On September 30, 2024, Dimensional Fund Advisors LP made a significant adjustment to its investment in The Aarons Co Inc (AAN, Financial), marking a notable shift in its portfolio. The firm reduced its holdings by 1,349,017 shares, resulting in a new total of 256,116 shares valued at a trading price of $9.95 per share. This transaction reflects a substantial decrease of 84.04% in the firm's position, underscoring a strategic realignment of its investment in AAN.

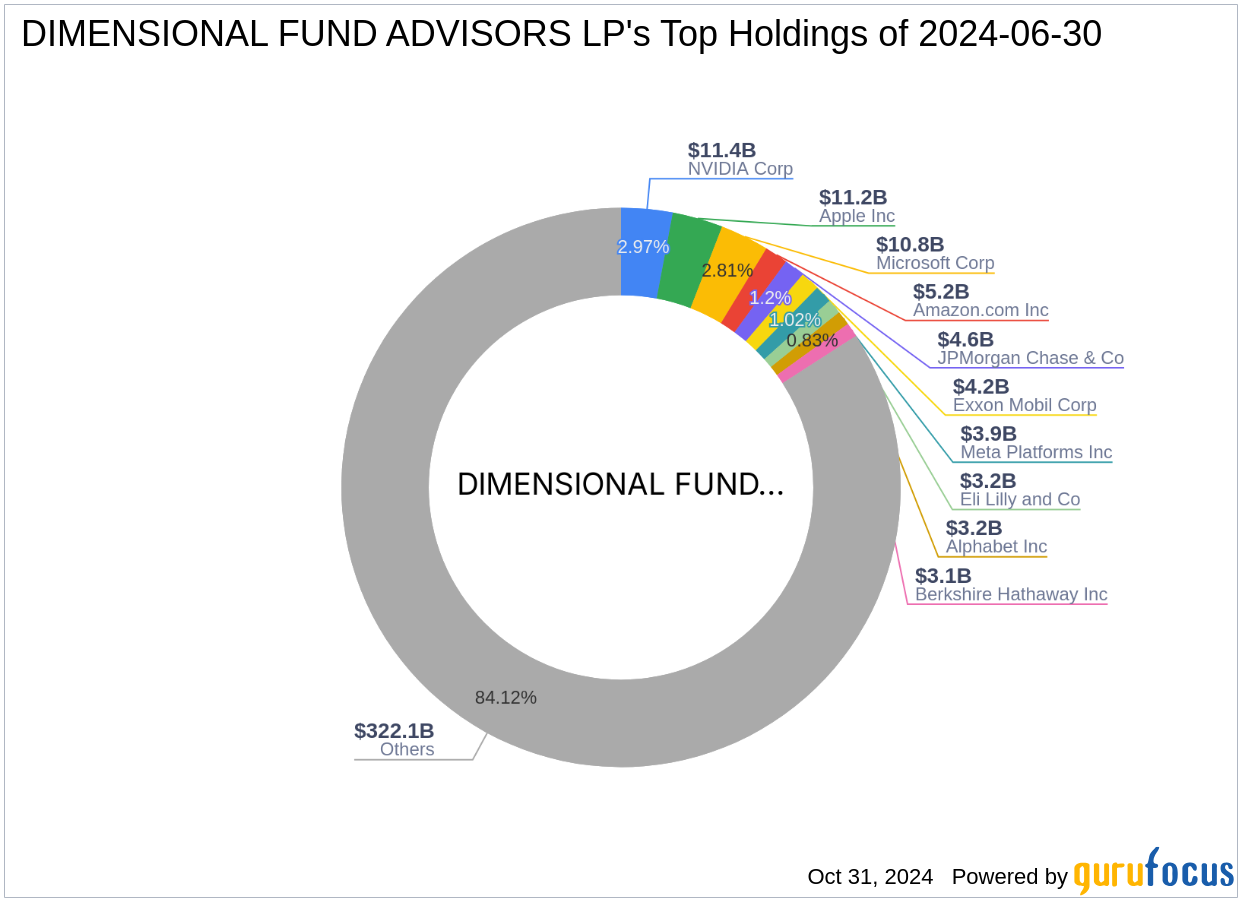

Profile of Dimensional Fund Advisors LP

Founded in 1981 by David G. Booth and Rex Sinquefield, Dimensional Fund Advisors LP has grown into a prominent financial entity with a focus on applying academic research to practical investment strategies. The firm manages approximately $382.85 billion in assets, emphasizing a dynamic market-driven process across diverse sectors, with technology and financial services being the most significant. Dimensional's approach combines flexibility in trading with a rigorous focus on market premiums, diversification, and cost-efficiency, benefiting from insights by renowned economists like Eugene Fama and Kenneth French.

Understanding The Aarons Co Inc

The Aarons Co Inc, listed under the ticker AAN, operates a specialized lease-to-own retail model in the United States. Since its IPO on November 25, 2020, the company has offered products ranging from furniture to electronics, primarily through its Aaron's Business and BrandsMart segments. Despite a challenging market, reflected by a current market capitalization of $318.347 million and a stock price of $10.09, AAN remains modestly undervalued with a GF Value of $11.89.

Portfolio Impact and Market Response

The reduction in AAN shares by Dimensional Fund Advisors LP has left the stock constituting a mere 0.80% of its total portfolio, a significant decrease that might signal a strategic shift or a response to the stock's performance metrics. Following the transaction, AAN's stock price showed a slight increase of 1.41%, indicating a mild market reaction to the sell-off.

