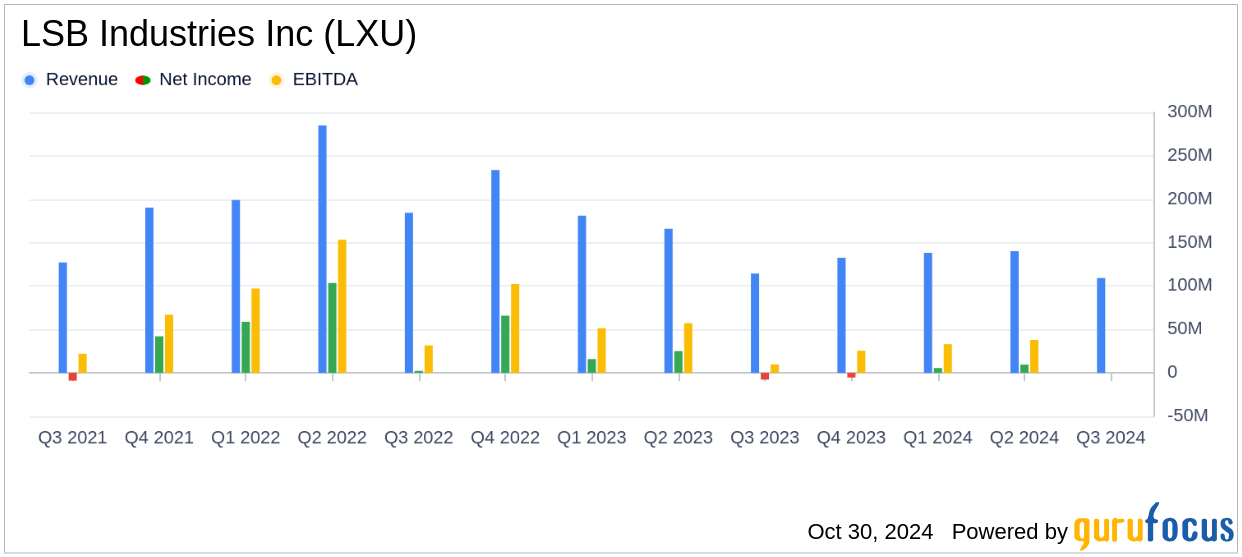

On October 29, 2024, LSB Industries Inc (LXU, Financial) released its 8-K filing detailing the financial results for the third quarter ended September 30, 2024. LSB Industries Inc, a key player in the manufacturing and sale of chemical products in the United States, reported net sales of $109.2 million, surpassing the analyst estimate of $95.86 million. However, the company faced a net loss of $25.4 million, significantly higher than the $7.7 million loss reported in the same quarter of 2023.

Company Overview and Market Position

LSB Industries Inc is engaged in the production and sale of chemical products for agricultural, industrial, and mining markets. Its product portfolio includes ammonia, fertilizer-grade ammonium nitrate, and urea ammonia nitrate for agricultural applications, as well as various industrial chemicals. The company's products are distributed throughout the United States and North America.

Performance and Challenges

The third quarter results reflect a challenging operational environment, with a net loss driven by approximately $16.3 million in turnaround costs and $5.6 million in one-time non-cash charges related to asset write-downs. Despite these setbacks, LSB Industries Inc achieved an adjusted EBITDA of $17.5 million, a notable increase from $9.2 million in the previous year. This improvement was attributed to higher ammonia prices and lower natural gas costs, which offset the impact of planned maintenance activities.

Financial Achievements and Industry Implications

LSB Industries Inc's financial achievements are significant in the context of the chemicals industry, where pricing and cost management are critical. The company's ability to increase adjusted EBITDA highlights its operational resilience and strategic focus on optimizing production and sales volumes. The investments in the Pryor facility, aimed at enhancing reliability and expanding UAN capacity, are expected to yield long-term benefits.

Key Financial Metrics

Key financial metrics from the income statement include net sales of $109.2 million, a gross loss of $7.9 million, and a diluted EPS of $(0.35). The balance sheet reported total cash of approximately $199.4 million and total debt of approximately $487.0 million as of September 30, 2024. Cash flow from operations was $17.1 million, with capital expenditures amounting to $31.0 million, reflecting investments in facility upgrades.

| Metric | Q3 2024 | Q3 2023 | % Change |

|---|---|---|---|

| Net Sales ($ in Thousands) | 109,217 | 114,287 | -4% |

| Net Loss ($ in Thousands) | (25,382) | (7,726) | -228% |

| Adjusted EBITDA ($ in Thousands) | 17,500 | 9,200 | 90% |

Analysis and Market Outlook

LSB Industries Inc's performance in the third quarter underscores the importance of strategic investments and operational efficiency in navigating industry challenges. The company's focus on expanding production capacity and optimizing its sales mix positions it well for future growth. The market outlook remains positive, with stable demand for industrial products and strong pricing dynamics in the ammonia market.

We delivered a strong increase in adjusted EBITDA relative to the third quarter of last year," stated Mark Behrman, LSB Industries' Chairman, President and CEO. "The year-over-year improvement was driven by higher ammonia prices coupled with lower natural gas prices compared to a year ago and an increase in industrial product production and sales."

Overall, LSB Industries Inc's third quarter results reflect a mix of challenges and opportunities, with strategic initiatives aimed at enhancing production capabilities and capitalizing on market dynamics. The company's commitment to safety and operational excellence remains a cornerstone of its strategy, as it continues to invest in growth and innovation.

Explore the complete 8-K earnings release (here) from LSB Industries Inc for further details.