Autodesk Inc (ADSK, Financial) has recently captured the attention of investors and financial analysts with its strong financial performance. With a current share price of $218.04 and a daily gain of 0.81%, despite a three-month decline of -12.9%, Autodesk Inc stands out in the market. A detailed analysis, supported by the GF Score, indicates that Autodesk Inc is poised for significant growth in the foreseeable future.

What Is the GF Score?

The GF Score is a proprietary ranking system developed by GuruFocus, assessing stocks based on five key valuation aspects from 2006 to 2021. Stocks with higher GF Scores typically yield better returns. The GF Score ranges from 0 to 100, with 100 indicating the highest potential for outperformance. Autodesk Inc has achieved a GF Score of 92, signaling strong future performance potential. Here's how Autodesk Inc ranks in each category:

- Financial strength rank: 7/10

- Profitability rank: 7/10

- Growth rank: 10/10

- GF Value rank: 9/10

- Momentum rank: 7/10

Understanding Autodesk Inc's Business

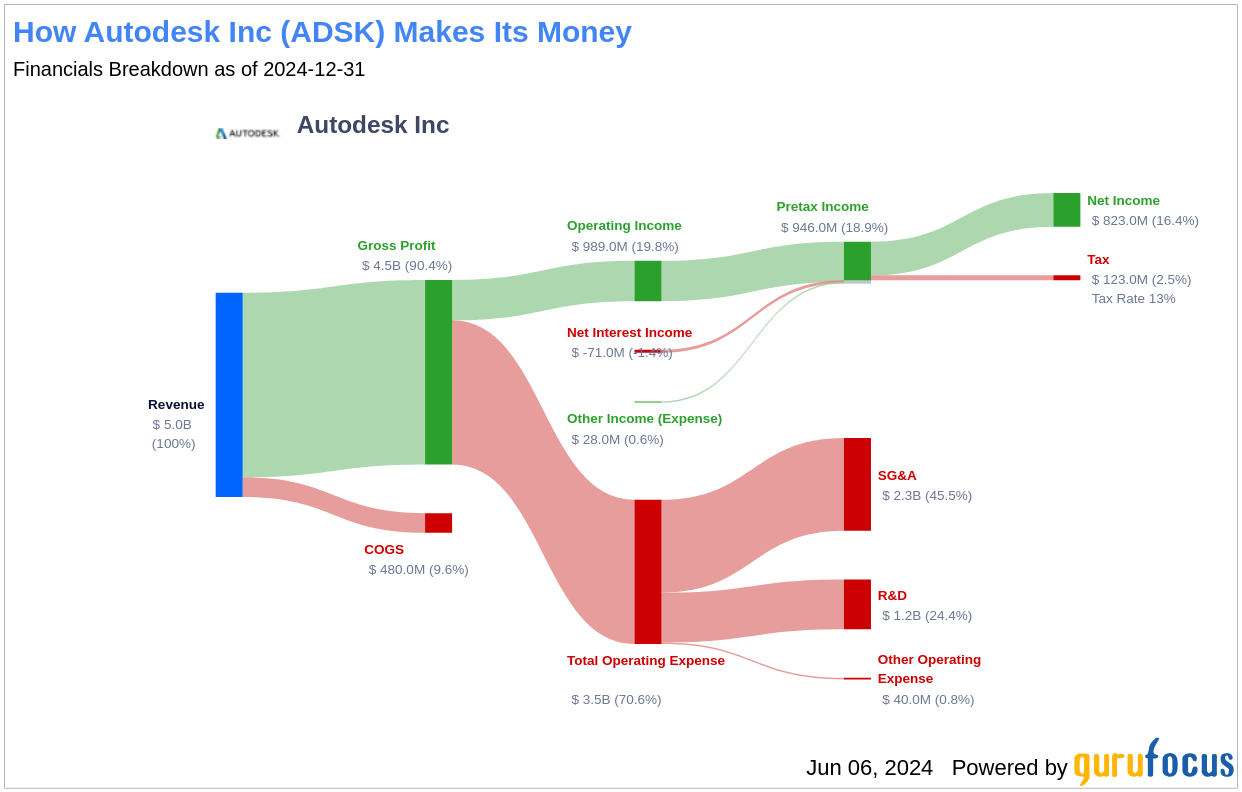

Founded in 1982, Autodesk Inc is a leading application software company that caters to industries such as architecture, engineering, construction, product design, manufacturing, and media and entertainment. With a market cap of $46.64 billion and annual sales of $5.497 billion, Autodesk boasts an operating margin of 20.52% and over 4 million paid subscribers across 180 countries. The company's software solutions are crucial for design, modeling, and rendering needs across these diverse industries.

