Overview of the Recent Transaction

On September 30, 2024, Vanguard Group Inc, a prominent investment management firm, executed a significant transaction by acquiring 1,998,822 shares of Resources Connection Inc (RGP, Financial). This move is part of Vanguard's strategy to diversify and strengthen its portfolio. The shares were purchased at a price of $9.70 per share, reflecting a proactive approach in capitalizing on market opportunities.

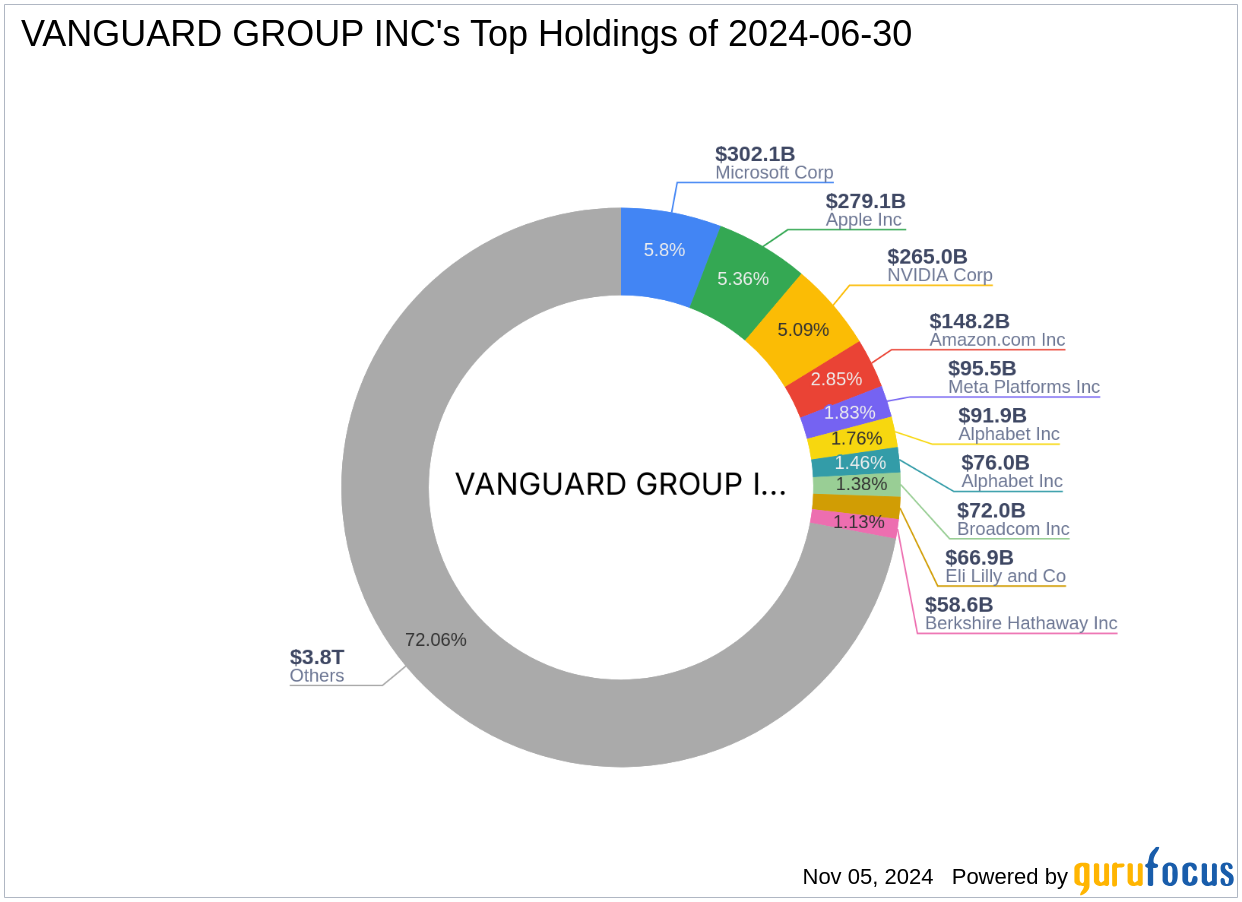

Profile of Vanguard Group Inc

Founded in 1975 by John C. Bogle, Vanguard Group Inc has grown into one of the world's leading investment management companies. The firm is renowned for its low-cost mutual funds and ETFs, and its unique client-owned structure, which aligns its interests with those of its investors. Vanguard's investment philosophy emphasizes long-term, cost-effective investment solutions, making it a trusted choice for over 20 million clients globally.

Introduction to Resources Connection Inc

Resources Connection Inc, trading under the symbol RGP, operates primarily through its subsidiary, Resources Global Professionals. The company offers consulting and business initiative support services, focusing on operational needs and change initiatives. With a significant portion of its revenue generated in North America, RGP also has a presence in Europe and the Asia-Pacific region, catering to a diverse client base.

