Unilever PLC (UL, Financial), a leading entity in the consumer packaged goods industry, has recently witnessed a notable fluctuation in its stock performance. With a current market capitalization of $149.88 billion, the stock price stands at $60.15, reflecting a recent decrease of 2.85% over the past week. However, looking at a broader timeline, Unilever has seen an impressive 18.61% increase over the past three months. According to the GF Value, the stock is currently Fairly Valued at $57.75, a slight increase from the previous $57.7, indicating a shift from being Modestly Undervalued.

Overview of Unilever PLC

Unilever PLC operates in diverse sectors including personal-care, homecare, and packaged food. Renowned for brands such as Knorr, Hellmann's, Axe, Dove, and TRESemmé, Unilever has expanded its portfolio through acquisitions like Paula's Choice and The Vegetarian Butcher. These strategic moves have fortified its market presence across various consumer segments.

Assessing Unilever's Profitability

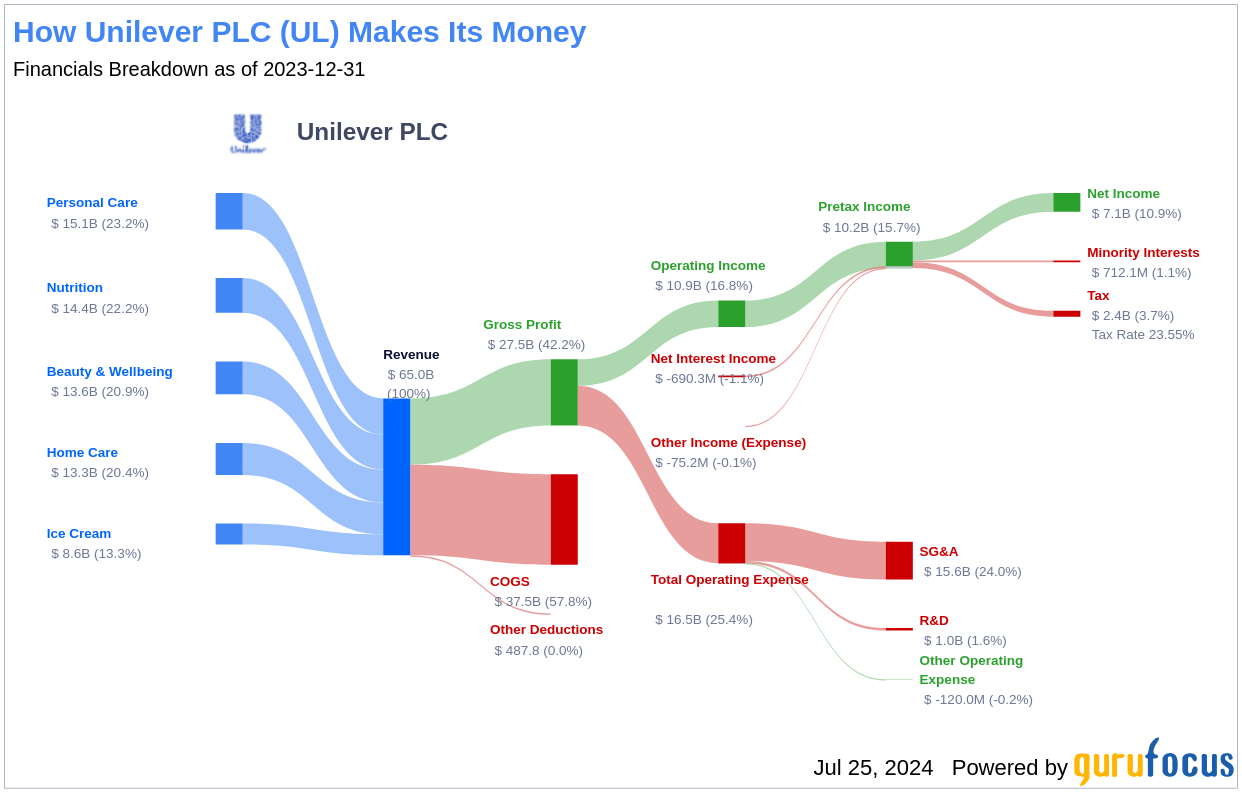

Unilever stands out in its sector with a high Profitability Rank of 8/10. The company's operating margin is an impressive 16.68%, higher than 88.6% of its peers. Additionally, its Return on Equity (ROE) of 34.38% and Return on Assets (ROA) of 8.37% are significantly above industry averages, underscoring its efficient management and strong financial health. The Return on Invested Capital (ROIC) at 11.12% further highlights its capability to generate profitable returns.

Growth Trajectory of Unilever

Unilever's Growth Rank is currently at 5/10, indicating moderate growth prospects. The company has maintained a steady increase in revenue, with a 3-Year Revenue Growth Rate per Share of 5.10% and a 5-Year Rate of 4.20%. However, its EPS growth has been less robust, with a slight decline over three years and only a modest increase over five years. Looking ahead, analysts estimate a future EPS growth rate of 5.74%, suggesting potential for improvement.

Notable Shareholders

Unilever's stock is held by prominent investors, including Ken Fisher (Trades, Portfolio) who owns 14,310,220 shares, representing 0.57% of total shares. HOTCHKIS & WILEY and Jeremy Grantham (Trades, Portfolio) are also significant holders, emphasizing the stock's appeal to savvy investors.

Competitive Landscape

Unilever competes with companies like Reckitt Benckiser Group PLC (LSE:RKT, Financial), Warpaint London PLC (LSE:W7L, Financial), and PZ Cussons PLC (LSE:PZC, Financial). Despite the varying market caps, Unilever's extensive product range and global footprint provide it with a competitive edge in the consumer goods sector.

Conclusion

Unilever PLC demonstrates robust profitability and a stable market position, making it a noteworthy contender in the consumer packaged goods industry. Despite a short-term decline, the stock has shown significant growth over the past three months. With its strategic acquisitions and consistent profitability, Unilever is well-positioned for sustained growth, making it an attractive option for investors looking for stability and potential in their portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: