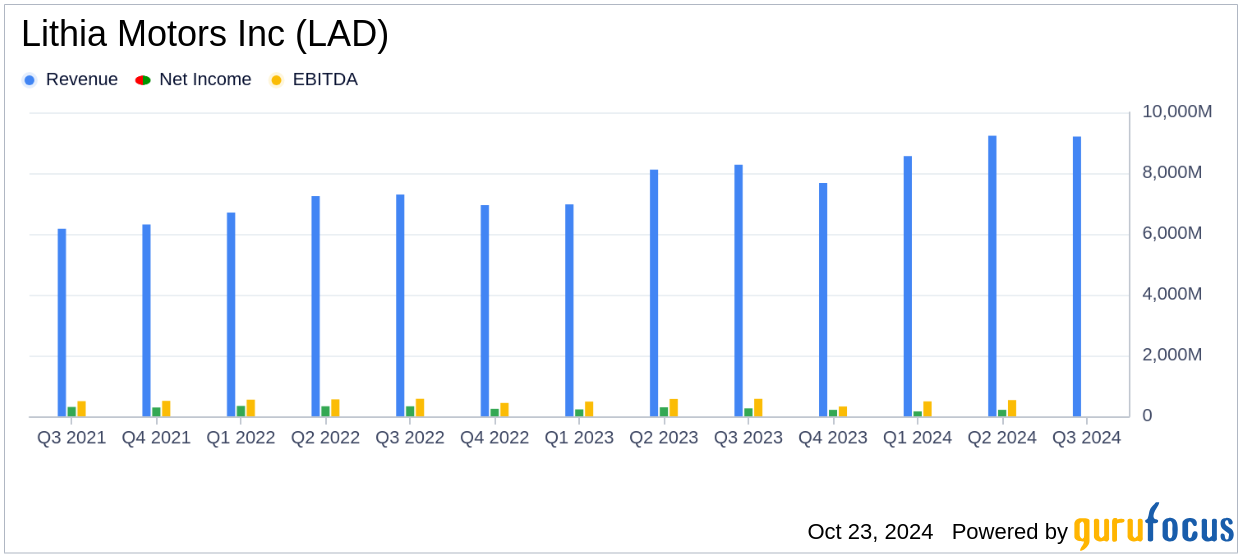

On October 23, 2024, Lithia Motors Inc (LAD, Financial) released its 8-K filing, reporting a record third-quarter revenue of $9.2 billion, marking an 11% increase from the previous year. However, the company's diluted earnings per share (EPS) fell to $7.80, an 18% decrease from the same period last year, missing the analyst estimate of $8.09.

Company Overview

Lithia Motors Inc (LAD, Financial) is a prominent retailer of new and used vehicles and related services, offering over 50 brands across nearly 500 stores globally, including the US, Canada, and the UK. Founded in 1946 and public since 1996, it is the largest auto dealer in the US, with a significant portion of its revenue derived from new-car sales. The company has been expanding through acquisitions and aims to increase its presence both domestically and internationally.

Performance and Challenges

While Lithia Motors Inc (LAD, Financial) achieved a notable revenue increase, the decline in EPS highlights challenges in maintaining profitability. The company's net income for the third quarter was $223 million, a 16% decrease from the previous year. Adjusted net income also saw a decline, dropping 14% to $222 million. These figures underscore the pressure on margins and the impact of non-core items, such as acquisition expenses and foreign currency exchange gains.

Financial Achievements and Industry Context

The company's revenue growth is significant in the Vehicles & Parts industry, where scale and operational efficiency are crucial. Lithia Motors Inc (LAD, Financial) continues to leverage its size and scale, as evidenced by the 6.3% increase in aftersales gross profit on a same-store basis. The company's financing operations also remained profitable, with Driveway Finance Corporation originating $518 million in loans.

Key Financial Metrics

Despite the revenue growth, Lithia Motors Inc (LAD, Financial) faced challenges in maintaining its gross profit margin, which decreased to 15.5% from 16.6% in the previous year. The company's operating profit as a percentage of revenue also declined to 4.6% from 5.5%. These metrics are critical as they reflect the company's ability to manage costs and sustain profitability in a competitive market.

Our third quarter performance was strong and demonstrated the team’s ability to grow our business, leveraging size and scale and seizing new opportunities while focusing on operational efficiency," said Bryan DeBoer, President and CEO.

Balance Sheet and Cash Flow

As of the end of the third quarter, Lithia Motors Inc (LAD, Financial) held approximately $1.1 billion in cash and cash equivalents, marketable securities, and available credit. The company also has unfinanced real estate that could provide additional liquidity of approximately $0.4 billion. These resources are vital for supporting ongoing operations and potential future acquisitions.

Dividend and Share Repurchases

The Board of Directors declared a dividend of $0.53 per share for the third quarter, payable on November 15, 2024. Additionally, the company repurchased approximately 986,000 shares during the year, with $560.9 million remaining under the current share repurchase authorization.

Analysis and Outlook

While Lithia Motors Inc (LAD, Financial) has demonstrated robust revenue growth, the decline in EPS and net income highlights the challenges of sustaining profitability amidst rising costs and competitive pressures. The company's strategic acquisitions and focus on operational efficiency are crucial for maintaining its market position and driving future growth. Investors will be keen to see how the company navigates these challenges in the coming quarters.

Explore the complete 8-K earnings release (here) from Lithia Motors Inc for further details.