Amidst a daily price drop of 7.87%, A10 Networks Inc (ATEN, Financial) has shown a three-month gain of 18.53%, with an Earnings Per Share (EPS) of $0.61. This raises a crucial question: Is A10 Networks fairly valued? This article delves into the intrinsic valuation of A10 Networks, guiding investors through a meticulous financial analysis.

Company Overview

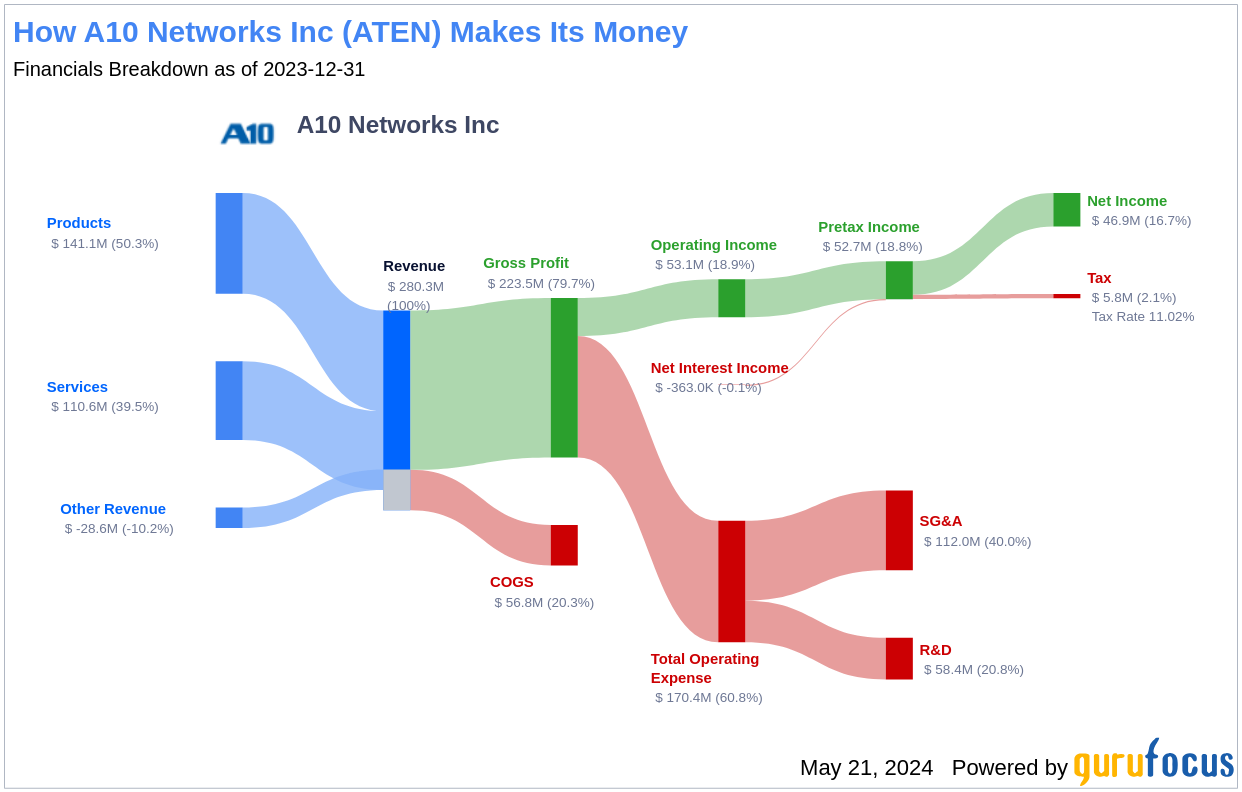

A10 Networks Inc is a key player in the secure application solutions sector, enhancing cyber protection and digital responsiveness across dynamic IT and network infrastructures. The company's product portfolio includes solutions like Thunder Application Delivery Controller and Thunder Threat Protection System, among others. A significant portion of its revenue is generated from the Americas, complemented by contributions from Europe, the Middle East, Africa, and the Asia Pacific regions. Currently, A10 Networks (ATEN, Financial) is trading at $15.16 per share with a market cap of $1.10 billion, closely aligning with its GF Value of $14.42, suggesting a fair valuation.

Understanding GF Value

The GF Value is a proprietary measure designed to predict a stock's intrinsic value by analyzing historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. For A10 Networks, the GF Value suggests the stock is fairly priced, indicating that its market price is in line with the value it is expected to generate. Investors should expect the stock price to hover around this value, with potential fluctuations driven by market dynamics.

Financial Strength and Stability

A10 Networks boasts a strong financial strength, with a cash-to-debt ratio of 36.41, ranking better than 79.92% of its peers in the software industry. This robust financial position minimizes the risk of capital loss and supports sustainable growth.

Profitability and Growth Perspectives

Despite its strong financial footing, A10 Networks' profitability is considered poor, with an operating margin of 15.59% that outperforms 83.49% of its industry counterparts. The company's growth metrics, however, paint a brighter picture. The 3-year average annual revenue growth rate stands at 5.7%, while the EBITDA growth rate over the same period is an impressive 18.5%.

Value Creation Analysis

Comparing the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC) provides insights into how effectively a company is creating value. A10 Networks' ROIC of 17.44 significantly surpasses its WACC of 11.95, indicating efficient value creation for shareholders.

Conclusion

In summary, A10 Networks (ATEN, Financial) is fairly valued at its current market price, reflecting its strong financial health and promising growth prospects. For a deeper dive into A10 Networks' financials, consider exploring its 30-Year Financials.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.