- GAAP EPS: Reported a loss of $(0.16) per diluted share, significantly below the analyst estimate of $(0.03).

- Net Income: Net loss available to common shareholders was $(23.7) million, compared to a net income of $165.8 million in the same quarter last year.

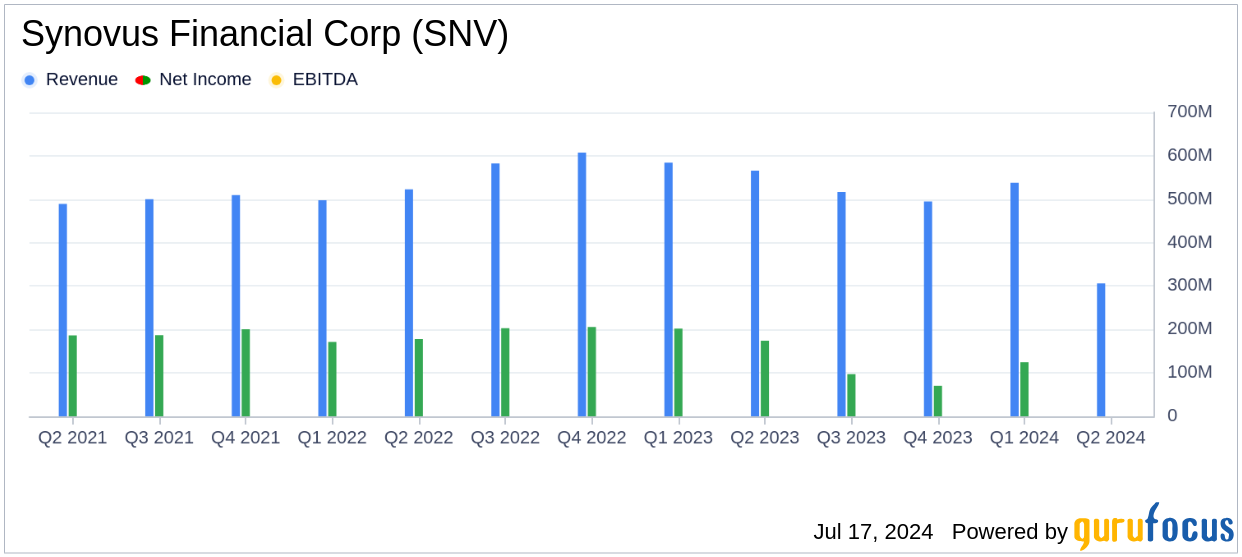

- Revenue: Total revenue for the quarter was $306.1 million, falling short of the analyst estimate of $429.04 million.

- Net Interest Income: Increased by $16.2 million, or 4%, sequentially, but decreased by $20.5 million, or 5%, year-over-year.

- Net Interest Margin (NIM): Expanded by 16 basis points to 3.20%, driven by securities repositioning and more stable deposit costs.

- Provision for Credit Losses: Declined 32% sequentially to $26.4 million, compared to $38.9 million in the same quarter last year.

- Non-Interest Revenue: Adjusted non-interest revenue grew 9% sequentially and 15% year-over-year, primarily due to higher capital markets fees and treasury and payment solutions.

On July 17, 2024, Synovus Financial Corp (SNV, Financial) released its 8-K filing for the second quarter of 2024. Synovus Financial Corp provides commercial and consumer banking, along with a full suite of specialized products and services, through its wholly-owned subsidiary bank, Synovus Bank, and other offices in Alabama, Florida, Georgia, South Carolina, and Tennessee.

Performance Overview

Synovus Financial Corp (SNV, Financial) reported a net loss available to common shareholders of $23.7 million, or $(0.16) per diluted share, for Q2 2024. This is a significant decline from the net income of $165.8 million, or $1.13 per diluted share, reported in Q2 2023. The adjusted diluted earnings per share stood at $1.16, consistent with the same period last year, but the reported EPS was impacted by a $257 million loss on the sale of securities.

Key Financial Metrics

| Metric | Q2 2024 | Q1 2024 | Q2 2023 |

|---|---|---|---|

| Net Income (Loss) Available to Common Shareholders | $(23.7) million | $114.8 million | $165.8 million |

| Adjusted Net Income Available to Common Shareholders | $169.6 million | $116.0 million | $169.5 million |

| Diluted Earnings (Loss) Per Share | $(0.16) | $0.78 | $1.13 |

| Adjusted Diluted Earnings Per Share | $1.16 | $0.79 | $1.16 |

| Total Revenue | $306.1 million | $537.7 million | $567.8 million |

Income Statement Highlights

Net interest income for Q2 2024 increased by $16.2 million, or 4%, compared to the previous quarter, but was down $20.5 million, or 5%, year-over-year. The net interest margin (NIM) expanded by 16 basis points to 3.20%, driven by a recent securities repositioning and more stable deposit costs.

Non-interest revenue saw a significant decline, reporting $(128.9) million, down $247.7 million sequentially and $241.1 million year-over-year. However, adjusted non-interest revenue grew by $10.7 million sequentially and $16.6 million year-over-year, primarily due to higher capital markets fees and treasury and payment solutions.

Balance Sheet and Cash Flow

Period-end loans declined by $216.5 million from Q1 2024, with commercial and industrial loans decreasing by $194.7 million. Period-end core deposits were $44.8 billion, a decline of $67.6 million from the previous quarter, primarily due to a drop in non-interest-bearing deposits.

Commentary and Analysis

“Our core second quarter results reflect a significant increase in earnings driven by margin expansion, strong fee income generation, and reduced credit costs. Our focus remains firmly on execution while minimizing uncertainty in performance associated with the net interest margin and credit costs,” said Synovus Chairman, CEO, and President Kevin Blair.

The company's performance in Q2 2024 highlights both achievements and challenges. The adjusted EPS of $1.16 aligns with analyst estimates, showcasing strong operational performance despite the securities loss. However, the reported net loss and significant decline in non-interest revenue underscore the volatility and risks inherent in the banking sector.

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Synovus Financial Corp for further details.