On September 30, 2024, State Street Corp executed a significant transaction by reducing its holdings in First Industrial Realty Trust Inc (FR, Financial) by 38,151 shares. This move adjusted the firm's total ownership to 6,554,200 shares, reflecting a subtle yet strategic portfolio adjustment. The shares were traded at a price of $55.98, marking a pivotal moment in the firm's investment strategy.

Profile of State Street Corp

State Street Corp, headquartered at One Lincoln Street, Boston, MA, is a prominent financial entity known for its robust investment strategies and extensive portfolio. The firm manages a diverse array of assets, with top holdings including giants like Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). With a focus primarily on technology and financial services, State Street Corp holds a commanding presence in the market, managing an equity portfolio worth approximately $2,285.63 trillion. The firm's investment philosophy emphasizes long-term growth and stability, leveraging large, influential markets to secure substantial returns.

Understanding First Industrial Realty Trust Inc

First Industrial Realty Trust Inc, a key player in the REIT sector, specializes in the ownership, management, and development of industrial real estate. Primarily focused on light industrial and bulk warehouse properties, the company has strategically positioned itself near major transportation hubs, enhancing its logistical advantages. First Industrial Realty Trust Inc has shown a consistent performance in the market with a current market capitalization of $7.24 billion and a stock price of $54.67, slightly down from the trade price. The company's business model, centered around medium-term lease revenues, caters to a diverse clientele across various sectors, including manufacturing and retail.

Analysis of the Trade Impact

The reduction of 38,151 shares by State Street Corp represents a minor adjustment in the firm's portfolio, with the position in First Industrial Realty Trust Inc now accounting for a mere 0.02% of its total holdings. This move could signify a strategic reallocation or a response to the broader market conditions, reflecting the firm's dynamic approach to portfolio management. Despite this reduction, State Street Corp maintains a significant influence in the company, holding 5.00% of the outstanding shares.

Market Context and Stock Performance

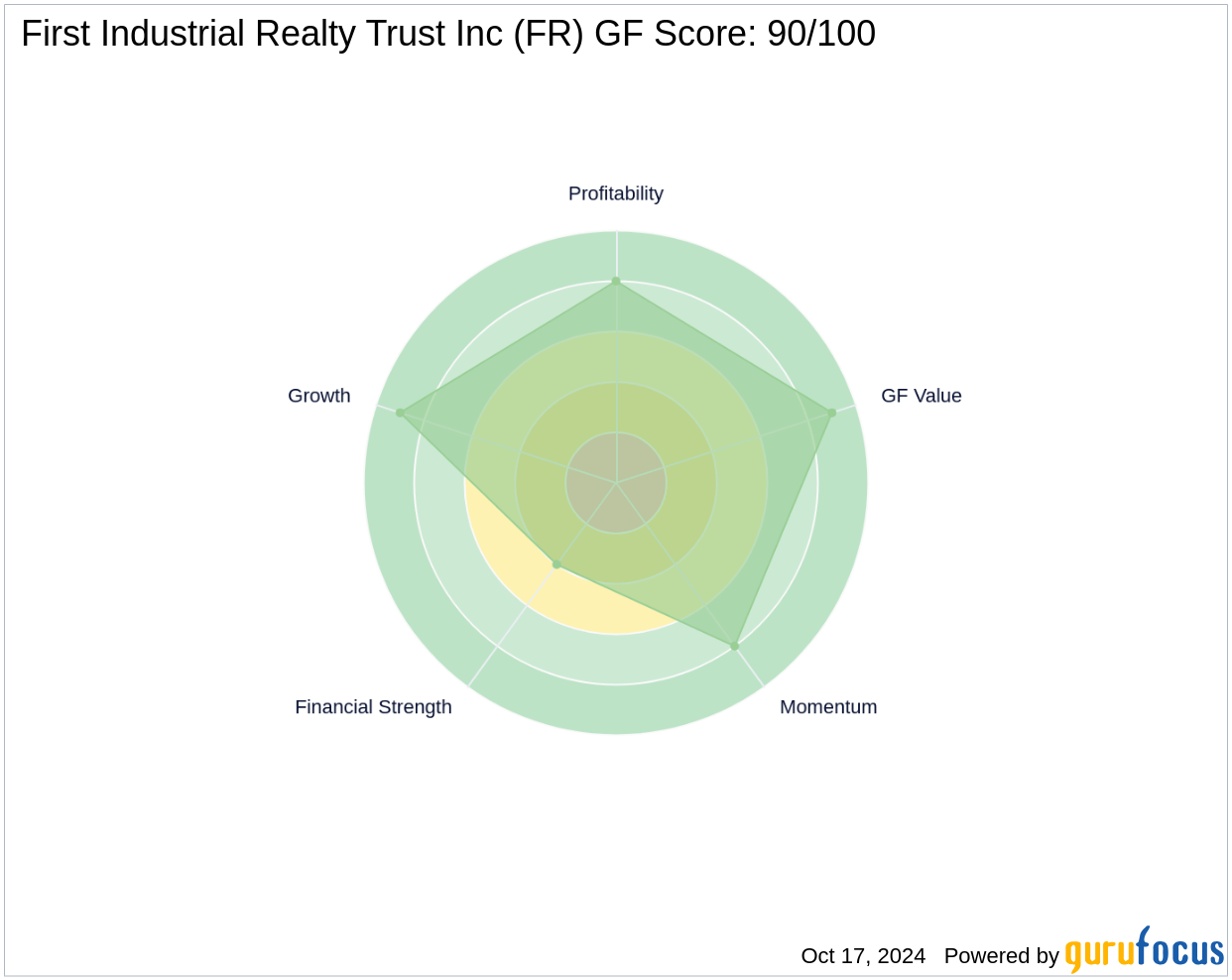

At the time of the transaction, First Industrial Realty Trust Inc's stock was trading at $55.98, closely aligned with its current price of $54.67. The stock is modestly undervalued with a GF Score of 90/100, indicating potential for high outperformance. The company's financial health, as indicated by its Financial Strength and Profitability Rank, remains robust, supporting its growth trajectory in the competitive REIT market.

Broader Market Implications

The trading activity by State Street Corp could signal a cautious approach towards the REIT sector, possibly due to market volatility or shifts in investment strategy. Other major stakeholders in First Industrial Realty Trust Inc, including Third Avenue Management (Trades, Portfolio), Ken Fisher (Trades, Portfolio), and Ron Baron (Trades, Portfolio), may also recalibrate their positions based on these market movements, influencing the sector's dynamics further.

This transaction by State Street Corp underscores the fluid nature of investment strategies in response to changing market conditions, highlighting the importance of staying informed on significant market activities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: