On October 31, 2024, Nine Energy Service Inc (NINE, Financial) released its 8-K filing detailing the financial results for the third quarter of 2024. The company, a North American onshore completion and production services provider, reported revenues of $138.2 million, exceeding its own guidance range of $127.0 to $137.0 million. However, the company posted a net loss of $10.1 million, or $0.26 per diluted share, missing the analyst estimate of -$0.09 per share.

Company Overview

Nine Energy Service Inc focuses on unconventional oil and gas resource development, operating primarily in the Completion Solutions segment. This segment provides a range of services including cementing, completion tools, and other related services across the U.S., Canada, and other international markets, with the majority of revenue generated in the United States.

Performance and Challenges

Despite a declining average U.S. rig count, Nine Energy Service Inc managed to increase its revenue by approximately 4% quarter-over-quarter. This growth was largely driven by market share gains in its cementing division, which saw a 12% revenue increase over the previous quarter. However, the company faces challenges due to fluctuating commodity prices and low activity levels in certain basins, such as the Northeast and Haynesville, which impact all service lines.

Financial Achievements

The company's ability to outperform its revenue guidance is a significant achievement, especially in the volatile oil and gas industry. This performance underscores Nine Energy Service Inc's strategic focus on market share expansion and operational efficiency, particularly in its cementing operations.

Key Financial Metrics

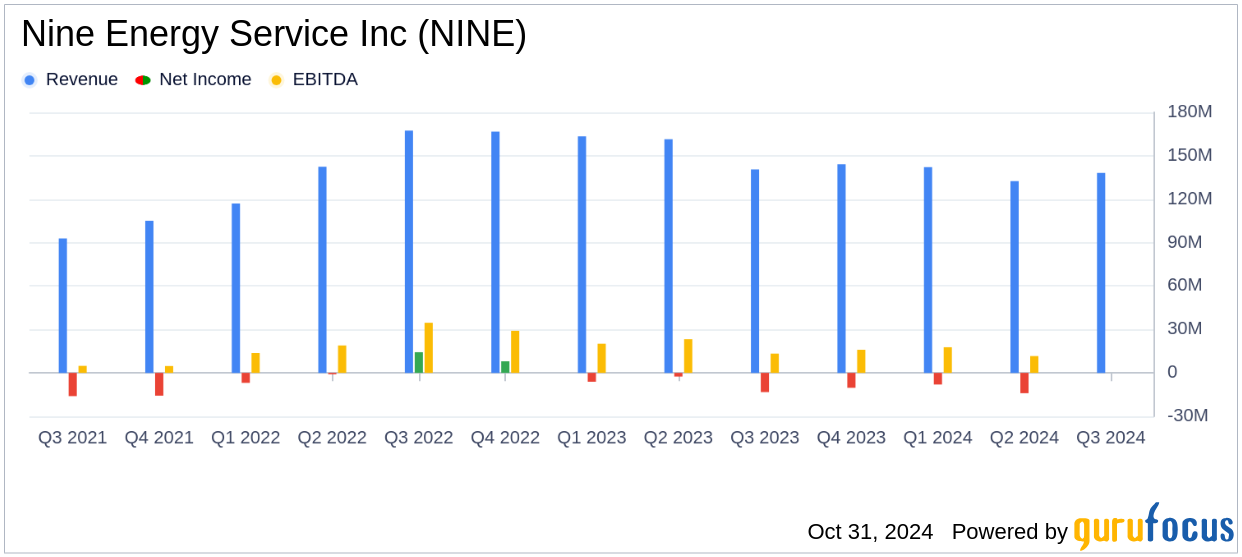

During Q3 2024, Nine Energy Service Inc reported a gross profit of $16.1 million and an adjusted EBITDA of $14.3 million. The company's adjusted gross profit was $24.7 million, reflecting its efforts to manage costs effectively. The return on invested capital (ROIC) was reported at -14.7%, with an adjusted ROIC of 3.9%, highlighting the company's ongoing challenges in achieving profitability.

| Metric | Q3 2024 | Q2 2024 |

|---|---|---|

| Revenue | $138.2 million | $132.4 million |

| Net Loss | $(10.1) million | $(14.0) million |

| Adjusted EBITDA | $14.3 million | $9.7 million |

Analysis and Outlook

Nine Energy Service Inc's performance in Q3 2024 demonstrates resilience in a challenging market environment. The company's strategic focus on cementing services and cost-saving initiatives have contributed to its revenue growth. However, the ongoing volatility in commodity prices and low activity levels in certain regions pose significant challenges. The company's liquidity position, with $15.7 million in cash and $27.6 million available under its revolving credit facility, provides some financial flexibility.

“Nine outperformed market drivers this quarter due in large part to market share gains across operating basins in our cementing division,” said Ann Fox, President and CEO of Nine Energy Service.

Looking ahead, Nine Energy Service Inc remains optimistic about the demand for oil and natural gas, with potential for increased activity in 2025 if commodity prices stabilize and customer budgets reset. The company's asset-light business model and focus on technology and service offerings position it well to capitalize on future market improvements.

Explore the complete 8-K earnings release (here) from Nine Energy Service Inc for further details.