Accenture PLC (ACN, Financial) has recently captured the attention of investors and financial analysts alike, thanks to its strong financial performance. With a current share price of $332.47 and a daily gain of 1%, coupled with a three-month increase of 4.8%, Accenture PLC stands out in the market. A detailed analysis, supported by the GF Score, indicates that Accenture PLC is poised for significant growth in the foreseeable future.

What Is the GF Score?

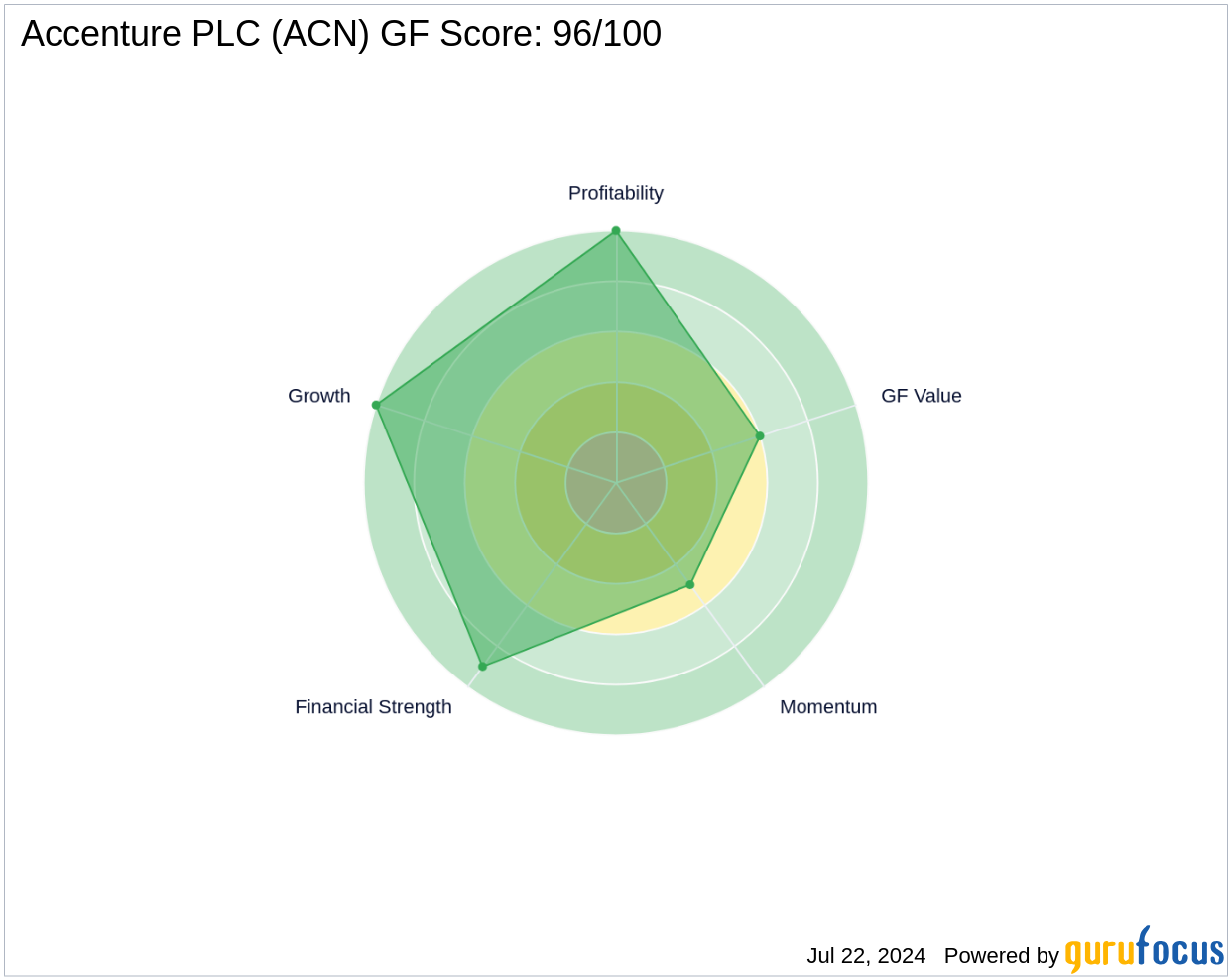

The GF Score is a proprietary ranking system developed by GuruFocus, assessing stocks based on five key valuation aspects. These aspects have shown a strong correlation with long-term stock performance from 2006 to 2021. Stocks with higher GF Scores typically yield better returns. The GF Score ranges from 0 to 100, with 100 indicating the