On October 29, 2024, American Tower Corp (AMT, Financial) released its 8-K filing detailing its financial performance for the third quarter of 2024. The company, which owns and operates over 220,000 cell towers globally and 28 data centers in the U.S., reported a slight increase in total revenue but a significant net loss, primarily due to the divestiture of its Indian operations.

Company Overview

American Tower Corp (AMT, Financial) is a leading global REIT that owns and operates a vast portfolio of communications infrastructure, including over 220,000 cell towers across the U.S., Asia, Latin America, Europe, and Africa. The company also manages 28 data centers in 10 U.S. markets following its acquisition of CoreSite. With a concentrated customer base, American Tower generates most of its revenue from top mobile carriers in each market.

Performance and Challenges

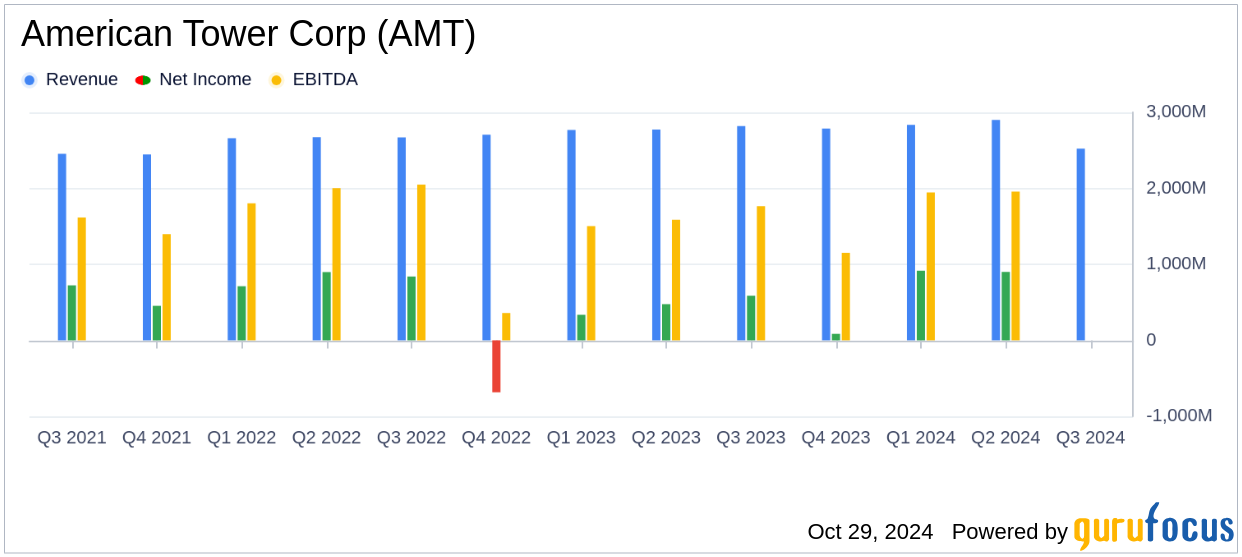

For the third quarter of 2024, American Tower reported total revenue of $2,522 million, a marginal increase of less than 0.1% compared to the previous year. However, the company faced a net loss of $780 million, a stark contrast to the previous year's performance, largely due to a $1.2 billion loss from the sale of its Indian operations. This divestiture was part of a strategic move to streamline operations but significantly impacted the company's financial results.

Financial Achievements and Industry Context

Despite the challenges, American Tower's Adjusted Funds From Operations (AFFO) attributable to common stockholders increased by 2.6% to $1,237 million. This metric is crucial for REITs as it reflects the company's ability to generate cash flow from operations, which is essential for sustaining dividends and funding growth.

Key Financial Metrics

The company's Adjusted EBITDA decreased by 0.9% to $1,687 million, with an Adjusted EBITDA margin of 66.9%. The net leverage ratio stood at 5.2x, indicating a moderate level of debt relative to earnings. Cash provided by operating activities increased by 13% to $1,469 million, highlighting strong operational cash flow despite the net loss.

| Metric | Q3 2024 | Growth Rate |

|---|---|---|

| Total Revenue | $2,522 million | 0.0% |

| Net Loss | $(780) million | (235.2)% |

| Adjusted EBITDA | $1,687 million | (0.9)% |

| AFFO | $1,237 million | 2.6% |

Analysis and Commentary

Steven Vondran, American Tower’s Chief Executive Officer, commented on the results, stating,

Adjusted for certain non-cash items in the quarter, including the loss taken upon closing our ATC India sale, our third quarter results continue to reflect the unabating demand for our global portfolio of communications infrastructure assets."This statement underscores the company's focus on long-term growth and strategic realignment despite short-term financial setbacks.

Conclusion

American Tower Corp (AMT, Financial) faces a challenging landscape with its recent divestiture impacting short-term financial results. However, the company's strategic focus on enhancing its portfolio and driving cost efficiencies positions it for potential future growth. Investors will be keen to see how these strategies unfold in the coming quarters, particularly in light of ongoing 5G rollouts and increasing demand for data center services.

Explore the complete 8-K earnings release (here) from American Tower Corp for further details.