Over the recent weeks, Petco Health and Wellness Co Inc (WOOF, Financial) has experienced a notable fluctuation in its stock price. As of the latest data, the stock stands at $3.89, marking a significant 33.71% increase over the past three months, despite a recent weekly loss of 10.30%. This volatility highlights a complex landscape for the company, juxtaposed against a backdrop of its GF Value of $11, which suggests a potential undervaluation. However, both the current and past GF Valuations advise caution, labeling the stock as a possible value trap.

Company Overview

Petco Health and Wellness Co Inc, operating in the cyclical retail industry, focuses on enhancing pet health and wellness through its extensive network of 1,423 pet care centers and robust online platforms. The company offers a diverse range of products and services, including pet food, supplies, and grooming, tailored to meet the needs of pets and pet parents alike. Despite its broad market presence, Petco's financial performance and stock valuation present a mixed picture that warrants a closer examination by investors.

Assessing Profitability

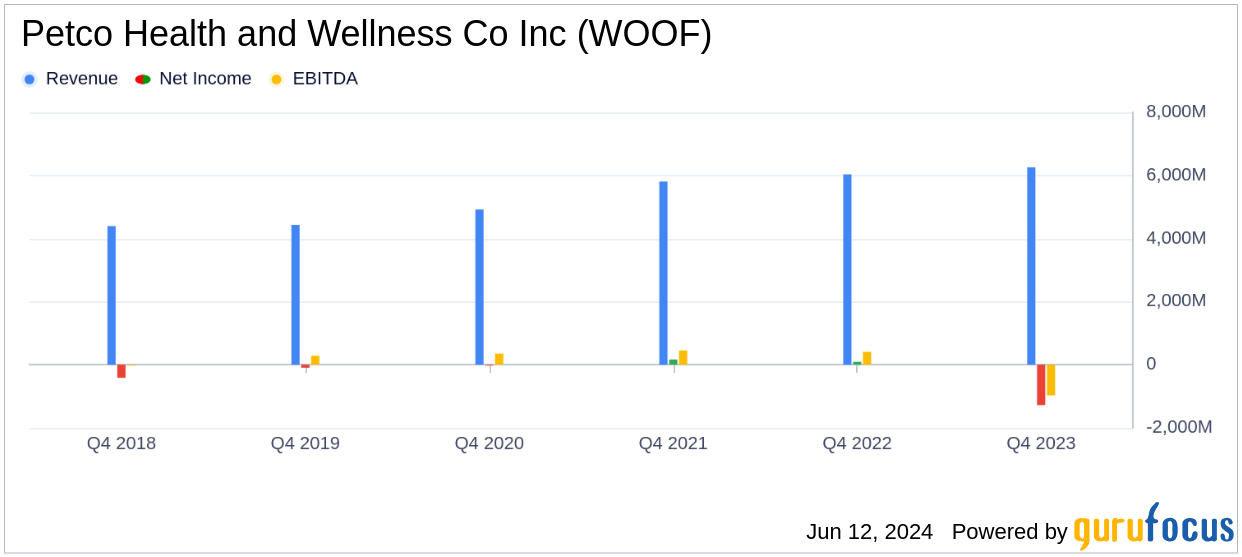

Petco's financial health, as indicated by its Profitability Rank of 4/10, shows challenges. The company's Operating Margin stands at -0.04%, which is better than 29.67% of its peers. This is complemented by a distressing ROE of -79.28% and ROA of -22.62%, positioning Petco lower in profitability compared to most companies in the industry. Additionally, its Return on Invested Capital (ROIC) is also negative at -0.04%. These metrics underscore a profitability struggle, despite being operational for over a decade, with only two profitable years in the last ten.

Growth Trajectory

The Growth Rank of Petco is also positioned at 4/10. While the company has managed a 5-Year Revenue Growth Rate per Share of 10.30%, better than 72.34% of its competitors, its future outlook appears constrained with a Total Revenue Growth Rate estimate of only 1.63% for the next three to five years. More concerning is the 3-Year EPS without NRI Growth Rate at -75.60%, indicating significant challenges in maintaining profitability and capitalizing on revenue growth.

Investor Holdings

Notable investors in Petco include Jim Simons, holding 503,700 shares, Steven Cohen (Trades, Portfolio) with 138,300 shares, and Joel Greenblatt (Trades, Portfolio) who holds 12,408 shares. These holdings, while significant, represent a small fraction of the company's total market cap, suggesting cautious positioning from these seasoned investors.

Competitive Landscape

Petco operates in a competitive sector, with key players like Olaplex Holdings Inc (OLPX, Financial) with a market cap of $1.26 billion, ARKO Corp (ARKO, Financial) valued at $741.917 million, and ChargePoint Holdings Inc (CHPT, Financial) at $827.216 million. These companies, while diverse in their offerings, represent the competitive pressures within the retail and wellness sectors that Petco faces.

Conclusion

In conclusion, Petco Health and Wellness Co Inc presents a paradoxical investment profile. On one hand, its significant market presence and growth in revenue per share highlight potential. On the other, its profitability issues and cautious investor sentiment, as reflected in its GF Valuation, suggest that potential investors should think twice. The company's future in the competitive landscape will depend heavily on its ability to turn around its profitability metrics and capitalize on its established market presence.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.