Long-established in the Medical Devices & Instruments industry, Baxter International Inc (BAX, Financial) has enjoyed a stellar reputation. Recently, the company experienced a daily gain of 0.62%, juxtaposed with a three-month change of -20.51%. However, fresh insights from the GF Score hint at potential headwinds. Notably, its diminished rankings in financial strength, growth, and valuation suggest that the company might not live up to its historical performance. Join us as we dive deep into these pivotal metrics to unravel the evolving narrative of Baxter International Inc.

What Is the GF Score?

The GF Score is a stock performance ranking system developed by GuruFocus using five aspects of valuation, which has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021. The stocks with a higher GF Score generally generate higher returns than those with a lower GF Score. Therefore, when picking stocks, investors should invest in companies with high GF Scores. The GF Score ranges from 0 to 100, with 100 as the highest rank.

- Financial strength rank: 5/10

- Profitability rank: 7/10

- Growth rank: 5/10

- GF Value rank: 4/10

- Momentum rank: 2/10

Based on the above method, GuruFocus assigned Baxter International Inc a GF Score of 69 out of 100, which signals poor future outperformance potential.

Understanding Baxter International Inc's Business

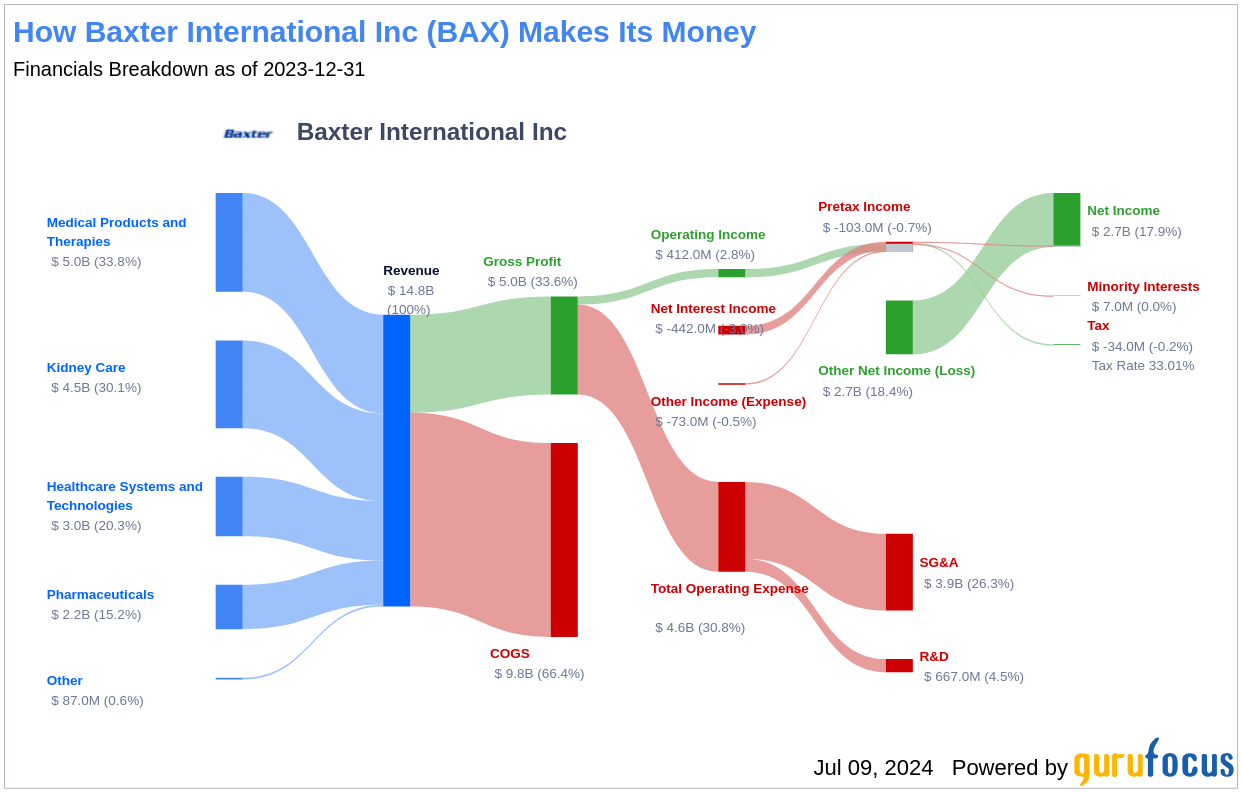

Baxter International Inc, with a market cap of $17.23 billion and sales of $14.89 billion, operates in the medical devices and instruments sector. The company enhanced its portfolio of hospital-focused offerings by acquiring Hillrom in late 2021, which added basic equipment, including hospital beds, to the portfolio, although about half of Hillrom's revenue comes from more digitally connected offerings like its smart beds and Voalte medical communications app. From its legacy operations, Baxter offers tools to help patients with acute and chronic kidney failure, which it plans to spin off by mid-2024. It also sells a variety of injectable therapies for use in care settings, such as IV pumps, administrative sets, and solutions; nutritional products; and surgical sealants and hemostatic agents.

Financial Strength Breakdown

Baxter International Inc's financial strength indicators present some concerning insights about the company's balance sheet health. The company has an interest coverage ratio of 1.06, which positions it worse than 95.82% of 407 companies in the Medical Devices & Instruments industry. This ratio highlights potential challenges the company might face when handling its interest expenses on outstanding debt. Additionally, the company's Altman Z-Score is just 2.06, which is below the safe threshold of 2.99. Moreover, the company's low cash-to-debt ratio at 0.21 indicates a struggle in handling existing debt levels. Furthermore, the company's debt-to-Ebitda ratio is 8, which is above Joel Tillinghast's warning level of 4 and is worse than 91.23% of 422 companies in the Medical Devices & Instruments industry.

Conclusion

Considering Baxter International Inc's financial strength, profitability, and growth metrics, the GF Score highlights the firm's unparalleled position for potential underperformance. Investors seeking more robust investment opportunities may consider exploring other companies with stronger GF Scores using the following screener link: GF Score Screen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.