highest potential for outperformance. Accenture PLC boasts a GF Score of 96, reflecting its strong potential for market outperformance.

- Financial strength rank: 9/10

- Profitability rank: 10/10

- Growth rank: 10/10

- GF Value rank: 6/10

- Momentum rank: 5/10

Understanding Accenture PLC's Business

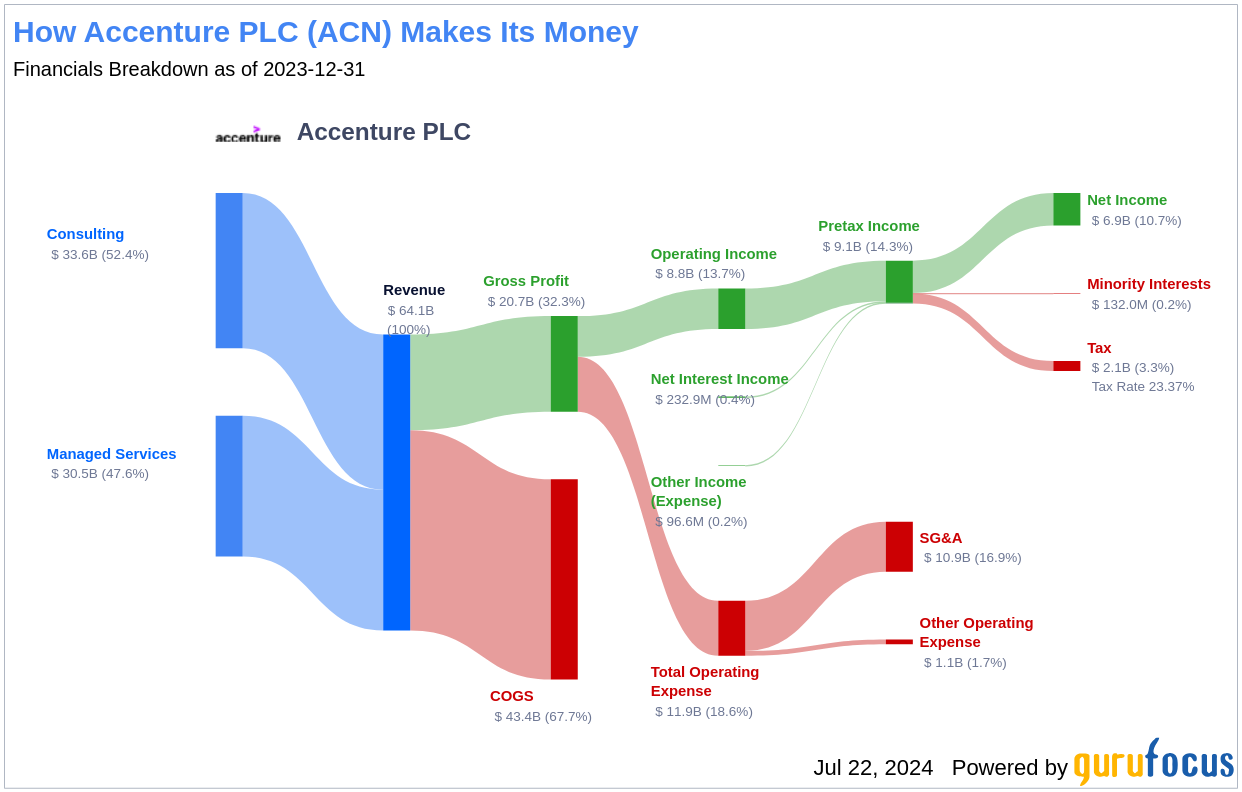

Accenture PLC is a global leader in IT services, offering a broad spectrum of consulting, strategy, technology, and operational services. The company aids enterprises across various sectors—including communications, media, technology, financial services, and health—in achieving digital transformation and improving operational efficiency. With nearly 500,000 employees across 200 cities in 51 countries, Accenture PLC generated sales of $64.48 billion and maintains an operating margin of 14.2%.

