On August 6, 2024, Hillman Solutions Corp (HLMN, Financial) released its 8-K filing for the second quarter of 2024. Hillman Solutions Corp is a provider of hardware-related products and related merchandising services to retail markets in North America. The company sells its products to hardware stores, home centers, mass merchants, pet supply stores, and other retail outlets. Its product lines include thousands of small parts such as fasteners and related hardware items; threaded rod and metal shapes; keys and accessories; builder's hardware; personal protective equipment, such as gloves and eye-wear; and identification items, such as tags and letters, numbers, and signs. The segments of the group are Hardware and Protective Solutions, which is the key revenue-generating segment; Robotics and Digital Solutions; and Canada. It has a business presence in the US, Canada, and Mexico.

Performance Overview

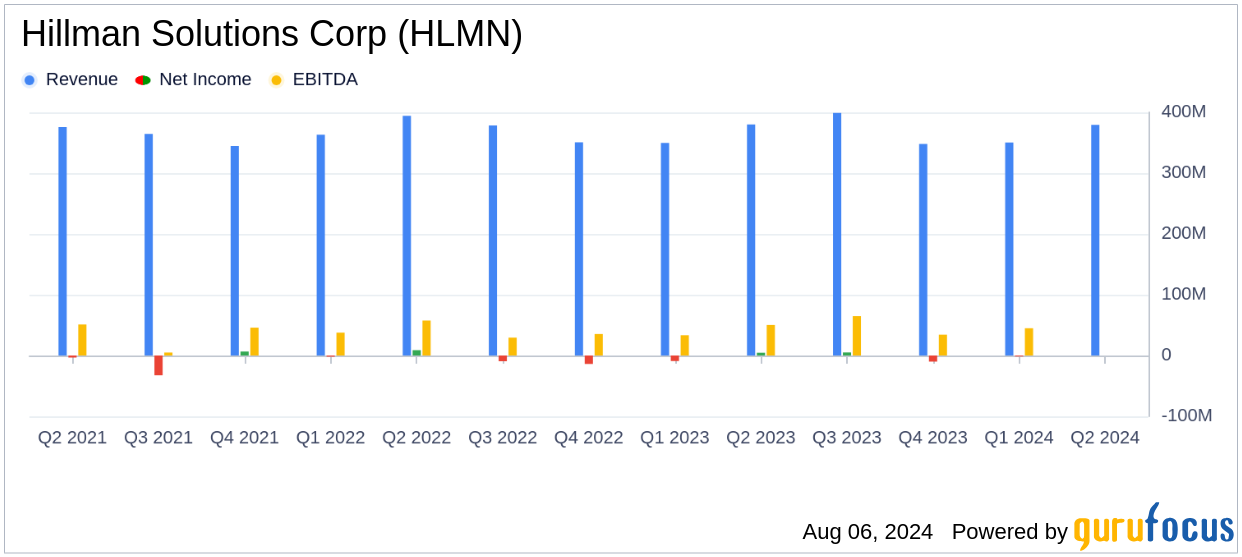

For the thirteen weeks ended June 29, 2024, Hillman Solutions Corp reported net sales of $379.4 million, a slight decrease of 0.2% compared to $380.0 million in the prior year quarter. Despite the marginal decline in revenue, the company achieved a significant increase in net income, totaling $12.5 million, or $0.06 per diluted share, compared to $4.5 million, or $0.02 per diluted share, in the prior year quarter. Adjusted diluted EPS was $0.16 per share, surpassing the analyst estimate of $0.13.

Key Financial Metrics

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Net Sales | $379.4 million | $380.0 million |

| Net Income | $12.5 million | $4.5 million |

| Adjusted Diluted EPS | $0.16 | $0.13 |

| Adjusted EBITDA | $68.4 million | $58.0 million |

Year-to-Date Highlights

For the twenty-six weeks ended June 29, 2024, Hillman Solutions Corp reported net sales of $729.7 million, unchanged from the prior year period. Net income for the period was $11.0 million, or $0.06 per diluted share, compared to a net loss of $(4.6) million, or $(0.02) per diluted share, in the prior year period. Adjusted diluted EPS for the year-to-date period was $0.25 per share, compared to $0.19 per share in the prior year period. Adjusted EBITDA totaled $120.7 million, up from $98.2 million in the prior year period.

Balance Sheet and Liquidity

As of June 29, 2024, Hillman Solutions Corp reported gross debt of $759.4 million, compared to $760.9 million on December 30, 2023, and $851.5 million on July 1, 2023. Net debt outstanding decreased to $705.3 million, compared to $722.4 million on December 30, 2023, and $813.8 million on July 1, 2023. Liquidity available totaled approximately $305.3 million, consisting of $251.2 million of available borrowing under the revolving credit facility and $54.0 million of cash and equivalents. Net debt to trailing twelve-month Adjusted EBITDA improved to 2.9x from 3.3x on December 30, 2023, and 4.0x on July 1, 2023.

Management Commentary

"During the second quarter we delivered outstanding bottom-line performance resulting from improved efficiencies and strong margins," commented Doug Cahill, Chairman, President, and Chief Executive Officer of Hillman. "We took great care of our customers during the quarter with exceptional fill rates of 95%, which ensures that our products are in stock and on the shelves of our retail partners. Although sales were impacted by prevailing market conditions, we continued to roll out new business wins and improve our financial position by strengthening our balance sheet."

Updated Full Year 2024 Guidance

Based on year-to-date performance and improved visibility on the remainder of the year, management has updated its full year 2024 guidance. The company now expects net sales to be in the range of $1.44 to $1.48 billion, down from the original guidance of $1.475 to $1.555 billion. However, Adjusted EBITDA guidance has been raised to $240 to $250 million from the original range of $230 to $240 million. Free Cash Flow guidance remains unchanged at $100 to $120 million.

For more detailed information, please refer to the 8-K filing.

Explore the complete 8-K earnings release (here) from Hillman Solutions Corp for further details.