On May 23, 2024, CSW Industrials Inc (CSWI, Financial) released its 8-K filing reporting record results for the fiscal 2024 fourth quarter and full year periods ended March 31, 2024. CSW Industrials Inc is a diversified industrial growth company with well-established, scalable platforms and domain expertise across three segments: Contractor Solutions, Engineered Building Solutions, and Specialized Reliability Solutions. The company's Contractor Solutions segment involves manufacturing efficient and performance-enhancing products for residential and commercial HVAC/R and plumbing applications, which are designed for professional end-use customers. The majority of the company revenue is generated from Contractor Solutions segment from US markets.

Fiscal 2024 Fourth Quarter Highlights

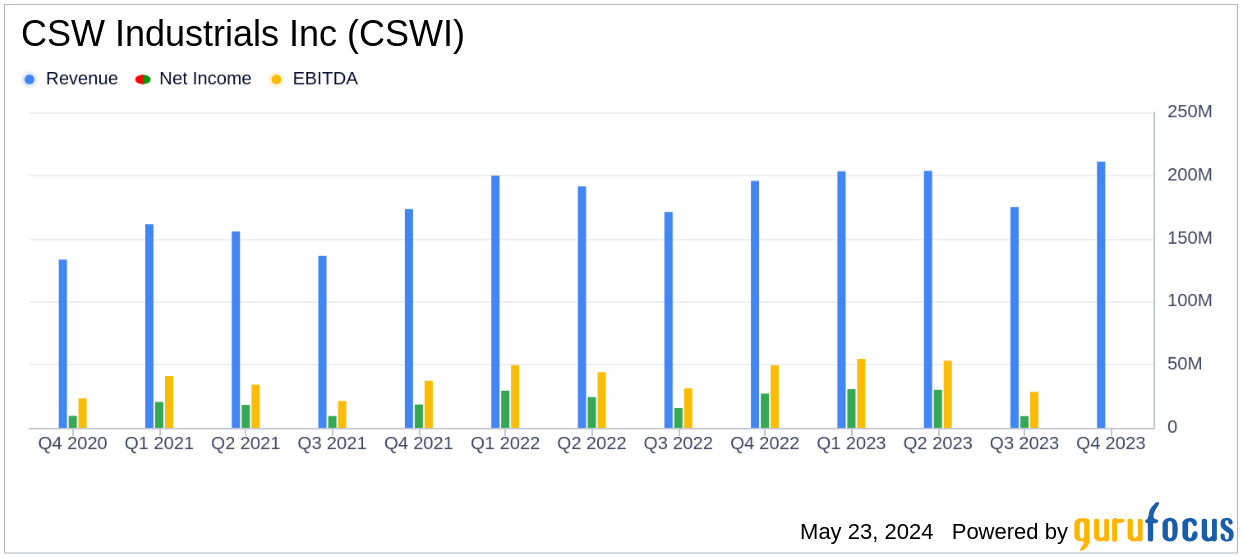

CSW Industrials Inc (CSWI, Financial) reported a 7.8% increase in total revenue to $210.9 million, surpassing the analyst estimate of $203.90 million. This growth was driven by a 6.0% organic increase and contributions from the Dust Free acquisition. Net income attributable to CSWI rose 17.4% to $31.8 million, compared to $27.1 million in the prior year period. Earnings per diluted share (EPS) increased 16.9% to $2.04, exceeding the analyst estimate of $1.86. EBITDA grew 13.0% to $55.8 million, with a margin expansion of 130 basis points to 26.5%.

Fiscal 2024 Full Year Highlights

For the full fiscal year, CSW Industrials Inc (CSWI, Financial) achieved a 4.6% increase in total revenue to $792.8 million, slightly below the analyst estimate of $785.85 million. Net income attributable to CSWI increased to $101.6 million, or $109.1 million adjusted, compared to $96.4 million in the prior year. Adjusted EPS grew 12.9% to $7.01, surpassing the annual estimate of $6.35. Adjusted EBITDA rose 14.9% to $200.0 million, with a margin expansion of 220 basis points to 25.2%.

Segment Performance

The Contractor Solutions segment reported a 5.4% increase in revenue to $141.2 million, driven by organic growth and the Dust Free acquisition. Segment operating income improved to $37.6 million, with an operating income margin of 26.6%. The Specialized Reliability Solutions segment saw an 8.0% increase in revenue to $41.6 million, with segment operating income rising to $6.7 million. The Engineered Building Solutions segment experienced a 20.4% increase in revenue to $30.1 million, with segment operating income improving to $5.7 million.

Financial Achievements

CSW Industrials Inc (CSWI, Financial) maintained balance sheet strength and strong cash flows, resulting in a leverage ratio (Debt to EBITDA) of approximately 0.73x. The company generated $164.3 million in cash flow from operations, a 35.3% increase from the prior year. CSWI invested $32.7 million in acquisitions and $16.6 million in organic capital expenditures, while returning $22.3 million to shareholders through share repurchases and dividends.

Commentary from Leadership

"I am very pleased with our record financial results in fiscal 2024, driven by organic growth that outpaced our markets and enhanced by strategic acquisitions. Our record revenue combined with our ability to leverage expenses has driven record profitability, resulting in best-in-class margins and record free cash flow," said Joseph B. Armes, CSW Industrials’ Chairman, President, and Chief Executive Officer.

Conclusion

CSW Industrials Inc (CSWI, Financial) has demonstrated robust financial performance in fiscal 2024, driven by organic growth, strategic acquisitions, and effective cost management. The company's strong balance sheet, cash flow generation, and commitment to shareholder returns position it well for continued success in the industrial products sector.

Explore the complete 8-K earnings release (here) from CSW Industrials Inc for further details.