On November 8, 2024, Clarus Corp (CLAR, Financial) released its 8-K filing detailing its financial results for the third quarter of 2024. The company, known for its outdoor equipment and lifestyle products, reported a decline in sales and earnings, reflecting ongoing market challenges and strategic adjustments.

Company Overview

Clarus Corp is a prominent designer, developer, manufacturer, and distributor of outdoor equipment and lifestyle products. The company operates through two main segments: Outdoor, which includes brands like Black Diamond Equipment and PIEPS, and Adventure, which encompasses Rhino-Rack, MAXTRAX, and TRED. These segments focus on providing innovative products for climbing, skiing, mountaineering, and automotive accessories.

Financial Performance and Challenges

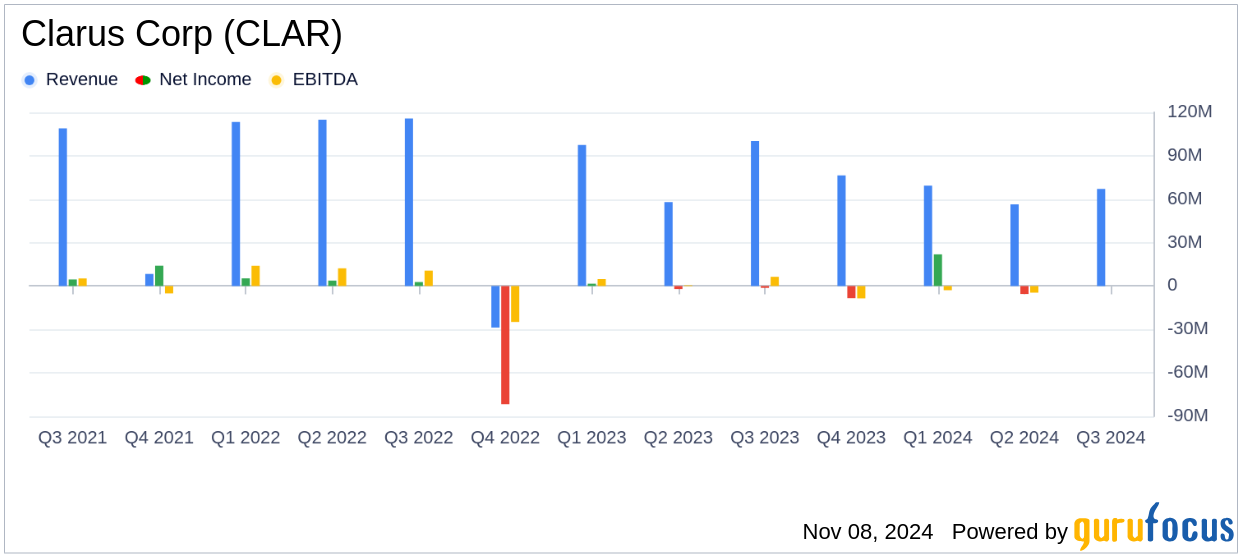

In the third quarter of 2024, Clarus Corp reported sales of $67.1 million, falling short of the analyst estimate of $73.01 million. This represents a significant decrease from $81.3 million in the same quarter last year. The decline was attributed to reduced consumer demand and strategic product line simplifications, particularly affecting the Outdoor segment.

Executive Chairman Warren Kanders commented on the situation, stating,

While macroeconomic headwinds have continued to limit consumer demand in the near-term, our focus in the third quarter was on advancing our strategic plan to position Clarus for long-term profitable growth."

Financial Achievements and Industry Context

Despite the challenges, Clarus Corp achieved a gross margin of 35.0%, up from 33.6% in the previous year, due to favorable product and channel mix. This improvement is crucial in the Travel & Leisure industry, where maintaining profitability amidst fluctuating demand is vital.

Key Financial Metrics

The company's adjusted income from continuing operations was $1.9 million, or $0.05 per diluted share, consistent with the previous year. However, the adjusted EBITDA margin decreased to 3.6% from 4.5%, indicating pressure on operational efficiency.

| Metric | Q3 2024 | Q3 2023 |

|---|---|---|

| Total Sales | $67.1 million | $81.3 million |

| Gross Margin | 35.0% | 33.6% |

| Adjusted EBITDA Margin | 3.6% | 4.5% |

Analysis and Outlook

Clarus Corp's performance reflects the broader challenges in the outdoor and adventure markets, exacerbated by macroeconomic factors. The company's strategic focus on inventory quality and SKU rationalization is a positive step towards long-term growth, but the immediate impact on sales is evident.

Looking ahead, Clarus Corp has adjusted its fiscal year 2024 sales expectations to between $260 million and $266 million, with an anticipated adjusted EBITDA of $7 million to $9 million. The company's debt-free balance sheet provides a solid foundation for future investments and strategic initiatives.

For more detailed insights and analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Clarus Corp for further details.