Financial Strength and Profitability

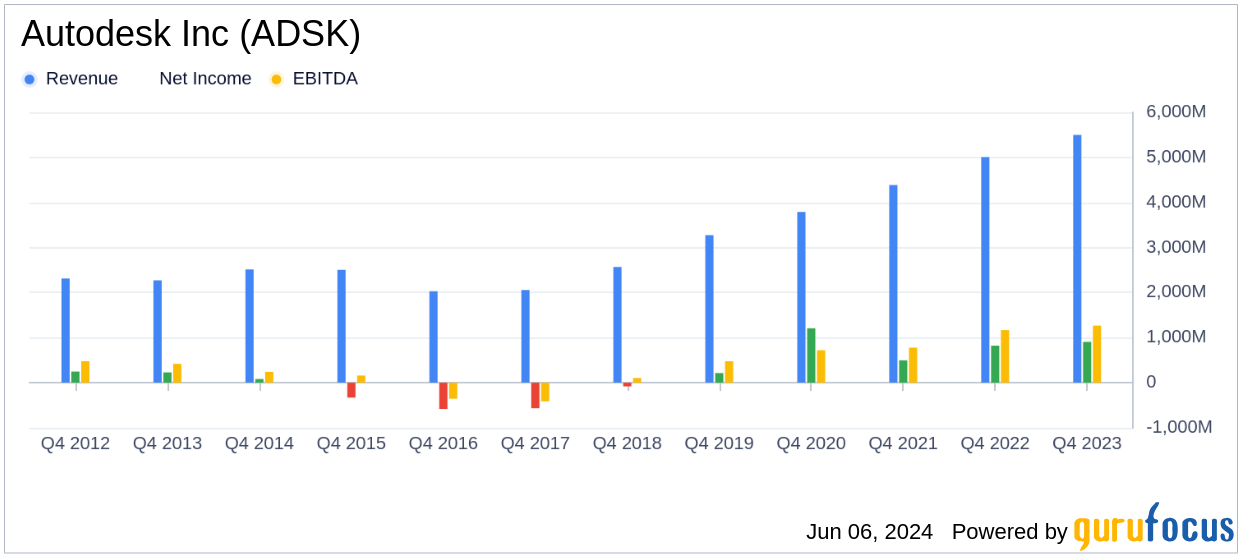

Autodesk Inc's financial strength is evident with an Interest Coverage ratio of 1,128, showcasing its ability to comfortably meet interest obligations. The company's strategic debt management is reflected in its Debt-to-Revenue ratio of 0.48. Additionally, Autodesk Inc's profitability is impressive, with a significant increase in its Operating Margin over the past five years, reaching 20.52% in 2024. The consistent rise in Gross Margin further underscores its efficiency in revenue conversion.

Growth Trajectory

Autodesk Inc is distinguished by its robust growth metrics. The company's 3-Year Revenue Growth Rate of 14.2% outperforms 62.82% of its peers in the software industry. Its EBITDA has also seen substantial growth, with a three-year growth rate of 21.7 and a five-year rate of 55.1, highlighting Autodesk's ongoing expansion and operational efficiency.

Conclusion

Considering Autodesk Inc's strong financial strength, impressive profitability, and consistent growth, the GF Score of 92 aptly reflects the company's superior position for potential market outperformance. Investors looking for similar opportunities can explore more companies with strong GF Scores through the GF Score Screen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.