On July 16, 2024, Nicolet Bankshares Inc (NIC, Financial) released its 8-K filing announcing its second quarter 2024 results. Nicolet Bankshares Inc, a United States-based bank holding company, focuses on lending and deposit gathering, offering a variety of banking-related products and services to businesses and individuals in the communities it serves.

Performance Overview

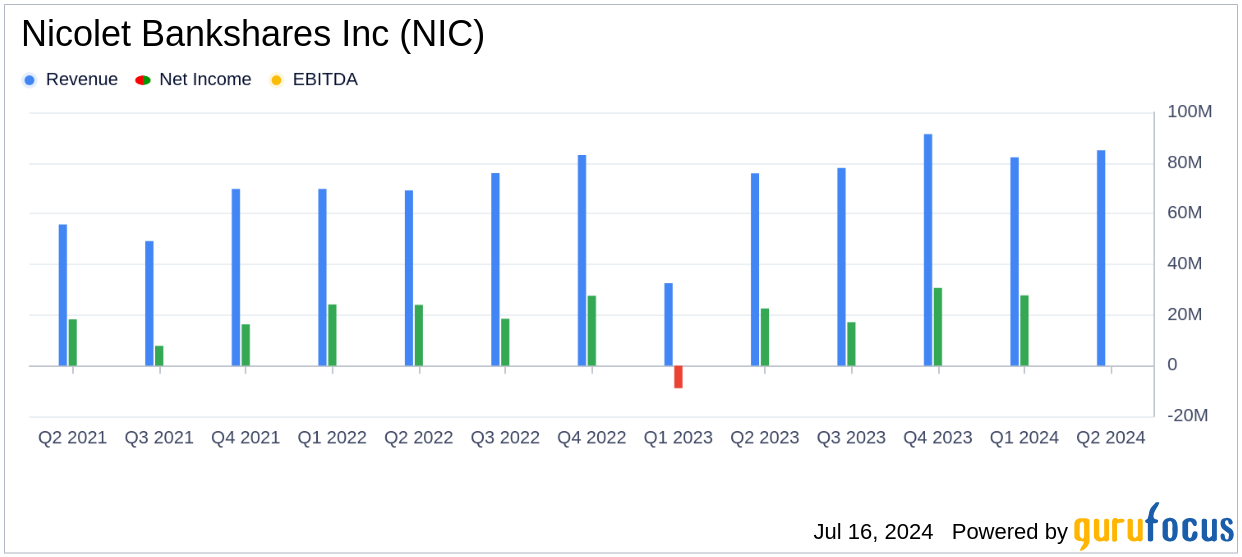

Nicolet Bankshares Inc (NIC, Financial) reported a net income of $29 million for the second quarter of 2024, an increase from $28 million in the previous quarter and $23 million in the same quarter last year. Earnings per diluted common share were $1.92, up from $1.82 in the first quarter of 2024 and $1.51 in the second quarter of 2023. For the first half of 2024, net income was $57 million, significantly higher than the $14 million reported for the first half of 2023.

Key Financial Achievements

The company experienced solid quarter-over-quarter loan growth of $132 million (2%) and growth in core deposits after seasonal lows in the first quarter. A quarterly cash dividend of $0.28 per common share was paid during the second quarter, marking a 12% increase over the first quarter.

Income Statement Highlights

Net interest income for the second quarter of 2024 was $65 million, up $3 million from the first quarter. This increase was primarily due to the repricing of new and renewed loans in a rising interest rate environment and solid loan growth. The net interest margin improved to 3.35%, up from 3.26% in the previous quarter. Noninterest income remained stable at $20 million, with a slight increase in net mortgage income.

Balance Sheet Review

As of June 30, 2024, Nicolet Bankshares Inc (NIC, Financial) reported total assets of $8.6 billion, an increase of $110 million from March 31, 2024. Total loans increased by $132 million, with growth in agricultural, commercial and industrial, and residential real estate loans. Total deposits rose by $75 million to $7.2 billion, driven by noninterest-bearing demand and time deposits. Total capital was $1.1 billion, up $28 million from the previous quarter.

Asset Quality

Nonperforming assets were $29 million, representing 0.34% of total assets, slightly up from $28 million or 0.33% of total assets in the previous quarter. The allowance for credit losses-loans was $65 million, representing 1.00% of total loans, consistent with the previous quarter. Asset quality trends remained solid, with negligible loan net charge-offs.

Commentary

"Our strong second quarter results are a continuation and improvement of our first quarter results," said Mike Daniels, Chairman, President, and CEO of Nicolet. "We witnessed growth in our core deposits after experiencing seasonal lows during tax season; loan growth remained strong for our markets; and our core lines of business are each performing well, despite market headwinds."

Analysis

Nicolet Bankshares Inc (NIC, Financial) has demonstrated robust financial performance in the second quarter of 2024, with significant growth in net income and earnings per share. The company's ability to maintain solid loan growth and increase core deposits highlights its strong market position and effective management strategies. The improvement in net interest margin and stable asset quality further underscore the company's financial health and resilience in a challenging market environment.

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Nicolet Bankshares Inc for further details.