On August 14, 2024, Natural Gas Services Group Inc (NGS, Financial) released its 8-K filing for the second quarter of 2024. Natural Gas Services Group Inc provides natural gas compression equipment and services to the energy industry. The company manufactures, fabricates, rents, sells, and maintains natural gas compressors and flare systems for oil and natural gas production and plant facilities. Its operating units include Rental, Sales, and Aftermarket services. The company generates the majority of its revenue by renting out low- to medium-horsepower compression equipment to natural gas production companies in unconventional oil and gas regions of the United States.

Performance Overview

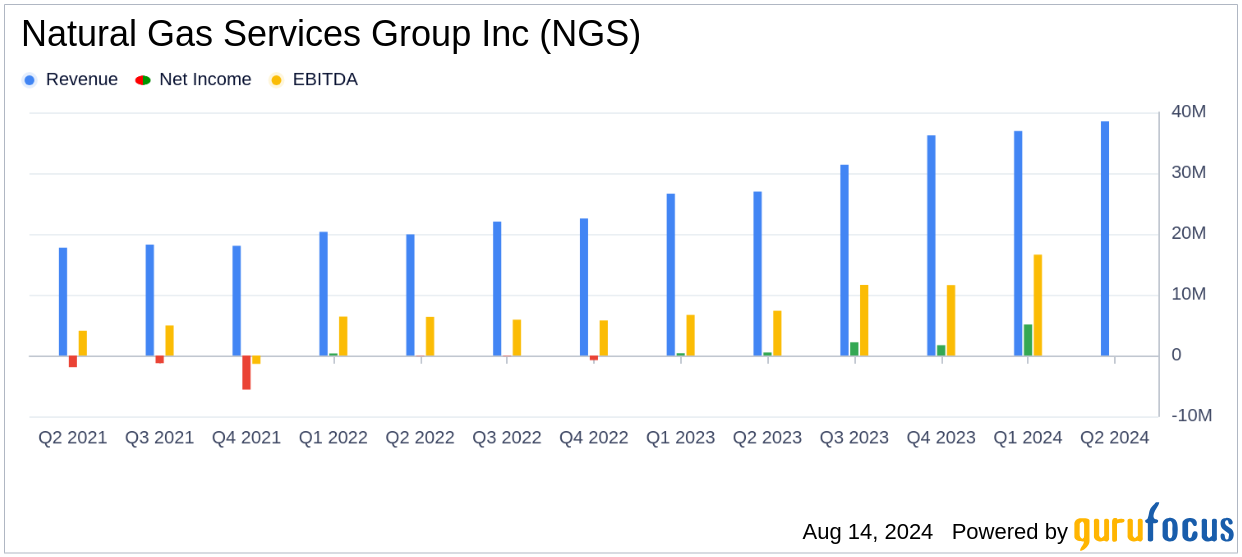

Natural Gas Services Group Inc (NGS, Financial) reported a significant increase in both revenue and net income for the second quarter of 2024. Total revenue for the quarter was $38.5 million, a 42.8% increase from $27.0 million in the same period last year. This growth was primarily driven by a 44.9% increase in rental revenue, which reached $34.9 million.

Net income for the quarter was $4.3 million, or $0.34 per basic share, compared to $0.5 million, or $0.04 per basic share, in the second quarter of 2023. Adjusted EBITDA also saw a substantial rise, increasing 66.6% to $16.5 million from $9.9 million in the same period last year.

Financial Achievements and Metrics

Natural Gas Services Group Inc (NGS, Financial) achieved several key financial milestones during the quarter:

- Rental revenue increased by 44.9% year-over-year and 4% sequentially.

- Net income rose to $4.3 million, a significant improvement from $0.5 million in the same period last year.

- Adjusted EBITDA increased to $16.5 million, up from $9.9 million in Q2 2023.

- Rented horsepower at quarter-end was 454,568, a 22% increase over the prior year.

- Horsepower utilization improved to 82.3%, up 370 basis points from last year.

Income Statement Highlights

| Three months ended | June 30, 2023 | June 30, 2024 |

|---|---|---|

| Total Revenue | $27.0 million | $38.5 million |

| Rental Revenue | $24.1 million | $34.9 million |

| Net Income | $0.5 million | $4.3 million |

| Adjusted EBITDA | $9.9 million | $16.5 million |

Management Commentary

“We delivered significant top and bottom-line growth this quarter, along with a material increase in net cash provided by operating activities, as we further grow and optimize our business,” said Justin Jacobs, Chief Executive Officer. “We continue to witness a strong market for oil production, particularly in the Permian Basin, and compression demand remains robust. As such, we are taking advantage of our industry position, innovative compression units, and strong customer relationships to increase investments in our large horsepower fleet as we look to drive growth in rental fleet horsepower, rental revenue, and cash flow.”

Updated Guidance

Based on its first-half performance and outlook for the remainder of the year, Natural Gas Services Group Inc (NGS, Financial) has updated its guidance for the 2024 fiscal year:

- Adjusted EBITDA is now expected to be in the range of $64 million to $68 million, up from the previous range of $61 million to $67 million.

- Growth capital expenditures are anticipated to be between $60 million and $80 million, an increase from the prior guidance of $40 million to $50 million.

- Maintenance capital expenditures remain unchanged, expected to be in the range of $8 million to $11 million.

- The target return on invested capital remains at least 20%.

Conclusion

Natural Gas Services Group Inc (NGS, Financial) has demonstrated robust financial performance in the second quarter of 2024, driven by strong rental revenue growth and improved operational efficiency. The company's updated guidance reflects its confidence in continued growth and value creation for stakeholders. Investors and analysts will be closely watching how NGS capitalizes on its strong market position and customer relationships to drive future growth.

Explore the complete 8-K earnings release (here) from Natural Gas Services Group Inc for further details.