On July 31, 2024, Deluxe Corp (DLX, Financial) released its 8-K filing for the second quarter of 2024. Deluxe Corp, a company engaged in providing payment solutions, operates in four segments: Payments, Data Solutions, Promotional Solutions, and Checks.

Performance Overview

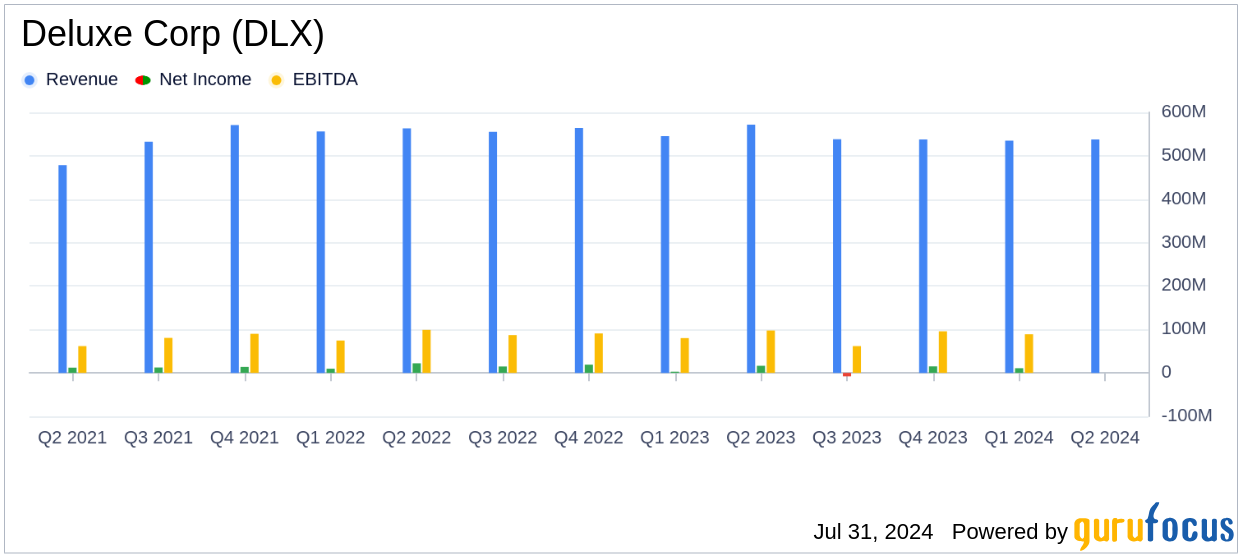

Deluxe Corp reported a 5.9% decrease in revenue, amounting to $537.8 million, compared to $571.7 million in the same quarter last year. This figure fell short of the analyst estimate of $537.90 million. However, the company saw a 25% increase in net income, reaching $20.5 million, up from $16.4 million in Q2 2023.

Despite the revenue decline, Deluxe Corp's GAAP diluted EPS expanded by 24.3% to $0.46, surpassing the analyst estimate of $0.28. Comparable adjusted diluted EPS also improved by 4.9% to $0.85.

Financial Achievements and Challenges

Deluxe Corp's performance highlights the company's ability to manage its operations efficiently despite a challenging revenue environment. The increase in net income and EPS indicates stronger operating results and lower restructuring expenses. The company's first-half operating cash flows increased by 40% to $66.2 million, and free cash flow was $17.6 million through six months.

However, the decline in revenue poses a challenge, reflecting potential issues in market demand or competitive pressures. The company’s ability to maintain profitability and cash flow amidst these challenges is crucial for its long-term sustainability.

Key Financial Metrics

| Metric | Q2 2024 | Q2 2023 | % Change |

|---|---|---|---|

| Revenue | $537.8 million | $571.7 million | (5.9%) |

| Comparable Adjusted Revenue | $534.9 million | $551.6 million | (3.0%) |

| Net Income | $20.5 million | $16.4 million | 25.0% |

| Comparable Adjusted EBITDA | $101.8 million | $100.2 million | 1.6% |

| Diluted EPS | $0.46 | $0.37 | 24.3% |

| Comparable Adjusted Diluted EPS | $0.85 | $0.81 | 4.9% |

Analysis and Outlook

Deluxe Corp's ability to improve its net income and EPS despite a decline in revenue demonstrates effective cost management and operational efficiency. The company's focus on core capital allocation priorities, including reducing net debt levels, positions it well for future growth.

Looking ahead, Deluxe Corp affirms its 2024 guidance, expecting revenue between $2.12 billion and $2.16 billion, adjusted EBITDA of $400 to $420 million, adjusted diluted EPS of $3.10 to $3.40, and free cash flow of $80 to $100 million. These projections reflect the company's confidence in its strategic initiatives and operational resilience.

For more detailed insights and to access the full earnings report, visit the 8-K filing.

Explore the complete 8-K earnings release (here) from Deluxe Corp for further details.