Overview of Recent Transaction

On November 8, 2024, the investment firm led by Carl Icahn (Trades, Portfolio) added 55,552 shares to its existing stake in CVR Partners LP (UAN, Financial), a notable player in the nitrogen fertilizer industry. This transaction, executed at a price of $68.86 per share, increased the firm's total holdings in UAN to 3,947,552 shares. This move not only reflects a significant commitment to CVR Partners but also impacts the firm's portfolio with a 0.04% increase in its overall composition.

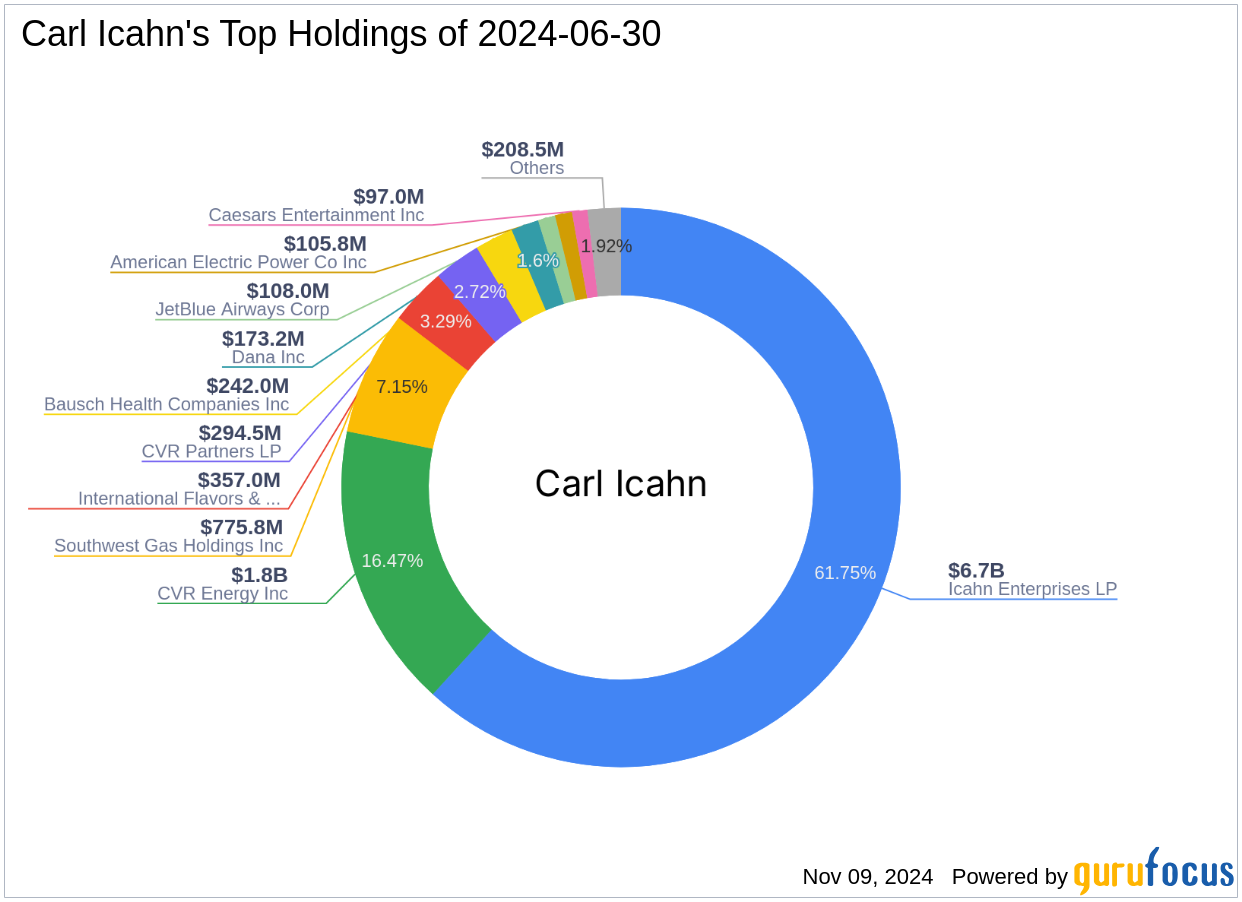

Carl Icahn (Trades, Portfolio)'s Investment Profile

Carl Icahn (Trades, Portfolio), renowned for his activist investment approach, manages assets through various vehicles including Icahn Partners and Icahn Management LP. The firm specializes in acquiring substantial positions in undervalued companies and pushing for strategic changes to unlock value. With a portfolio equity of $10.84 billion, Icahn's top holdings include Icahn Enterprises LP (IEP, Financial), CVR Energy Inc (CVI, Financial), and now, CVR Partners LP (UAN, Financial), among others. The firm's investment philosophy centers on contrarian bets in out-of-favor sectors or companies.

Details of the Trade Action

The recent acquisition of shares in CVR Partners LP has bolstered Icahn's position in the company, bringing the ownership to an impressive 37.35% of the total shares outstanding. This strategic addition underscores the firm's confidence in CVR Partners' potential and aligns with Icahn's history of deep involvement in the operational facets of the businesses in which it invests.

