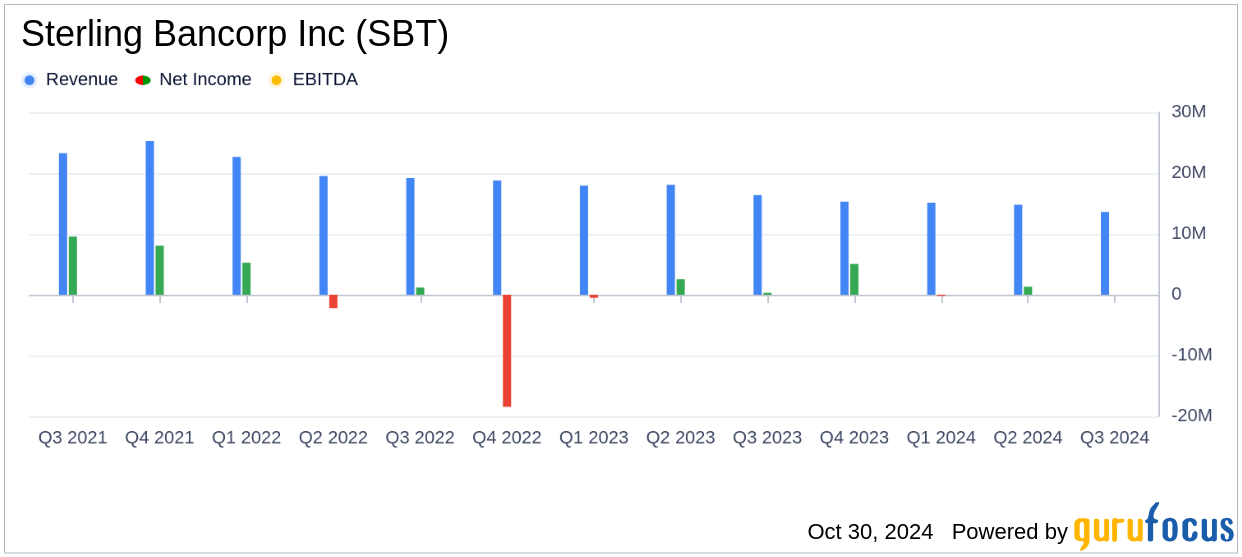

Sterling Bancorp Inc (SBT, Financial) released its 8-K filing on October 30, 2024, detailing its financial performance for the third quarter ended September 30, 2024. The company reported a net loss of $0.1 million, or $0.00 per diluted share, falling short of the analyst estimate of $0.03 earnings per share. Revenue for the quarter was $13.6 million, also below the estimated $14.81 million.

Company Overview

Sterling Bancorp Inc is a unitary thrift holding company primarily operating through its wholly-owned subsidiary, Sterling Bank. The bank offers a variety of loan products and retail banking services, including savings and current accounts, demand and term deposits, payment cards, and more. It serves residential and commercial markets with products such as construction loans, residential and commercial real estate loans, and consumer loans.

Performance and Challenges

The third quarter of 2024 was challenging for Sterling Bancorp Inc, as it reported a net loss compared to a net income of $1.3 million in the previous quarter. The company's net interest margin decreased to 2.30% from 2.44% in the second quarter, reflecting increased interest expenses. Nonperforming loans rose to $13.2 million, representing 1.08% of total loans, indicating potential asset quality concerns.

Financial Achievements and Industry Context

Despite the challenges, Sterling Bancorp Inc maintained a strong capital position with a consolidated leverage ratio of 14.18%. Total deposits increased by 3% to $2.1 billion, demonstrating the company's ability to attract and retain customer deposits. The provision for credit losses was a recovery of $2.3 million, highlighting effective credit risk management.

Key Financial Metrics

| Metric | Q3 2024 | Q2 2024 |

|---|---|---|

| Net Income (Loss) | $(0.1) million | $1.3 million |

| Net Interest Income | $13.6 million | $14.4 million |

| Net Interest Margin | 2.30% | 2.44% |

| Total Deposits | $2.1 billion | $2.0 billion |

Analysis and Strategic Developments

The company's strategic decision to enter into a definitive stock purchase agreement with EverBank Financial Corp for the sale of Sterling Bank is a significant development. This transaction, valued at $261.0 million, is expected to close in the first quarter of 2025, subject to regulatory approvals and shareholder consent. This move could potentially reshape Sterling Bancorp Inc's future operations and financial structure.

The Transaction is expected to close in the first quarter of 2025, subject to customary closing conditions, including the approval of the definitive stock purchase agreement, the Transaction, and the plan of dissolution by the requisite vote of the Company’s shareholders and the receipt of required regulatory approvals."

Overall, while Sterling Bancorp Inc faces near-term challenges, its strategic initiatives and strong capital position may provide a foundation for future growth and stability in the banking sector.

Explore the complete 8-K earnings release (here) from Sterling Bancorp Inc for further details.