Overview of the Recent Transaction

On September 19, 2024, M&G INVESTMENT MANAGEMENT LTD, a prominent investment firm, executed a significant transaction by acquiring an additional 2,163,837 shares of REE Automotive Ltd (REE, Financial). This move increased the firm's total holdings in REE to 3,910,851 shares, marking a substantial endorsement of the automotive company's potential. The shares were purchased at a price of $5.78 each, reflecting a strategic addition to M&G's portfolio.

Insight into M&G INVESTMENT MANAGEMENT LTD

M&G INVESTMENT MANAGEMENT LTD, based at 10 Fenchurch Avenue, London, is known for its robust investment strategies and a diverse portfolio that includes top holdings such as Broadcom Inc (AVGO, Financial) and Microsoft Corp (MSFT, Financial). With an equity portfolio valued at approximately $25.85 billion, the firm focuses heavily on the Industrials and Energy sectors, aligning its investments with long-term growth perspectives.

REE Automotive Ltd at a Glance

Founded in Israel, REE Automotive Ltd is at the forefront of electric vehicle technology, specializing in the development of its revolutionary REEcorner technology. This innovation integrates critical vehicle components into a single module, enhancing the design and efficiency of electric vehicles. Despite its cutting-edge technology, REE's financial health shows a market capitalization of $137.364 million with a current stock price of $7.38, reflecting a significant 27.68% increase since the transaction date.

Impact on the Market and Stock Performance

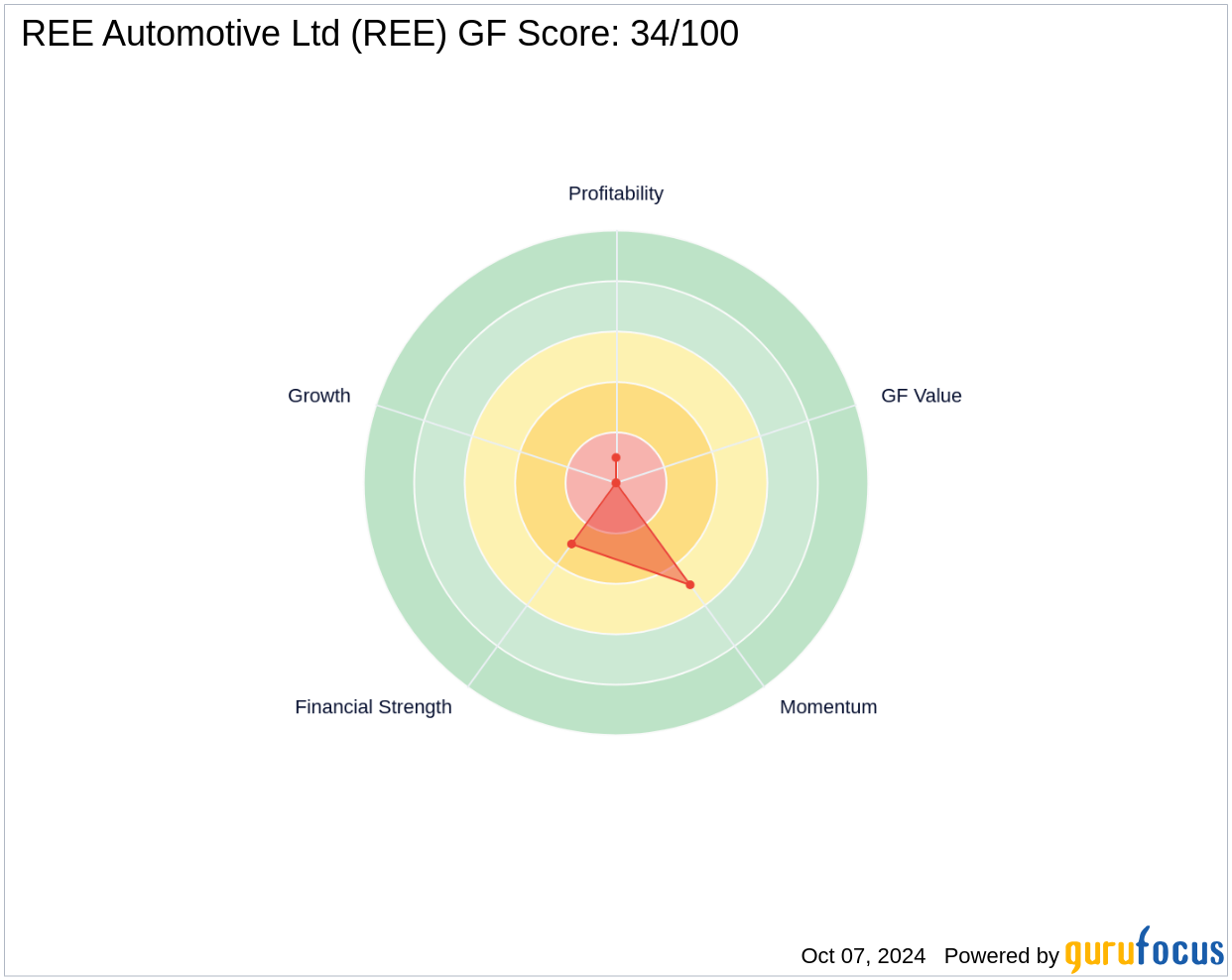

Following M&G's investment, REE's stock price experienced a notable rise, indicating positive market reception. However, the company's GF Score of 34/100 suggests potential challenges in future performance. The stock's year-to-date increase of 48.79% contrasts with a significant overall decline of 97.88% since its IPO, highlighting the volatile nature of this investment.

Strategic Investment Rationale

M&G's decision to increase its stake in REE Automotive may be driven by the firm's confidence in REE's technological advancements and potential market growth. This aligns with M&G's investment philosophy of focusing on innovative companies that have the potential to lead their respective industries.

Automotive and Electric Vehicle Sector Trends

The automotive and electric vehicle industry is currently undergoing significant transformations with a push towards sustainability and innovation. Companies like REE that pioneer technologies to reduce emissions and enhance efficiency are well-positioned to benefit from these trends, despite the current financial metrics indicating challenges in profitability and growth.

Future Outlook for REE Automotive

Looking ahead, REE Automotive's performance in the upcoming quarters will be crucial. The industry's focus on innovation and the increasing adoption of electric vehicles may bolster REE's market position. However, the company's financial health and the competitive landscape will play critical roles in its ability to capitalize on these opportunities.

Conclusion

The recent acquisition by M&G INVESTMENT MANAGEMENT LTD highlights a significant endorsement of REE Automotive's potential within the electric vehicle sector. While the investment aligns with M&G's strategy of backing technologically innovative companies, the future success of this stake will depend on REE's market performance and the evolving dynamics of the automotive industry. This transaction not only reflects the firm's investment acumen but also underscores the market's gradual shift towards sustainable automotive solutions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.