On August 6, 2024, Surgery Partners Inc (SGRY, Financial) released its 8-K filing announcing its second-quarter 2024 financial results. Surgery Partners Inc is a healthcare services company with an integrated outpatient delivery model focused on providing quality, cost-effective solutions for surgical and related ancillary care in support of both patients and physicians. It operates in two segments: Surgical Facility Services and Ancillary Services, with the former accounting for the majority of revenue.

Performance Overview

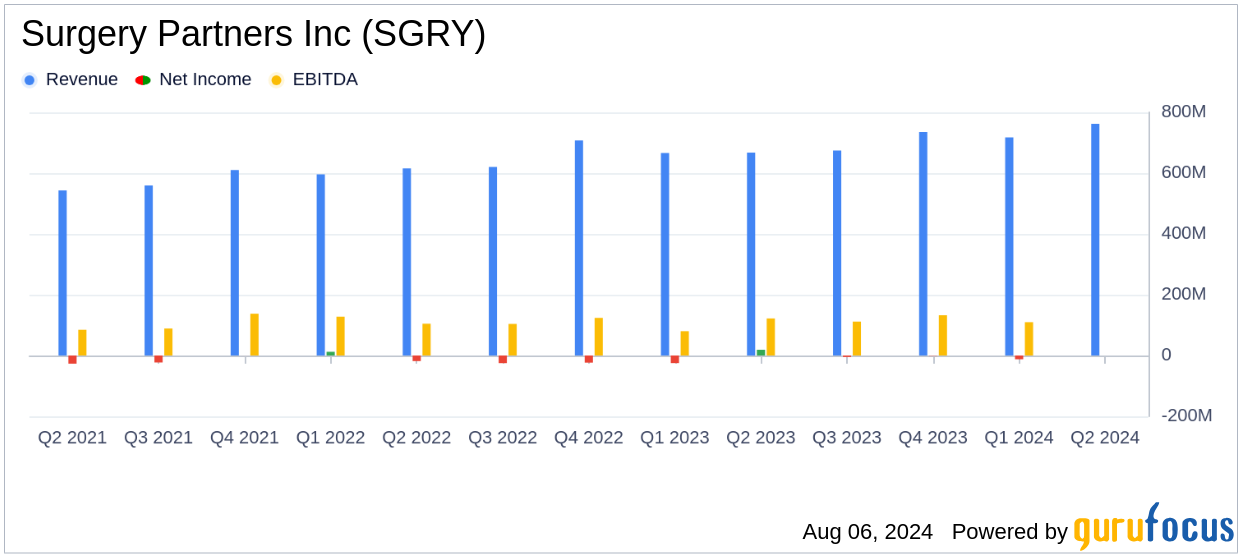

Surgery Partners Inc (SGRY, Financial) reported a 14.2% increase in revenues to $762.1 million for Q2 2024, surpassing the analyst estimate of $735.57 million. Same-facility revenues grew by 9.9%, driven by a 5.7% increase in revenue per case and a 3.9% increase in same-facility cases. Despite these gains, the company reported a net loss attributable to Surgery Partners Inc of $15.5 million. Adjusted EBITDA rose by 18.1% to $118.3 million, with an adjusted EBITDA margin of 15.5%, expanding by 50 basis points from the prior year period.

Financial Achievements and Challenges

The company's financial achievements are significant in the healthcare providers and services industry, where operational efficiency and cost management are crucial. The 14.2% revenue growth and 18.1% increase in Adjusted EBITDA highlight the company's ability to scale its operations effectively. However, the net loss of $15.5 million indicates ongoing challenges in managing costs and achieving profitability.

Income Statement Highlights

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Revenues | $762.1 million | $667.6 million |

| Net Loss Attributable to Surgery Partners Inc | $(15.5) million | $(18.9) million |

| Adjusted EBITDA | $118.3 million | $100.2 million |

| Adjusted EBITDA Margin | 15.5% | 15.0% |

Balance Sheet and Cash Flow

As of June 30, 2024, Surgery Partners had cash and cash equivalents of $213.5 million and $647.8 million of borrowing capacity under its revolving credit facility. Cash flows from operating activities were $82.8 million for Q2 2024, compared to $52.1 million in the prior year quarter. Year-to-date operating cash flows were $123.5 million, compared to $126.6 million in the prior year period. Free Cash Flow was $22.4 million for year-to-date 2024.

Outlook and Strategic Initiatives

Surgery Partners Inc has raised its full-year 2024 guidance, projecting revenues to exceed $3.075 billion and Adjusted EBITDA to surpass $508 million. The company continues to focus on physician recruiting and acquisitions, having deployed nearly $220 million on several transactions year-to-date. This strategic focus is expected to drive long-term growth and operational efficiency.

Wayne DeVeydt, Executive Chairman of the Board, stated, "We are proud to report strong growth in Adjusted EBITDA and revenue, both ahead of our expectations. We achieved these results by continuing to focus on exceptional clinical quality and value, operational execution, and the strategic impact of physician recruiting and acquisitions."

For more detailed information, readers can access the full 8-K filing.

Explore the complete 8-K earnings release (here) from Surgery Partners Inc for further details.