Apple Inc (AAPL, Financial) has recently captured the attention of investors and financial analysts alike, thanks to its strong financial performance and promising growth trajectory. With its shares currently priced at $214.76, Apple Inc has experienced a daily gain of 0.31% and an impressive three-month increase of 25.28%. A detailed analysis, supported by the GF Score, indicates that Apple Inc is poised for significant future growth.

What Is the GF Score?

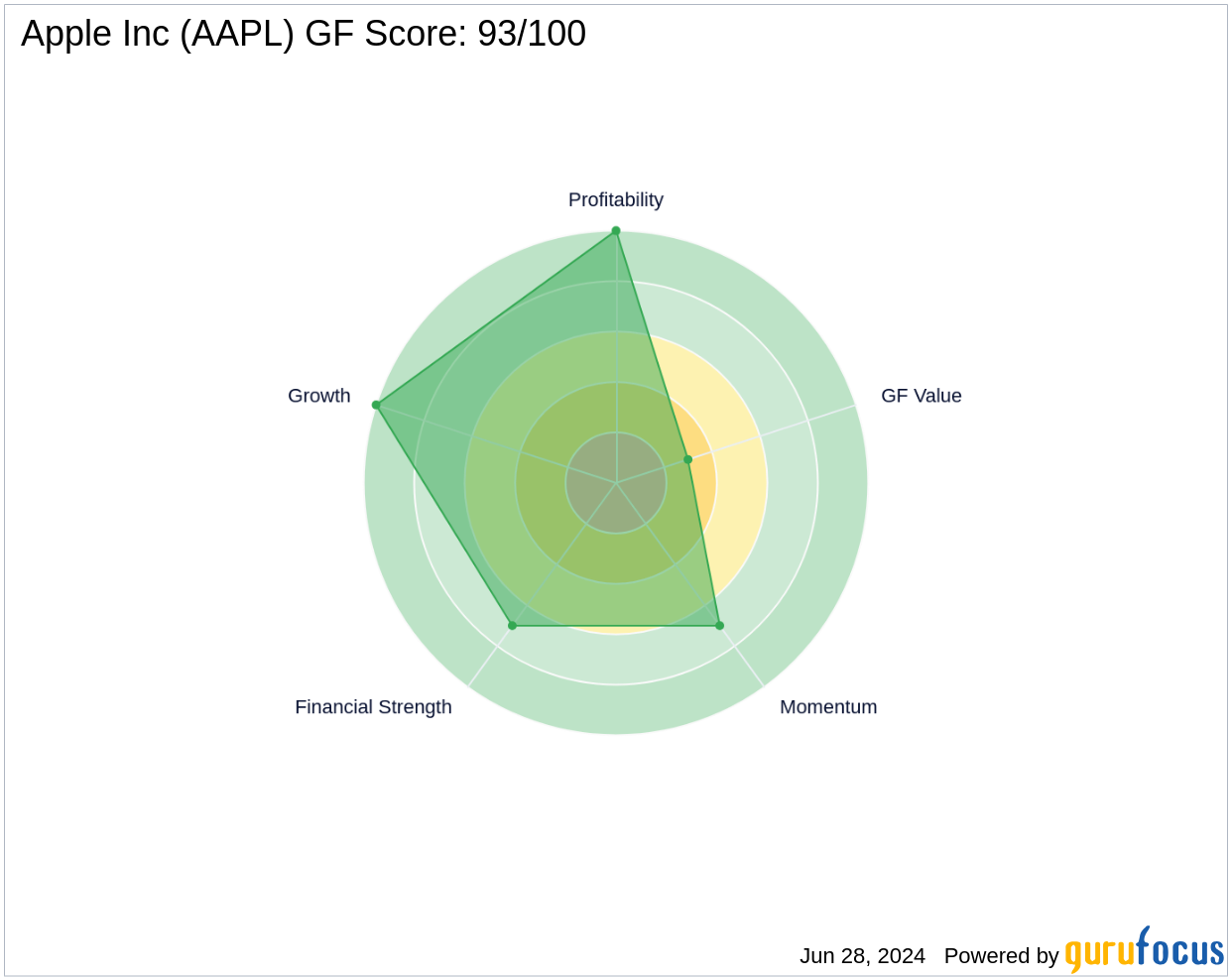

The GF Score is a proprietary ranking system developed by GuruFocus, assessing stocks based on five key aspects of valuation. These aspects have been proven to correlate strongly with long-term stock performance from 2006 to 2021. Stocks with higher GF Scores typically yield better returns. The GF Score ranges from 0 to 100, with 100 representing the highest potential for outperformance. Apple Inc boasts a GF Score of 93, indicating a strong potential for market-leading returns.

