Bank of the James Financial Group Inc (BOTJ, Financial) released its 8-K filing on October 25, 2024, announcing its financial results for the third quarter and first nine months of 2024. The company, a bank holding entity, offers a comprehensive range of banking services, including retail and commercial banking, mortgage brokerage, and investment advisory services.

Performance Overview

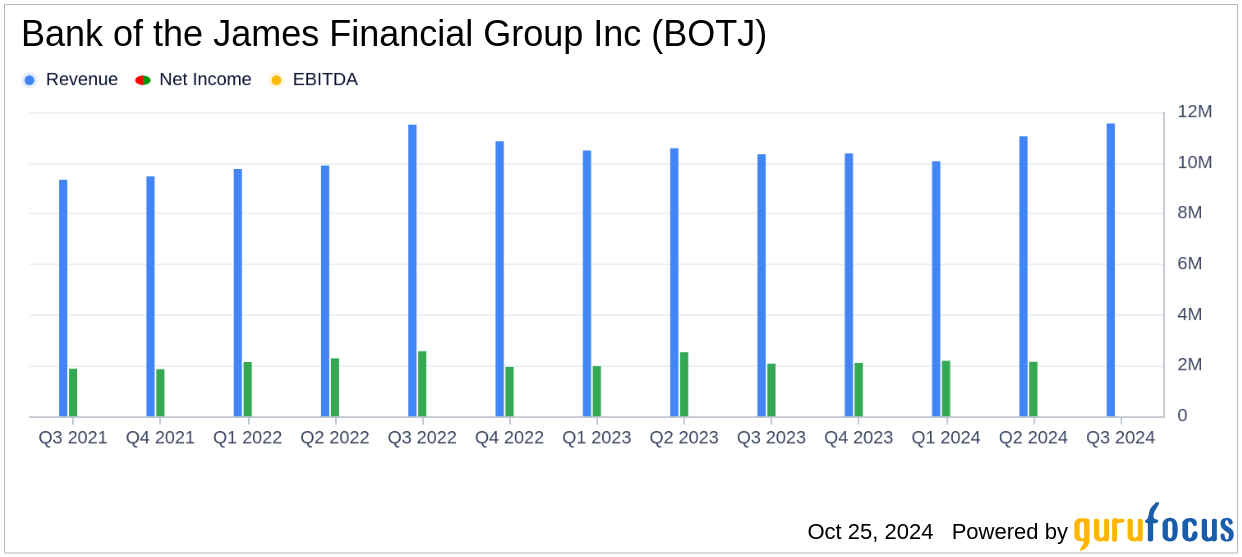

For the third quarter of 2024, Bank of the James Financial Group Inc reported a net income of $1.99 million, or $0.44 per share, slightly down from $2.08 million, or $0.46 per share, in the same period of 2023. Over the first nine months, net income was $6.33 million, compared to $6.60 million in the previous year. Despite the challenges posed by high interest rates, the company maintained stable earnings, reflecting strong interest expense management and diversified income streams.

Robert R. Chapman III, CEO of the Bank, commented: “The Company delivered stable, strong earnings that contributed to building value, growing stockholders’ equity, and a significant increase in book value per share. Our performance once again generated positive returns for shareholders, which have for many years included paying a quarterly cash dividend.”

Financial Achievements and Challenges

The company achieved significant loan growth, with total assets surpassing $1 billion, primarily driven by a $25 million increase in the loan portfolio. Total deposits also grew, with interest-bearing demand accounts increasing by $2.7 million. However, the high interest rate environment has pressured margins, with the net interest margin slightly decreasing to 3.16% from 3.21% in the previous year.

J. Todd Scruggs, Executive Vice President and CFO, noted: “Even before the Federal Reserve announced a 50 basis point reduction in rates, we anticipated that a stabilizing rate environment would gradually lessen the pressure on margins we have experienced.”

Income and Expense Analysis

Net interest income after provision for credit losses was $7.42 million for the third quarter, down from $7.53 million a year earlier. Total interest income increased to $11.56 million, reflecting adjustments to variable rate commercial loans. Noninterest income rose by 19% to $3.82 million, driven by wealth management fees and gains on mortgage loan sales. Noninterest expenses increased by 8% to $8.78 million, attributed to staffing new locations and performance-based compensation accruals.

Balance Sheet Highlights

As of September 30, 2024, total assets were $1.01 billion, up from $969.37 million at the end of 2023. Loans, net of allowance for credit losses, increased to $627.11 million, with commercial real estate loans showing notable growth. The company's asset quality remained strong, with a nonperforming loans ratio of 0.20%. Total deposits reached $907.61 million, supported by strategic location expansions and deposit-gathering initiatives.

| Metric | Q3 2024 | Q3 2023 | Change |

|---|---|---|---|

| Net Income | $1.99 million | $2.08 million | -4.23% |

| Net Interest Income | $7.42 million | $7.53 million | -1.46% |

| Noninterest Income | $3.82 million | $3.20 million | +19.38% |

| Total Assets | $1.01 billion | $969.37 million | +4.18% |

Conclusion

Bank of the James Financial Group Inc's performance in the third quarter of 2024 demonstrates resilience in a challenging interest rate environment. The company's strategic focus on loan growth, deposit expansion, and maintaining high asset quality has positioned it well for future stability and growth. As interest rates stabilize, the company anticipates gradual improvements in margins, supporting its long-term value creation for shareholders.

Explore the complete 8-K earnings release (here) from Bank of the James Financial Group Inc for further details.