Financial and Market Analysis of Resources Connection Inc

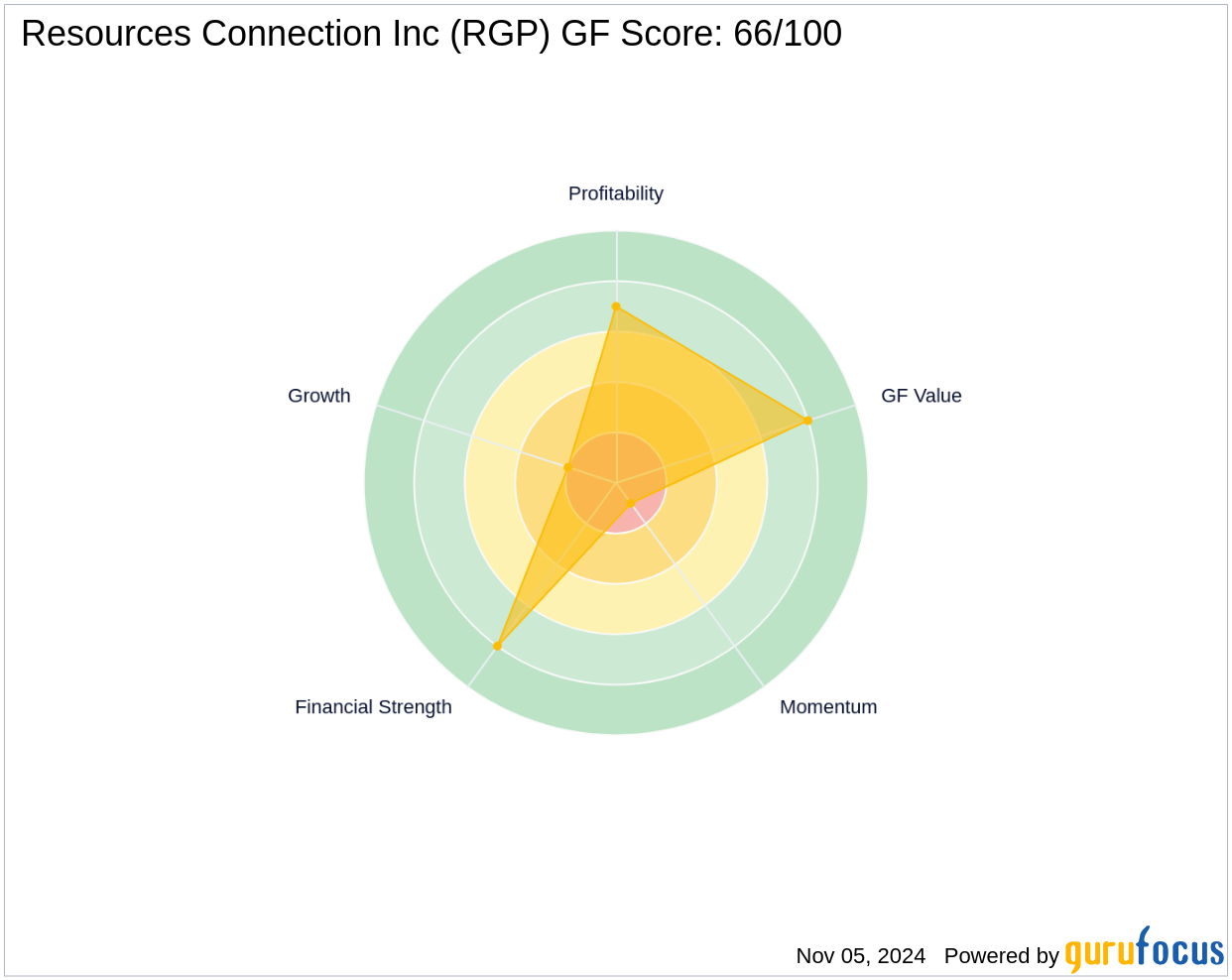

As of the latest data, Resources Connection Inc has a market capitalization of approximately $267.436 million, with a current stock price of $7.99. Despite being significantly undervalued with a GF Value of $12.35, the stock has experienced a year-to-date price decrease of 43.61%. The company holds a PE Ratio of 22.19, indicating its earnings relative to its share price.

Impact of the Trade on Vanguard’s Portfolio

The recent acquisition of RGP shares by Vanguard represents a strategic addition to its diverse portfolio. Although the exact percentage impact on Vanguard's portfolio is minimal, the addition of these shares aligns with Vanguard's strategy of investing in undervalued stocks with potential for appreciation.

Sector and Market Considerations

Vanguard's top sectors include Technology and Financial Services, with major holdings in giants like Apple Inc and Microsoft Corp. The addition of RGP, a Business Services sector company, diversifies Vanguard's portfolio beyond its traditional top sector holdings, potentially mitigating sector-specific risks and capitalizing on growth opportunities in the consulting and business services arena.

Performance Metrics and Valuation of RGP

Resources Connection Inc has a GF Score of 66/100, suggesting moderate future performance potential. The company's financial strength is solid, with a Balance Sheet Rank of 8/10 and a Profitability Rank of 7/10. However, its Growth Rank is relatively low at 2/10, indicating some challenges in revenue and earnings growth.

Conclusion

Vanguard Group Inc's recent acquisition of shares in Resources Connection Inc reflects a calculated move to enhance its portfolio with a potentially undervalued stock. This transaction not only diversifies Vanguard's holdings but also positions it to benefit from any upward valuation adjustments in RGP's market segment. As the market dynamics evolve, the strategic significance of this investment may become increasingly apparent, potentially yielding favorable returns for Vanguard's investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.