- Financial strength rank: 7/10

- Profitability rank: 10/10

- Growth rank: 10/10

- GF Value rank: 3/10

- Momentum rank: 7/10

Understanding Apple Inc's Business

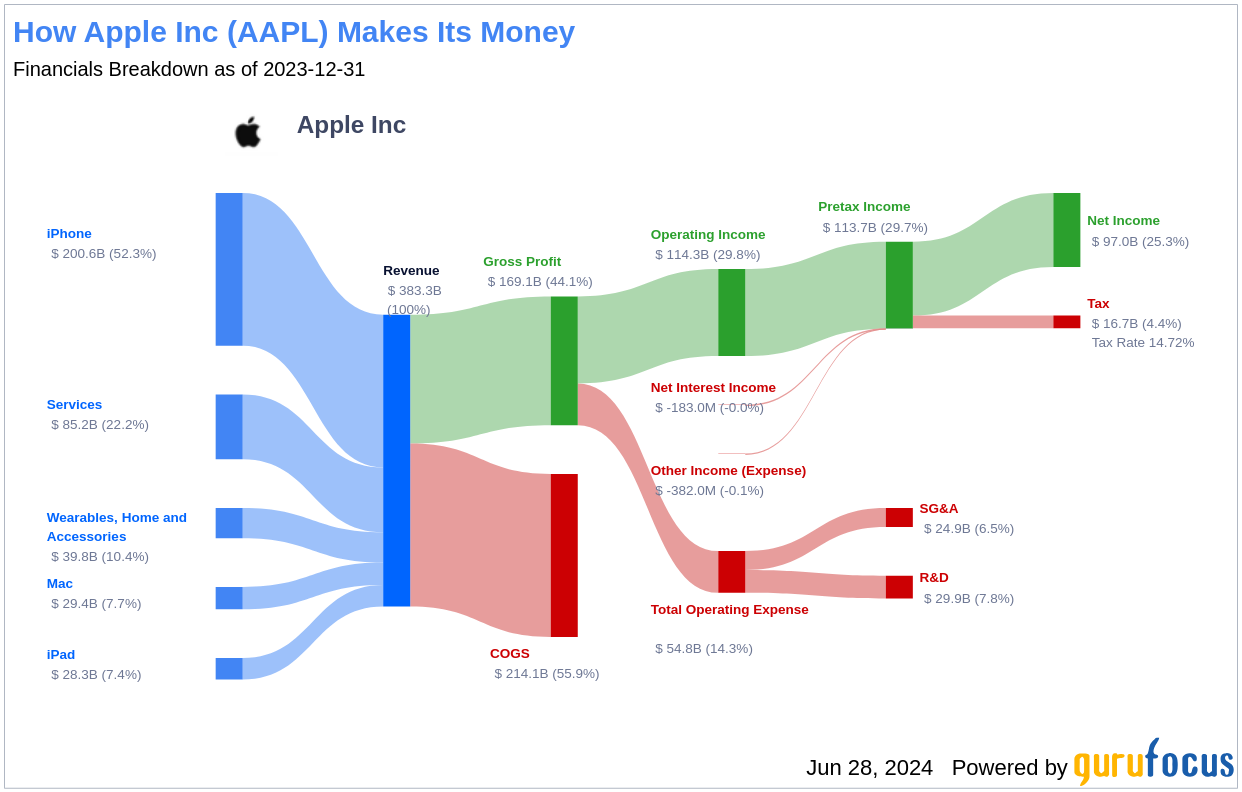

Apple Inc, with a market cap of $3.29 trillion and annual sales of $381.62 billion, is one of the largest global companies. It boasts a diverse portfolio of hardware and software products primarily centered around its flagship product, the iPhone. Apple's other offerings, including the Mac, iPad, and Apple Watch, integrate into an expansive ecosystem designed to complement the iPhone. The company has also ventured into new applications like streaming video and augmented reality, enhancing its product suite. Apple designs its software and semiconductors and collaborates with subcontractors like Foxconn and TSMC for manufacturing.

Financial Strength and Profitability

Apple Inc's financial robustness is reflected in its Financial Strength rating and an impressive Interest Coverage ratio of 59.12. This indicates a strong ability to meet interest obligations, a factor highly valued by investors like Benjamin Graham. The company's Altman Z-Score of 9.82 suggests a low probability of financial distress. Additionally, Apple's strategic debt management is evidenced by a Debt-to-Revenue ratio of 0.27, underscoring its financial health.

Growth Metrics

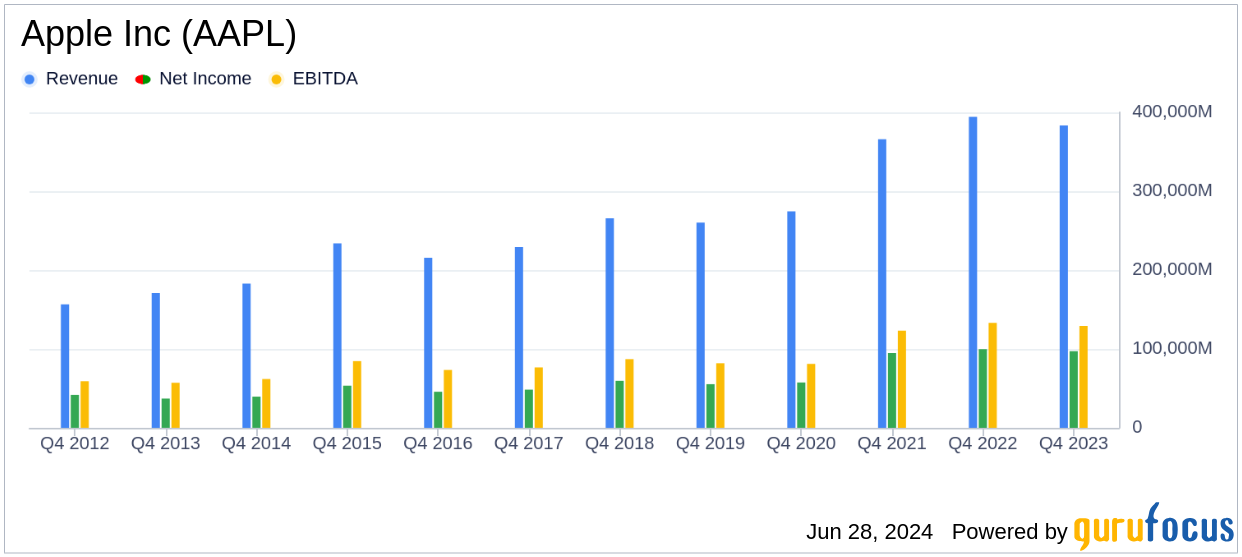

Apple Inc is ranked highly for growth, with a Growth rank of 10/10. The company's 3-Year Revenue Growth Rate of 15.7% outperforms 80.63% of its peers in the Hardware industry. This is complemented by a strong increase in EBITDA over recent years, highlighting its capacity for sustained growth.

Conclusion

Considering Apple Inc's robust financial strength, impressive profitability, and consistent growth metrics, the GF Score underscores the company's unmatched potential for outperformance. Investors looking for similar opportunities can explore other high-scoring companies using the GF Score Screen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.