On July 25, 2024, Arch Resources Inc (ARCH, Financial) released its 8-K filing for the second quarter of 2024. Arch Resources Inc is a producer of metallurgical and coking coal, selling its coal to power plants, steel mills, and industrial facilities. The company operates through two segments: Metallurgical (MET) and Thermal, with the majority of its revenue derived from the Metallurgical segment and primarily from Asia.

Performance and Challenges

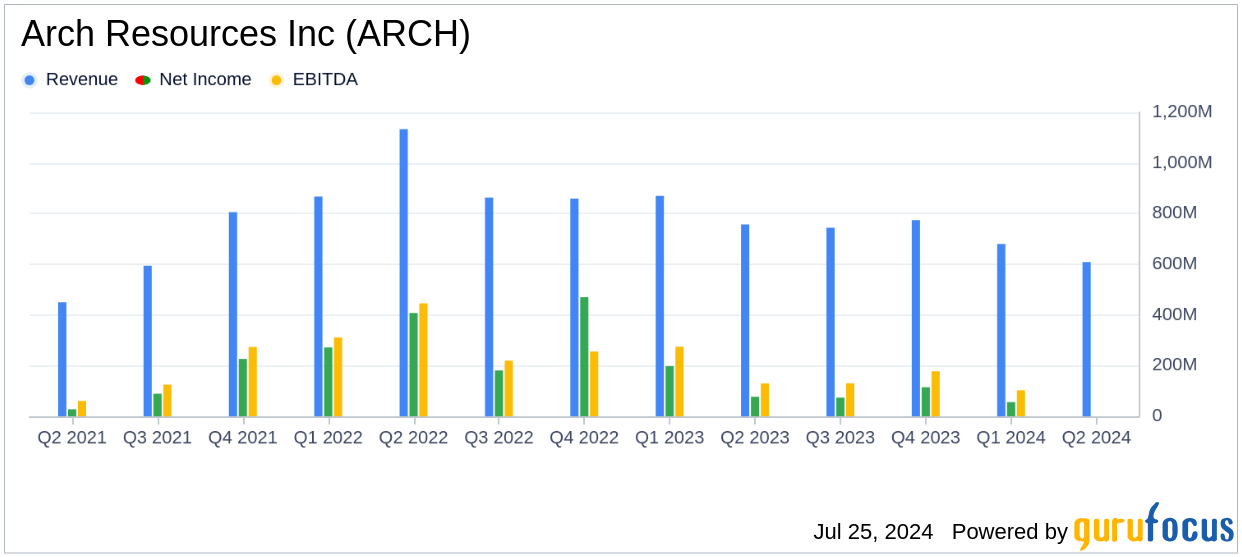

Arch Resources Inc reported net income of $14.8 million, or $0.81 per diluted share, for Q2 2024, significantly lower than the $77.4 million, or $4.04 per diluted share, reported in the same period last year. The company achieved adjusted EBITDA of $60.0 million, down from $130.4 million in Q2 2023. Revenues for the quarter totaled $608.8 million, a decrease from $757.3 million in the prior-year quarter.

The company faced significant logistical challenges due to the extended closure of the Baltimore shipping channel following the collapse of the Francis Scott Key Bridge. Despite these challenges, Arch Resources managed to ship 2.0 million tons of coking coal and set a quarterly production record in its metallurgical segment.

Financial Achievements

Arch Resources Inc's financial achievements include paying down an additional $12.5 million of debt, bringing the total debt level to $133.3 million and achieving a net positive cash position of $146.0 million. The company also repurchased 94,367 shares and declared a quarterly cash dividend of $0.25 per share.

These achievements are crucial for the company as they reflect its ability to manage debt and return value to shareholders, which is particularly important in the highly competitive and capital-intensive coal industry.

Income Statement Highlights

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Revenue | $608.8 million | $757.3 million |

| Net Income | $14.8 million | $77.4 million |

| Adjusted EBITDA | $60.0 million | $130.4 million |

| Earnings Per Share (Diluted) | $0.81 | $4.04 |

Operational Update

Arch Resources Inc's metallurgical segment contributed adjusted EBITDA of $87.3 million in Q2 2024. However, the logistical challenges reduced adjusted EBITDA by more than $12 million. The company deferred the shipment of nearly 150,000 tons of thermal byproduct to prioritize coking coal shipments, which increased the segment's cash cost per ton sold by an estimated $6 per ton. This cost impact was partially offset by a $12.8 million severance tax rebate from the State of West Virginia.

The thermal segment effectively broke even for the second straight quarter, with the West Elk longwall mine generating a solid cash margin while the Powder River Basin assets were cash negative.

Financial, Liquidity, and Capital Return Program Update

During Q2 2024, Arch Resources deployed $19.6 million in its capital return program, repurchasing 94,367 shares for $15.0 million and declaring a fixed dividend of $0.25 per share. The company generated discretionary cash flow of $12.3 million, reflecting a $15.2 million working capital build.

Arch Resources ended the quarter with $279.3 million in cash, cash equivalents, and short-term investments, and a net cash position of $146.0 million. The company has deployed over $1.3 billion under its capital return program since February 2022.

Sustainability and Market Update

Arch Resources maintained exemplary environmental, social, and governance performance, achieving a lost-time incident rate of 0.47 incidents per 200,000 employee-hours worked and recording zero environmental violations. The company received several safety and reclamation awards from the States of Colorado and Wyoming.

Global coking coal demand remains subdued due to weak infrastructure and property market spending in China, the monsoon season in India, and slow recovery in Europe. However, Asian steelmakers signal an expected need for increasing volumes in future periods.

Outlook

Arch Resources Inc remains focused on driving continuous improvement in execution across its operating platform to support strong, value-generating capital returns for stockholders. The company believes it is well-positioned to capitalize as global steel demand stabilizes and resumes its anticipated long-term growth trajectory.

Explore the complete 8-K earnings release (here) from Arch Resources Inc for further details.