On August 7, 2024, ACM Research Inc (ACMR, Financial) released its 8-K filing detailing its financial results for the second quarter ended June 30, 2024. ACM Research Inc is a United States-based company engaged in developing, manufacturing, and selling single-wafer wet cleaning equipment used by semiconductor manufacturers to improve product yield in fabricating integrated circuits or chips.

Performance Overview

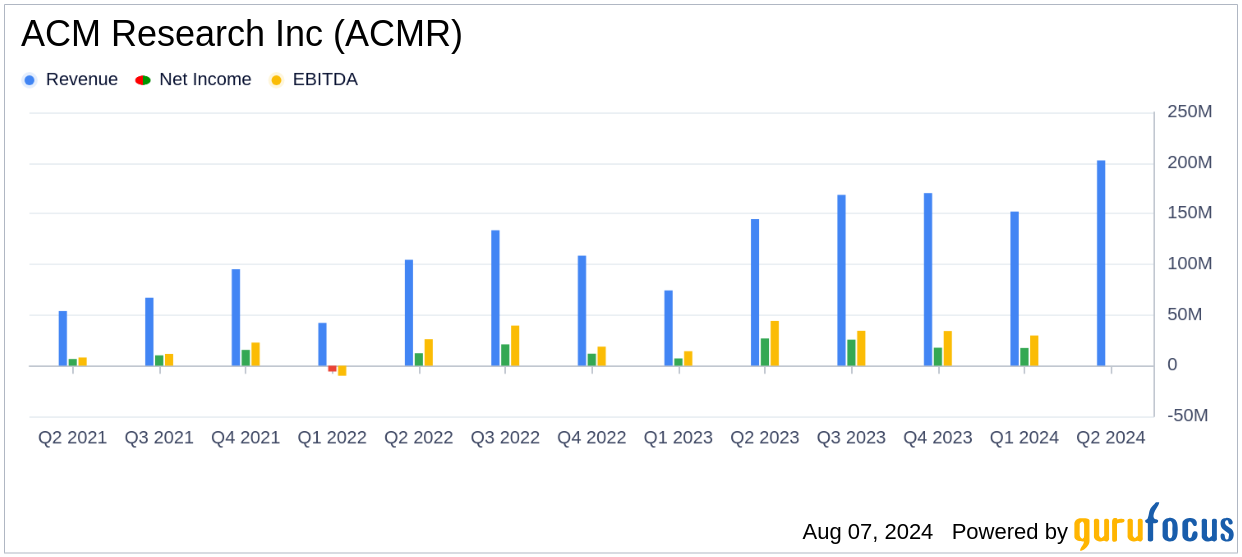

ACM Research Inc (ACMR, Financial) reported record revenue of $202.48 million for Q2 2024, surpassing the analyst estimate of $163.05 million. This represents a significant increase from the $144.58 million reported in Q2 2023. The company also reported a gross margin of 47.8%, slightly up from 47.5% in the same period last year.

Net income attributable to ACM Research Inc was $24.21 million, or $0.35 per diluted share, compared to $26.83 million, or $0.41 per diluted share, in Q2 2023. Despite a slight decrease in net income, the company demonstrated strong profitability and positive cash flow from operations.

Key Financial Achievements

ACM Research Inc's financial achievements are noteworthy in the semiconductor industry, where maintaining high revenue growth and profitability is crucial. The company’s revenue growth is driven by continued investments from customers and market share gains from both existing and new products.

I am pleased with our second quarter results. We delivered record revenue, strong profitability, and positive cash flow from operations," said ACM’s President and Chief Executive Officer, Dr. David Wang.

Income Statement Highlights

| Metric | Q2 2024 | Q2 2023 |

|---|---|---|

| Revenue | $202.48 million | $144.58 million |

| Gross Margin | 47.8% | 47.5% |

| Net Income | $24.21 million | $26.83 million |

| Diluted EPS | $0.35 | $0.41 |

Balance Sheet and Cash Flow

As of June 30, 2024, ACM Research Inc reported total assets of $1.67 billion, up from $1.49 billion as of December 31, 2023. The company’s cash and cash equivalents increased to $324.03 million from $182.09 million at the end of 2023, reflecting strong liquidity.

Current liabilities stood at $586.17 million, compared to $500.66 million at the end of 2023, while total equity increased to $1.00 billion from $926.16 million.

Outlook and Future Prospects

ACM Research Inc has raised its revenue guidance for fiscal year 2024 to a range of $695 million to $735 million, up from the prior range of $650 million to $725 million. This upward revision reflects the company’s confidence in continued customer investments, market share gains, and strong product cycles for the second half of the year.

We have raised our 2024 revenue outlook to reflect continued investments by our customers, market share gains, and strong product cycles for the second half of the year," said Dr. Wang.

In conclusion, ACM Research Inc's Q2 2024 financial results highlight the company's robust performance and strategic growth in the semiconductor industry. For more detailed insights and analysis, visit the full 8-K filing.

Explore the complete 8-K earnings release (here) from ACM Research Inc for further details.