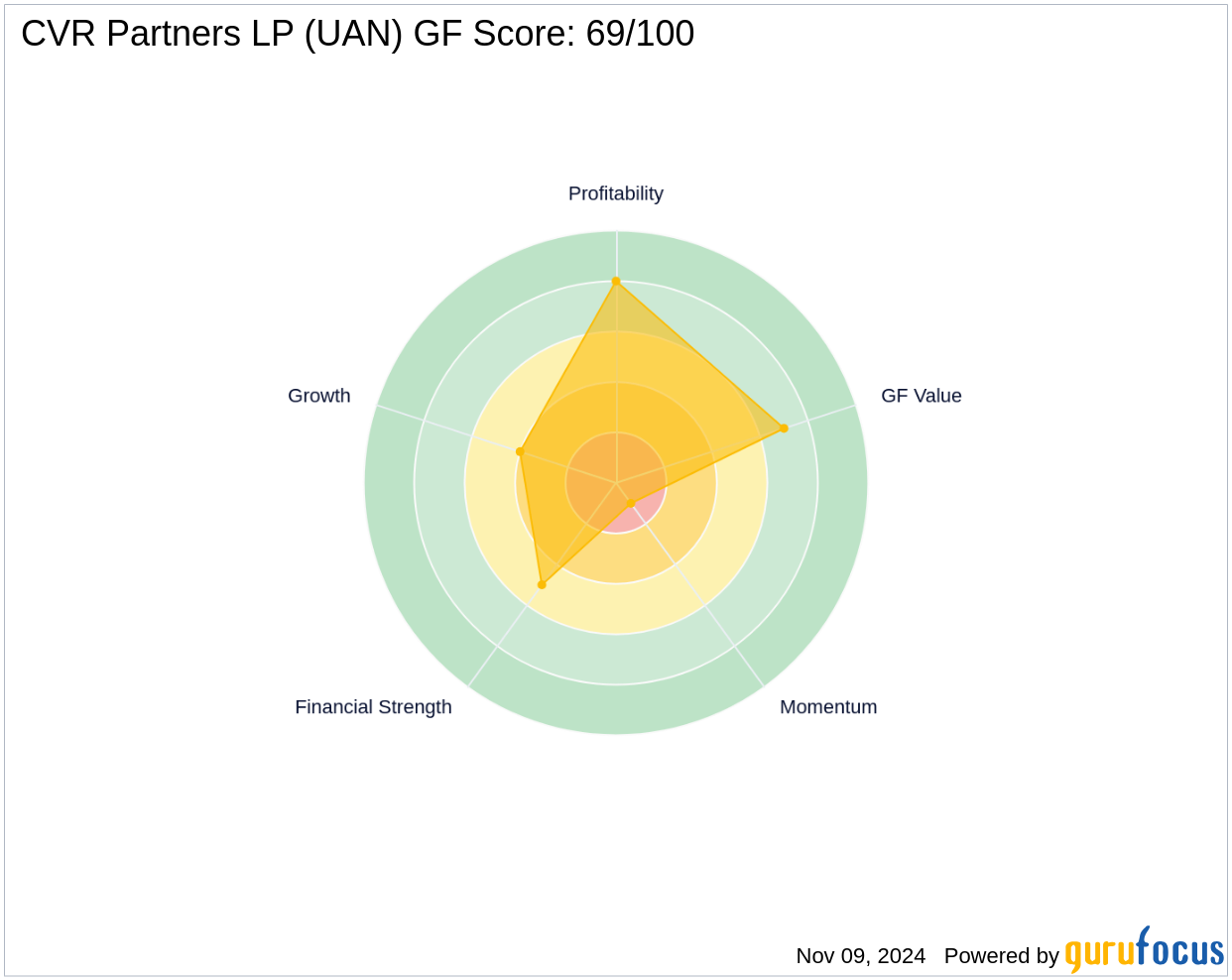

Analysis of CVR Partners LP

CVR Partners LP specializes in the production of nitrogen fertilizer products such as Urea Ammonium Nitrate (UAN, Financial) and ammonia, primarily serving agricultural sectors across key U.S. states. Despite a challenging market, CVR Partners maintains a solid operational base, reflected in its profitability rank of 8/10 and a Operating Margin growth of 83.10%.

Market Position and Performance Analysis

With a market capitalization of approximately $729.728 million and a current stock price of $69.04, CVR Partners is positioned as a significant entity within the agriculture industry. The stock is currently deemed "Fairly Valued" according to the GF Value, with a GF Value of $69.37. The stock's year-to-date performance shows a modest increase of 1.71%, indicating stability in its market value.

Investment Rationale

The decision by Icahn to increase its stake in CVR Partners likely stems from the firm's solid financial metrics and the potential for growth in the agricultural sector. The company's strong Profitability Rank and consistent revenue growth are key factors that make it an attractive investment. Moreover, the strategic importance of nitrogen-based fertilizers in agriculture could signal robust future demand, aligning with Icahn's investment strategy of choosing undervalued companies with growth potential.

Comparative Context and Future Outlook

Within Icahn's portfolio, CVR Partners LP stands out not only for its sizeable share but also for its strategic relevance in the energy and utilities sectors. Looking ahead, the agriculture industry's dynamics and CVR Partners' role within it suggest potential for both short-term gains and long-term growth, contingent on market conditions and operational efficiencies.

In conclusion, this recent acquisition by Carl Icahn (Trades, Portfolio)'s firm not only reinforces its strategic positioning within CVR Partners LP but also highlights a calculated bet on the future of the agricultural sector and nitrogen fertilizer market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: