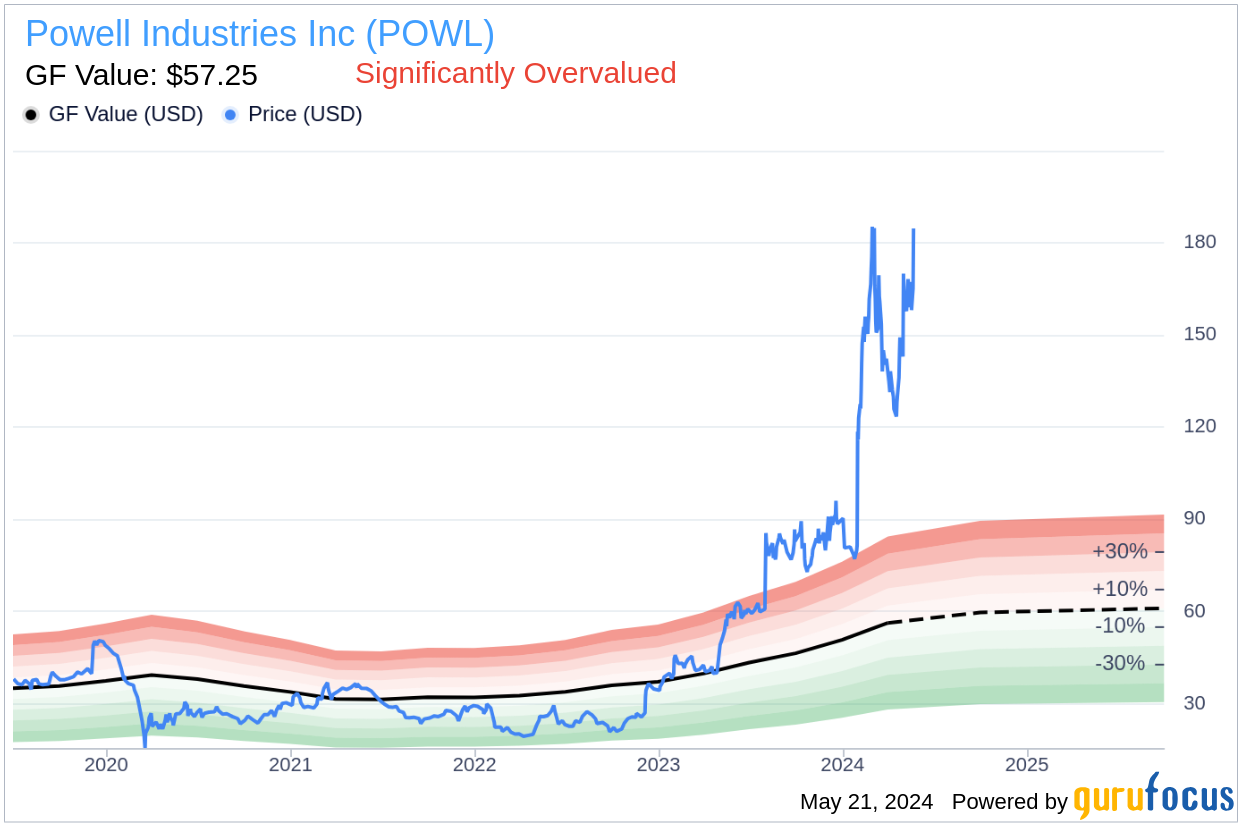

Powell Industries Inc is a pivotal player in the U.S., specializing in the design, manufacture, and service of equipment for electrical energy distribution and control. The company's key products include integrated power control room substations and electrical houses, primarily serving industries like oil and gas refining, mining, and electric utilities. Despite its robust market presence, there is a stark contrast between its current stock price of $184.65 and the GF Value of $57.25, suggesting a potential overvaluation.

Understanding GF Value

The GF Value is a proprietary measure indicating the fair value of a stock based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. For Powell Industries, the GF Value suggests that the stock is significantly overvalued, which might lead to inferior future returns compared to its business growth. This valuation is a critical indicator for potential investors, signaling caution.

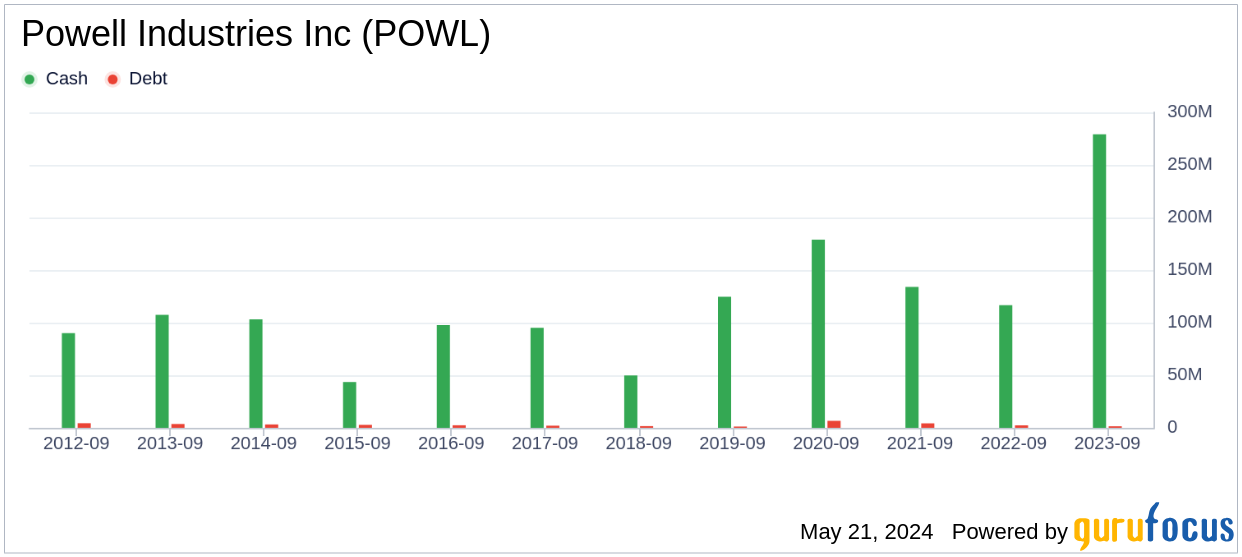

Financial Strength and Stability

Powell Industries boasts a strong financial strength, with a cash-to-debt ratio of 335.48, ranking better than 92.68% of its peers in the Industrial Products industry. This robust financial foundation reduces the risk of capital loss and supports the company's long-term stability.

Profitability and Growth Prospects

Profitability is a vital aspect of investment analysis. Powell Industries has maintained profitability over the past decade, with an operating margin of 13.73%, indicating efficiency in its operations. The company's growth rates in revenue and EBITDA further underscore its potential to enhance shareholder value.

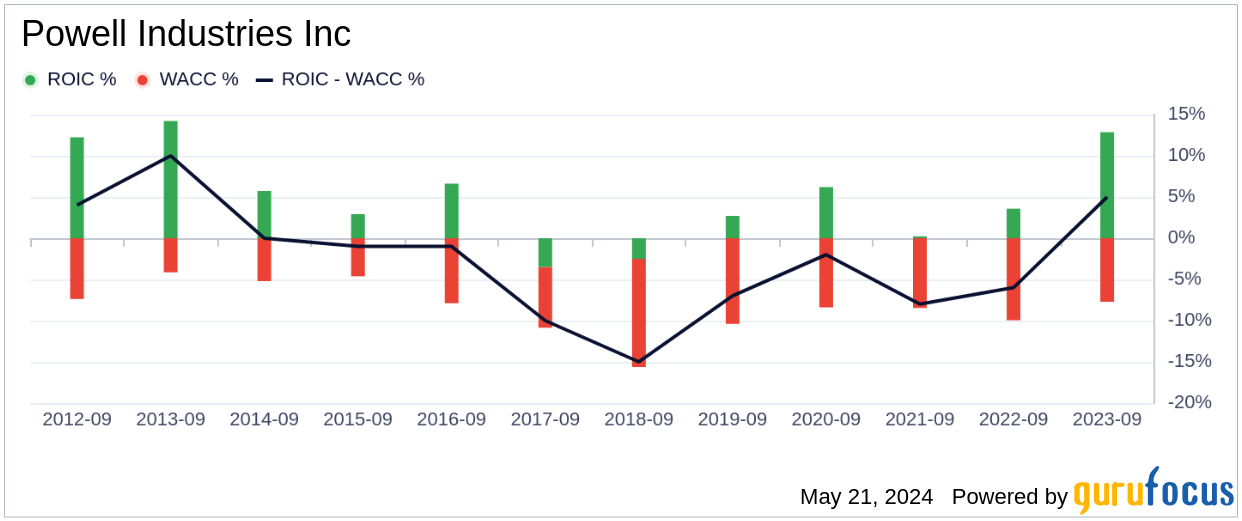

Evaluating Return on Investment

The comparison between Return on Invested Capital (ROIC) and Weighted Average Cost of Capital (WACC) shows that Powell Industries is creating value for its shareholders, with an ROIC of 20.87 compared to a WACC of 8.64. This positive spread is indicative of effective capital management.

Conclusion

Although Powell Industries (POWL, Financial) appears significantly overvalued based on its GF Value, the company's strong financial health, solid profitability, and positive investment returns present a nuanced picture. Investors interested in Powell Industries should consider both the potential overvaluation risk and the company's robust financial metrics. For a deeper understanding, visit Powell Industries' 30-Year Financials.

To discover other high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.