Comparative Sector Analysis

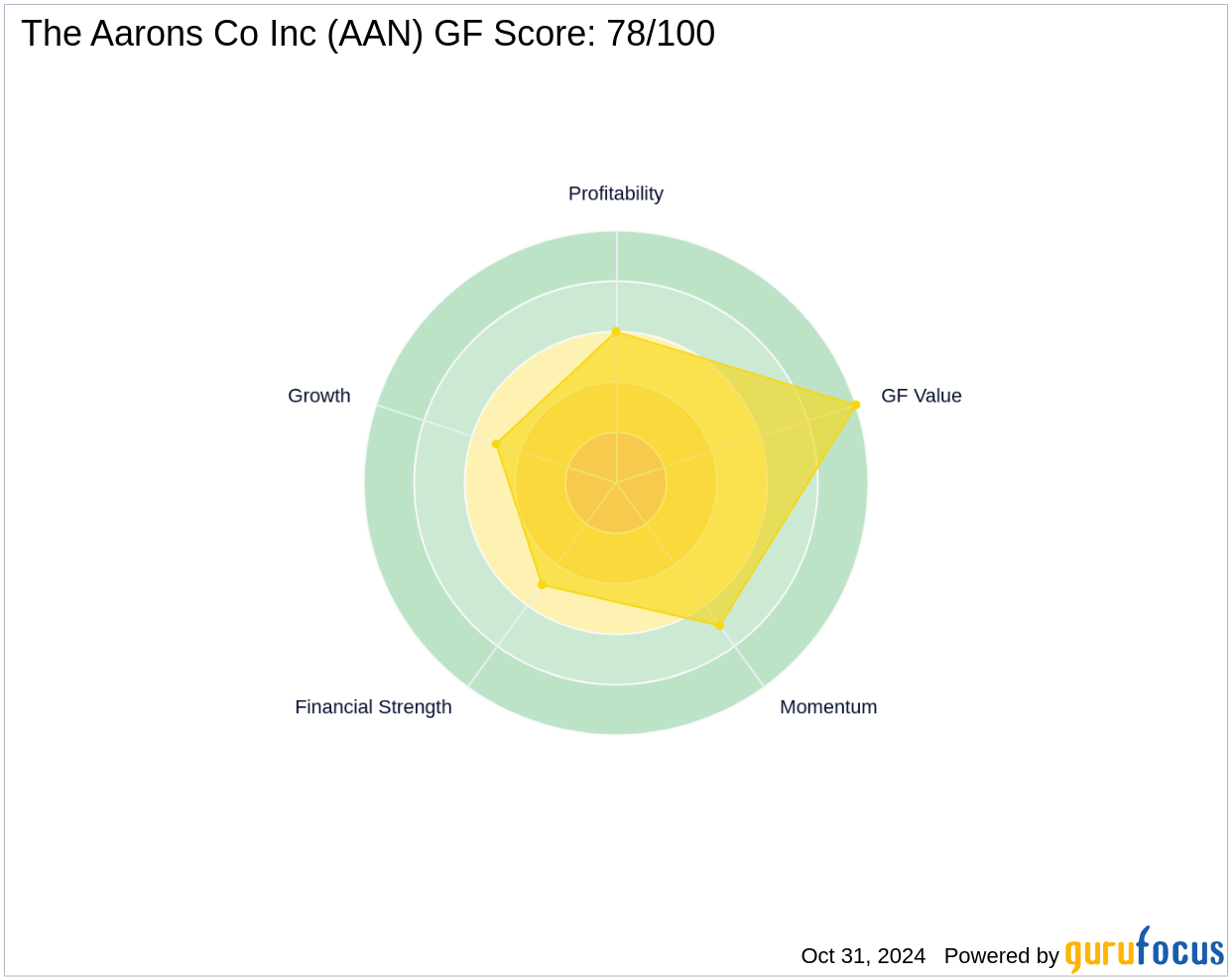

AAN operates within the competitive Business Services sector. The company's performance, including a GF Score of 78, suggests a potential for average market performance. However, challenges such as a negative return on equity (ROE) of -6.21% and a return on assets (ROA) of -2.37% highlight areas of concern. The firm's strategic reduction in AAN could be a response to these underlying financial metrics and sectoral trends.

Insights from Other Major Shareholders

While Dimensional Fund Advisors LP has scaled back its investment, other significant shareholders like Hotchkis & Wiley Capital Management LLC and Mario Gabelli (Trades, Portfolio) maintain their stakes. This diversity in shareholder confidence could indicate varying expectations of AAN's financial health and market trajectory.

Future Prospects for The Aarons Co Inc

Looking ahead, The Aarons Co Inc faces both challenges and opportunities. Analysts will be watching closely to see if the company can leverage its business model to navigate the tough retail environment and improve its financial standings. For Dimensional Fund Advisors LP, the decision to reduce its stake might be part of a broader strategy to optimize its portfolio performance amidst evolving market conditions.

This transaction underscores the dynamic nature of investment strategies in response to shifting market performances and sectoral developments. Investors and market watchers will undoubtedly keep a close eye on Dimensional Fund Advisors LP's future moves and The Aarons Co Inc's response to its operational challenges.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.