Financial Strength Breakdown

Accenture PLC's financial robustness is evident in its Financial Strength rating. With an Interest Coverage ratio of 171.01, the company comfortably meets its interest obligations, a strong indicator of financial health. Additionally, an Altman Z-Score of 7.25 further underscores its stability, minimizing the risk of financial distress. The strategic management of its debt, with a Debt-to-Revenue ratio of 0.07, solidifies its financial foundation.

Profitability and Growth Metrics

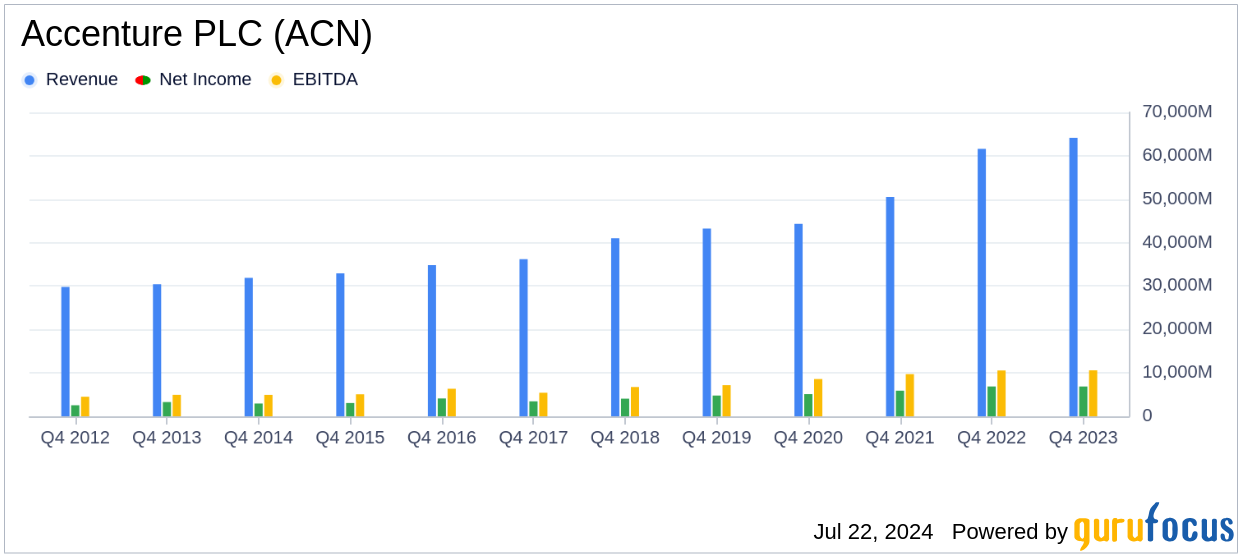

Accenture PLC's Profitability Rank is exemplary, supported by a consistent increase in Gross Margin over the past five years, demonstrating its efficiency in converting revenue into profit. The company's Predictability Rank of 4.5 stars reflects its reliable operational performance, enhancing investor confidence. Furthermore, its commitment to growth is evident from its impressive Growth Rank and above-industry-average revenue growth rates.

Conclusion

Considering Accenture PLC's strong financial strength, profitability, and growth metrics, the GF Score highlights the firm's unparalleled position for potential outperformance. Investors looking for robust investment opportunities may find Accenture PLC an attractive option.

Explore more high-potential stocks with our GF Score Screen exclusively available to GuruFocus Premium members.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.