On July 25, 2024, Carrier Global Corp (CARR, Financial) released its 8-K filing for the second quarter of 2024, showcasing a strong financial performance that exceeded analyst expectations. Carrier Global, a leading manufacturer of heating, ventilation, and air conditioning (HVAC), refrigeration, and fire and security products, reported significant growth in net sales and earnings per share (EPS).

Company Overview

Carrier Global Corp (CARR, Financial) manufactures HVAC, refrigeration, and fire and security products. The HVAC segment serves both residential and commercial markets, with a sales mix of 60% commercial and 40% residential. The refrigeration segment includes transportation refrigeration, Sensitech supply chain monitoring, and commercial refrigeration businesses. The fire and security business manufactures fire detection and suppression, access controls, and intrusion detection products. In April 2023, Carrier announced plans to divest its fire and security and commercial refrigeration businesses and acquired Germany-based Viessmann for approximately $13 billion.

Q2 2024 Financial Highlights

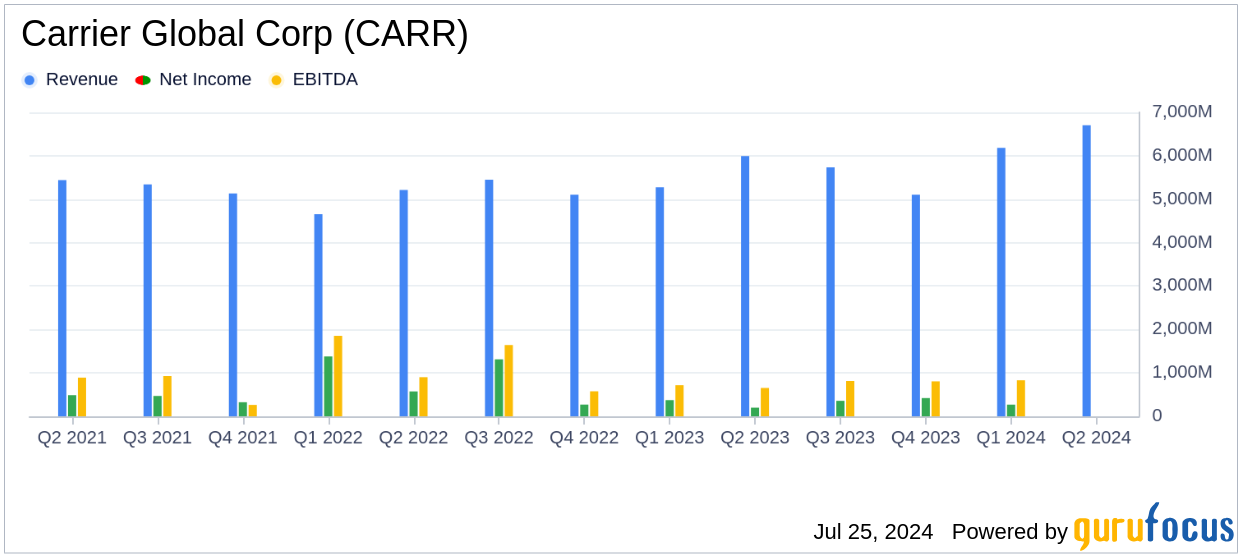

Carrier Global Corp (CARR, Financial) reported net sales of $6.7 billion for Q2 2024, a 12% increase compared to the same period last year. This growth includes a 2% organic sales increase and a 12% contribution from the acquisition of Viessmann Climate Solutions, offset by a 2% impact from divestitures. The company's GAAP EPS was $2.55, significantly higher than the previous year, while adjusted EPS was $0.87, reflecting double-digit growth.

Performance and Challenges

The HVAC segment saw a 2% organic sales increase, with strong performance in the Americas and EMEA regions. However, the Asia Pacific region experienced a decline in sales, primarily driven by residential light commercial in China. The refrigeration segment reported a 1% organic sales increase, driven by over 30% growth in container sales, while the fire and security segment showed broad-based growth with a 3% organic sales increase.

Financial Achievements

Carrier Global Corp (CARR, Financial) achieved a GAAP operating profit of $3.7 billion, up over 650% from the previous year, primarily due to the gain on the sale of Access Solutions and the addition of Viessmann Climate Solutions. Adjusted operating profit was $1.2 billion, up 26%. The company also reported net income of $2.3 billion and adjusted net income of $793 million. Free cash flow for the quarter was $549 million.

Key Financial Metrics

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Net Sales | $6.7 billion | $6.0 billion |

| GAAP EPS | $2.55 | $0.23 |

| Adjusted EPS | $0.87 | $0.76 |

| Free Cash Flow | $549 million | $504 million |

Commentary and Analysis

"Carrier delivered another quarter of strong financial performance, while making great progress with our portfolio transformation," said Carrier Chairman & CEO David Gitlin. "We delivered solid sales and roughly 30% orders growth as we continue to outperform in our markets. Our strong operational execution drove 200 basis points of adjusted operating margin expansion and double-digit adjusted earnings growth."

Carrier Global Corp (CARR, Financial) reaffirmed its full-year 2024 adjusted EPS guidance range and announced plans to repurchase about $1 billion worth of shares in the second half of 2024. The company's strong financial performance and strategic initiatives, including the divestiture of non-core businesses and the acquisition of Viessmann, position it well for future growth.

For more detailed financial data and insights, visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from Carrier Global Corp for further details.