On August 7, 2024, Oscar Health Inc (OSCR, Financial) released its 8-K filing for the second quarter of 2024, showcasing impressive financial performance that exceeded analyst estimates. Oscar Health Inc is a health insurance company that offers various insurance plans for individuals, families, and employees, including virtual care and other related services. The company also provides Medicare Advantage plans for adults aged 65 and older.

Performance Highlights

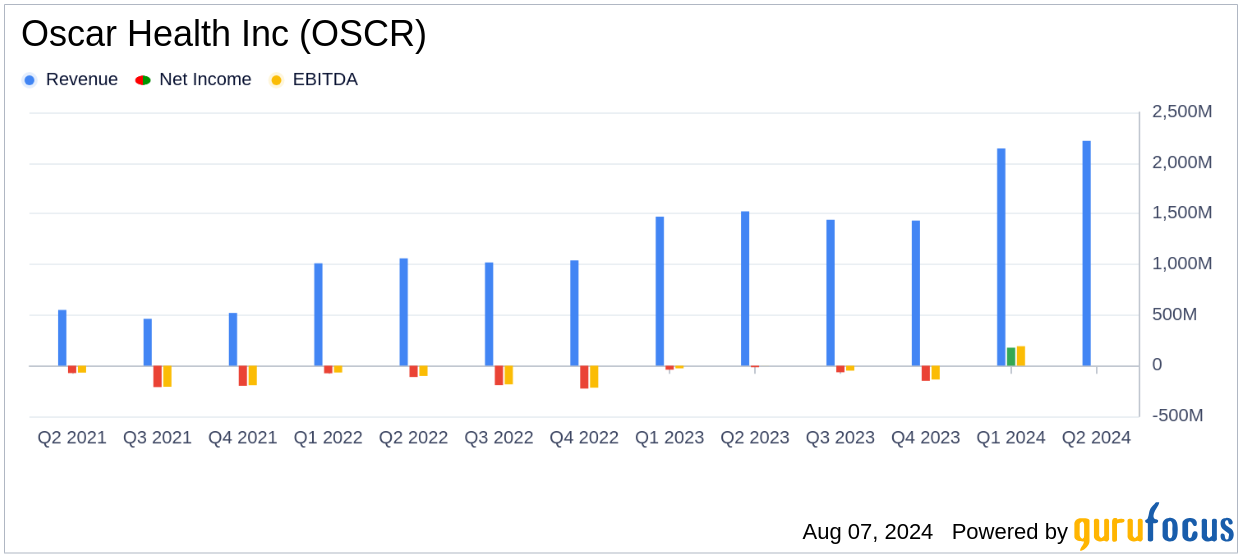

Oscar Health Inc reported total revenue of $2.2 billion for the quarter ended June 30, 2024, marking a 46% increase year-over-year (YoY). This figure surpassed the analyst estimate of $2.154 billion. The company's net income attributable to Oscar was $56.2 million, or $0.20 per diluted share, significantly higher than the analyst estimate of $0.16 per share.

Key Financial Achievements

The company's Medical Loss Ratio (MLR) improved by 90 basis points YoY to 79.0%, indicating better cost management in healthcare services. Additionally, the Selling, General, and Administrative (SG&A) Expense Ratio improved by 260 basis points YoY to 19.6%, reflecting enhanced operational efficiencies.

“Oscar reported strong second quarter results, closing out the best six months in the company's history," said Mark Bertolini, CEO of Oscar Health. “We continued to report robust revenue growth, improved operating margin, and strong bottom line performance. Based on our outperformance in the first half of the year, we updated our full year 2024 guidance. We are well-positioned to deliver on our target for Adjusted EBITDA profitability this year.”

Income Statement and Balance Sheet Insights

Oscar Health Inc's income statement revealed total operating expenses of $2.15 billion, up from $1.53 billion in the same period last year. Despite the increase in expenses, the company achieved earnings from operations of $67.8 million, compared to a loss of $6.5 million in Q2 2023.

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Total Revenue | $2.2 billion | $1.52 billion |

| Net Income | $56.2 million | -$15.5 million |

| Medical Loss Ratio | 79.0% | 79.9% |

| SG&A Expense Ratio | 19.6% | 22.2% |

On the balance sheet, Oscar Health Inc reported total assets of $5.01 billion as of June 30, 2024, up from $3.60 billion at the end of 2023. The increase in assets was driven by higher cash and cash equivalents, which stood at $2.27 billion, compared to $1.87 billion at the end of 2023.

Cash Flow and Membership Growth

The company's cash flow statement showed net cash provided by operating activities of $1.13 billion for the first six months of 2024, a significant increase from $580.2 million in the same period last year. This robust cash flow was supported by a substantial increase in membership, which grew to 1.58 million members, up from 970,543 members in Q2 2023.

Updated Full Year 2024 Outlook

Based on the strong performance in the first half of the year, Oscar Health Inc has updated its full-year 2024 guidance. The company now projects revenue to be in the range of $9.0 billion to $9.1 billion, up from the previous range of $8.3 billion to $8.4 billion. Adjusted EBITDA is expected to be between $160 million and $210 million, higher than the prior range of $125 million to $175 million.

Oscar Health Inc's impressive Q2 2024 results highlight the company's strong growth trajectory and operational efficiencies. With a significant increase in revenue and net income, coupled with improved cost management metrics, Oscar Health Inc is well-positioned to continue its upward momentum in the healthcare plans industry.

Explore the complete 8-K earnings release (here) from Oscar Health Inc for further details.