NVIDIA Corp (NVDA, Financial) has recently captured the attention of investors and financial analysts alike, thanks to its strong financial performance and promising growth trajectory. With a current share price of $1,064.69, NVIDIA Corp has experienced a daily gain of 2.57% and an impressive three-month increase of 35.09%. A detailed analysis, supported by the GF Score, indicates that NVIDIA Corp is poised for significant future growth.

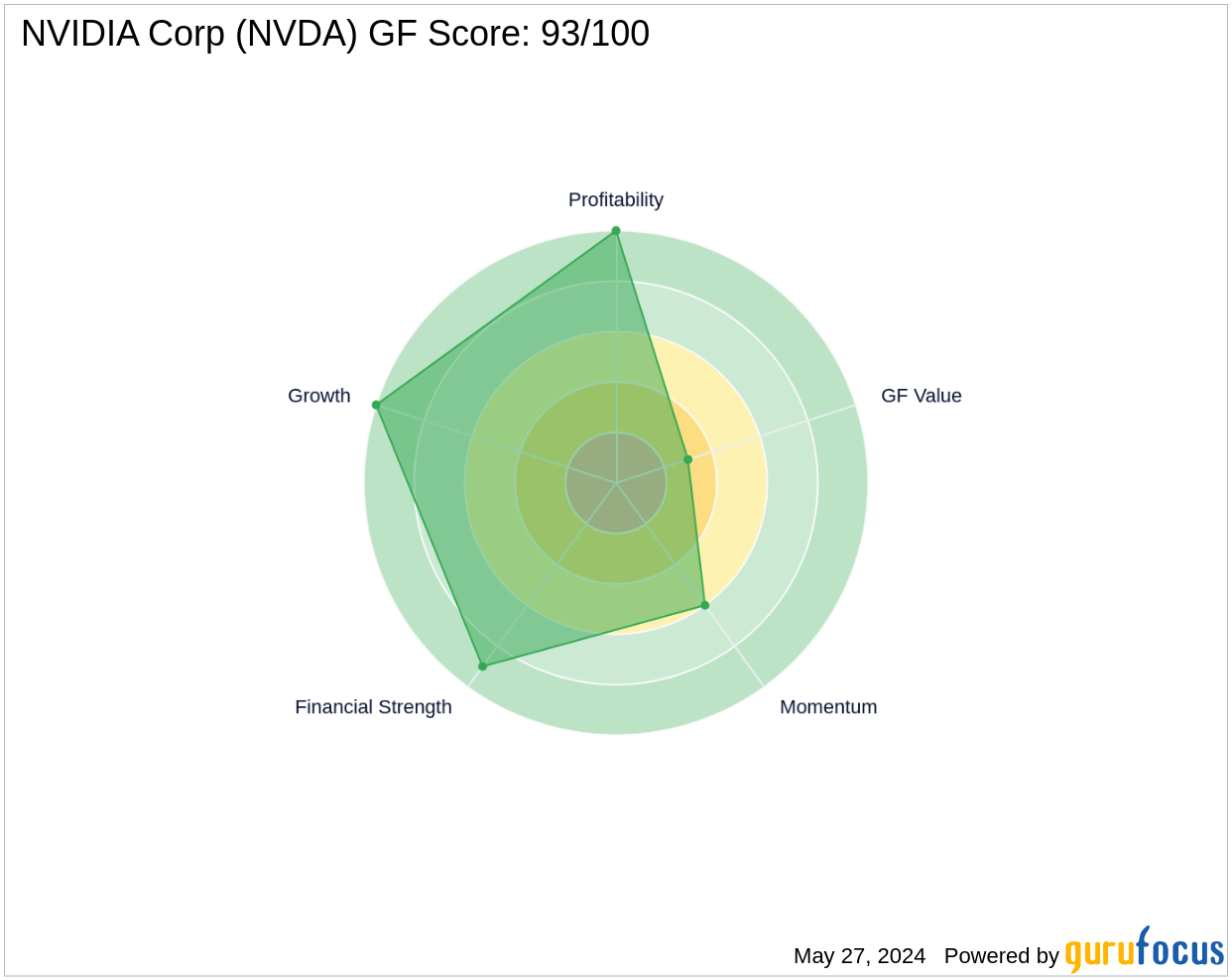

What Is the GF Score?

