Overview of the Recent Transaction

On September 30, 2024, State Street Corp made a significant addition to its investment portfolio by acquiring 47,054 shares of KeyCorp (KEY, Financial), a prominent financial institution. This transaction increased State Street Corp's total holdings in KeyCorp to 45,960,573 shares, reflecting a modest portfolio position of 0.03% and a substantial 5.00% ownership in KeyCorp itself. The shares were purchased at a price of $16.75 each, marking a strategic move by the firm in the financial sector.

Profile of State Street Corp

Headquartered at One Lincoln Street, Boston, MA, State Street Corp is a major player in the investment sector, managing a diverse portfolio across various industries. With top holdings in leading companies like Apple Inc (AAPL, Financial) and Amazon.com Inc (AMZN, Financial), the firm's investment philosophy focuses on maximizing returns through strategic market positions. The firm's equity stands at a staggering $2,285.63 trillion, with a significant focus on technology and financial services sectors.

Insight into KeyCorp's Business Model

KeyCorp, based in Ohio with over $180 billion in assets, operates primarily in Ohio and New York. It serves middle-market commercial clients through a hybrid community/corporate bank model, encompassing segments like Commercial Bank and Consumer Bank. Despite being modestly overvalued with a GF Value of $14.79 and a current stock price of $17.335, KeyCorp maintains a solid market presence with a capitalization of $17.18 billion.

Impact of the Trade on State Street Corp's Portfolio

The recent acquisition of KeyCorp shares has bolstered State Street Corp's presence in the financial services sector, aligning with its strategic focus. Although the trade impact on the portfolio is minimal at 0%, the firm's significant stake in KeyCorp underscores a confident outlook on the bank's market performance and growth potential.

Market Performance and Valuation of KeyCorp

KeyCorp's current market valuation metrics reveal a PE Ratio of 22.51, indicating profitability but also suggesting a premium against its intrinsic value. The stock is currently seen as modestly overvalued with a price to GF Value ratio of 1.17. However, its year-to-date stock price increase of 18.65% reflects positive market sentiment.

Sector Influence and Competitive Positioning

State Street Corp's investment in KeyCorp is a strategic move within the financial services sector, where it holds a significant position. KeyCorp competes robustly in the banking industry, supported by its comprehensive service model and strategic market focus, which align with State Street Corp's investment criteria.

Comparative Analysis with Other Investment Gurus

Other notable investors like George Soros (Trades, Portfolio) and firms such as HOTCHKIS & WILEY also hold positions in KeyCorp, highlighting its appeal in the investment community. This collective interest from top investors may indicate a strong confidence in KeyCorp's market strategy and financial health.

Future Prospects and Strategic Initiatives of KeyCorp

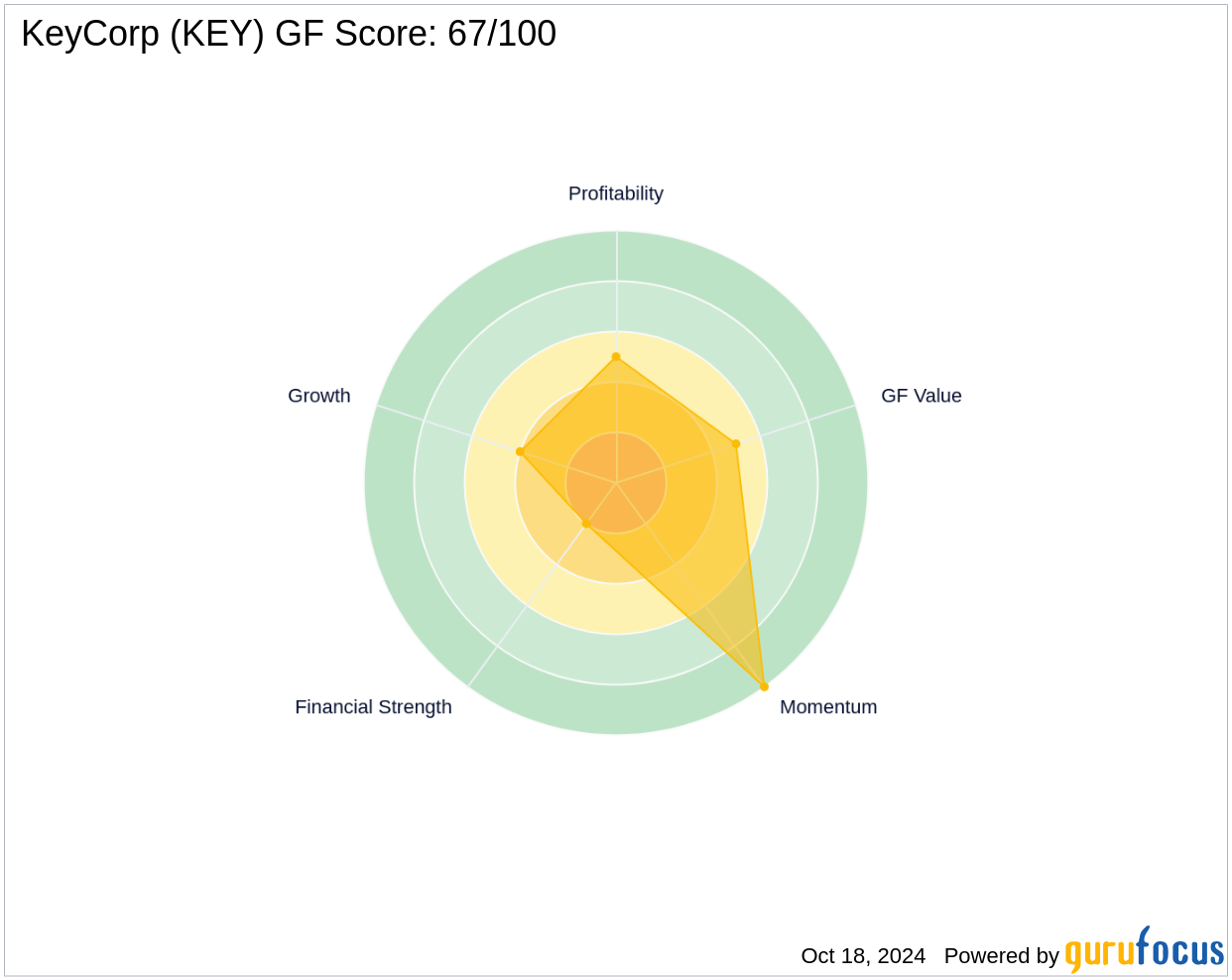

Looking ahead, KeyCorp's strategic initiatives aimed at enhancing client services and expanding market reach are expected to drive future growth. With a GF Score of 67/100, indicating a potential for average future performance, KeyCorp is positioned to maintain its competitive edge in the banking sector.

This strategic acquisition by State Street Corp not only enhances its portfolio but also positions both firms for potential growth in the evolving financial landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: