Koss Corp (KOSS, Financial) released its 8-K filing on October 31, 2024, detailing the financial results for the first quarter ended September 30, 2024. The company, known for its high-fidelity headphones and audio products, reported a decline in net sales and an increase in net losses compared to the same period last year.

Company Overview

Koss Corp is a prominent player in the audio/video industry, specializing in the design, manufacture, and sale of stereo headphones and related accessories. The company offers a diverse range of products, including wireless Bluetooth headphones, speakers, computer headsets, and active noise-canceling headphones. A significant portion of its revenue is generated from stereo headphone sales.

Performance and Challenges

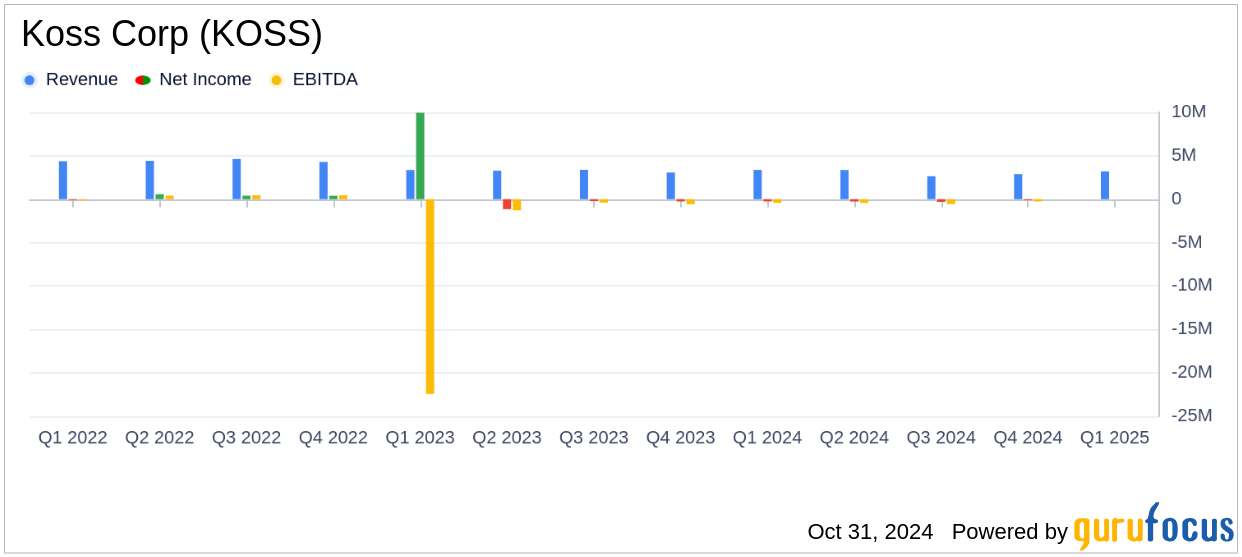

For the first quarter of fiscal year 2025, Koss Corp reported net sales of $3.20 million, a 5.1% decrease from $3.37 million in the same quarter of the previous year. The company also experienced a net loss of $419,535, compared to a net loss of $257,609 in the prior year. This resulted in a basic and diluted loss per share of $0.05, up from $0.03 last year.

The decline in sales was attributed to reduced orders from domestic distributors and a drop in sales to Education and Music customers. However, the launch of the Porta Pro Wireless 2.0 in September 2024 helped boost sales to European distributors by over 30% and increased Direct-to-Consumer (DTC) sales, particularly through Amazon.

Financial Achievements

Despite the challenges, Koss Corp achieved a notable improvement in gross margins, which rose to 36.6% from 31.6% a year ago. This was driven by a favorable mix of customer and product sales, with higher margins on new product sales and increased DTC sales volume.

“Sales to our domestic distributors were down versus the prior year mainly due to timing of orders. We also saw a decline in sales to our Education and Music customers,” said Michael J. Koss, Chairman and CEO. “Backed by the launch of the next generation Porta Pro Wireless 2.0, sales to our two largest European distributors surpassed last year’s levels by over 30%.”

Key Financial Metrics

| Metric | Q1 2024 | Q1 2023 |

|---|---|---|

| Net Sales | $3,201,868 | $3,373,938 |

| Gross Profit | $1,172,926 | $1,067,690 |

| Net Loss | $(419,535) | $(257,609) |

| Loss Per Share | $(0.05) | $(0.03) |

Analysis and Outlook

The financial results highlight the challenges Koss Corp faces in maintaining sales momentum amidst fluctuating demand from different customer segments. The improvement in gross margins is a positive sign, indicating effective cost management and strategic product launches. However, the increased net loss underscores the need for the company to address operational inefficiencies and adapt to changing market dynamics.

Looking ahead, Koss Corp's focus on expanding its product line and enhancing its DTC sales channels could provide a pathway to improved financial performance. The company is also monitoring supply chain disruptions and freight cost increases, which could impact future profitability.

Explore the complete 8-K earnings release (here) from Koss Corp for further details.