The GF Score is a proprietary ranking system developed by GuruFocus, assessing stocks based on five key valuation aspects. These aspects have been proven to correlate with long-term stock performance from 2006 to 2021. A higher GF Score typically indicates a higher potential for returns. The components of the GF Score for NVIDIA Corp are as follows:

- Financial strength rank: 9/10

- Profitability rank: 10/10

- Growth rank: 10/10

- GF Value rank: 3/10

- Momentum rank: 6/10

With an overall GF Score of 93 out of 100, NVIDIA Corp is flagged as having high potential for outperformance.

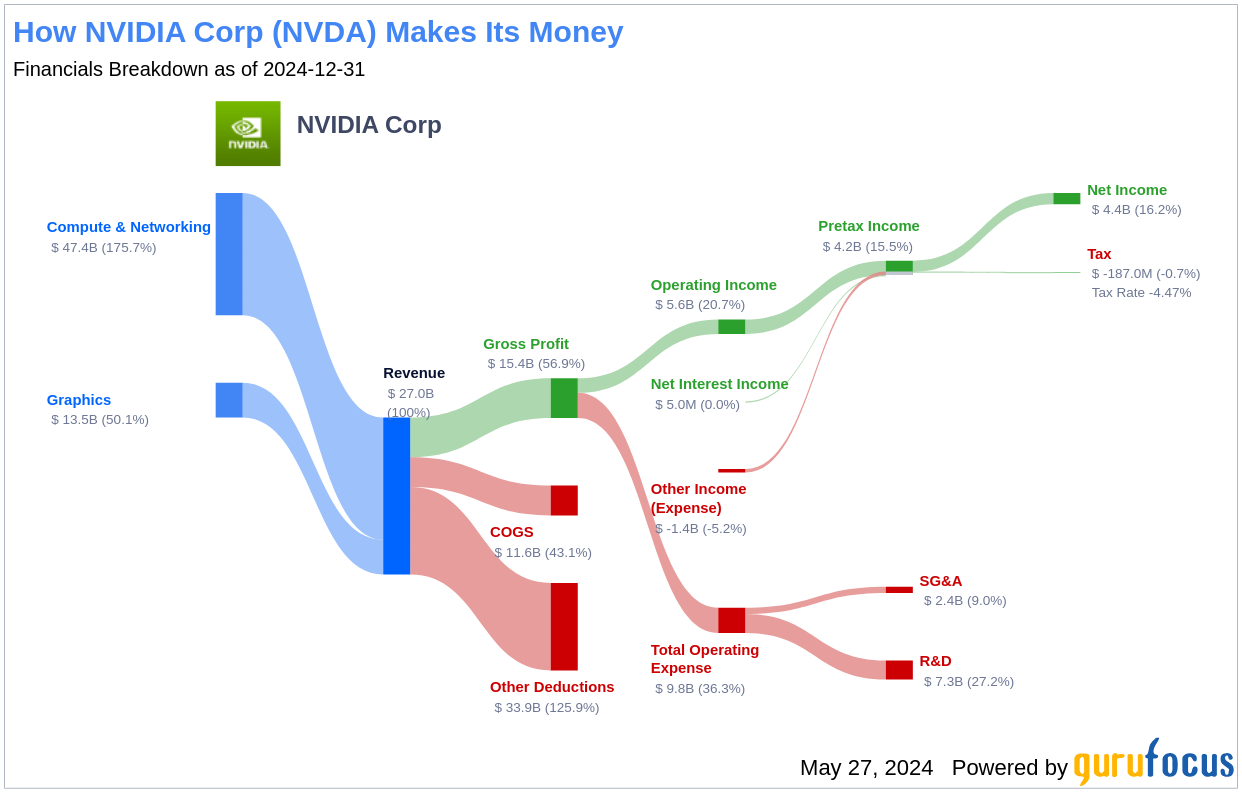

Understanding NVIDIA Corp's Business

NVIDIA Corp, with a market cap of $2.62 trillion and annual sales of $79.77 billion, is a pioneer in graphics processing units (GPUs). Initially focused on enhancing PC gaming experiences, NVIDIA's GPUs have become crucial in artificial intelligence applications. The company offers both AI GPUs and a software platform, Cuda, for AI model development and training. Additionally, NVIDIA is expanding into data center networking solutions, facilitating complex workload management.

Financial Strength Breakdown

NVIDIA Corp's financial strength is evident in its robust balance sheet and prudent capital management. The company's Interest Coverage ratio stands at an impressive 187.22, significantly above the benchmark set by investing legend Benjamin Graham. Furthermore, with an Altman Z-Score of 60, NVIDIA demonstrates a strong buffer against financial distress. The strategic Debt-to-Revenue ratio of 0.14 further solidifies its financial health.

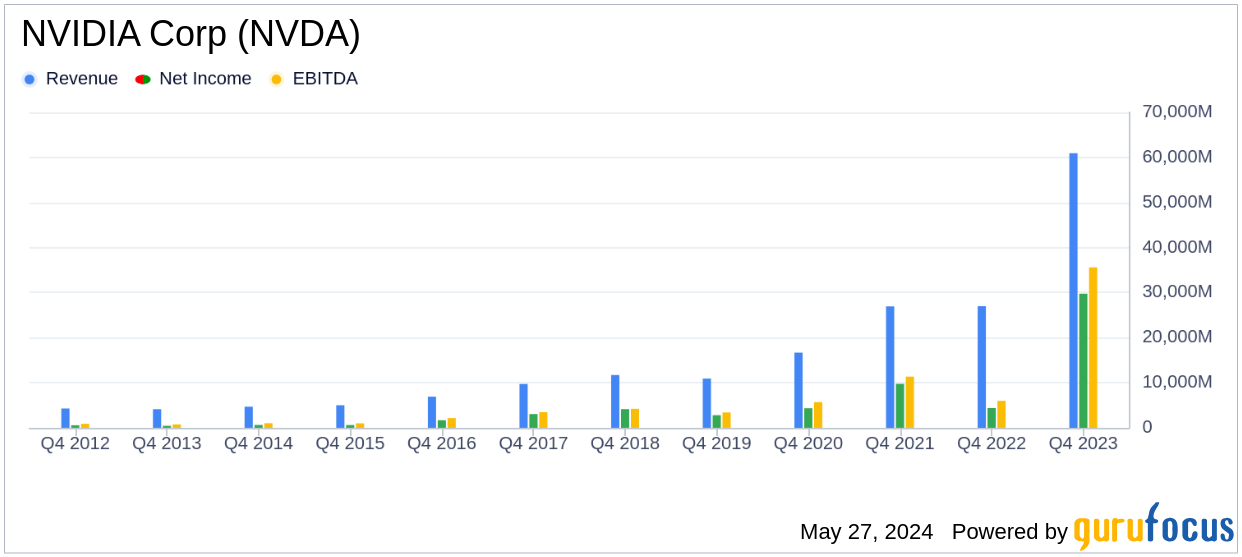

Profitability and Growth Metrics

NVIDIA Corp's profitability is highlighted by its impressive Operating Margin, which has consistently increased over the past five years, reaching 54.12% in 2024. The company's Gross Margin also reflects a rising trend, indicating efficient revenue conversion into profit. NVIDIA's commitment to growth is underscored by its 54.3% 3-Year Revenue Growth Rate, outperforming 94.7% of its industry peers. The robust EBITDA growth further emphasizes its growth capabilities.

Conclusion

Considering NVIDIA Corp's strong financial metrics, profitability, and growth indicators, the GF Score highlights the company's exceptional position for potential market outperformance. Investors looking for similar opportunities can explore more companies with strong GF Scores using the GF Score Screen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.