Acacia Research Corp (ACTG, Financial) released its 8-K filing on November 12, 2024, detailing its financial performance for the third quarter of 2024. The company, which focuses on acquiring and operating businesses in the industrial, energy, and technology sectors, reported a significant increase in revenue but faced challenges in meeting analyst expectations.

Company Overview

Acacia Research Corp is dedicated to acquiring and managing businesses across various sectors, leveraging its expertise and capital to drive value. The company evaluates opportunities based on cash flow attractiveness and operates on principles of people, process, and performance.

Performance and Challenges

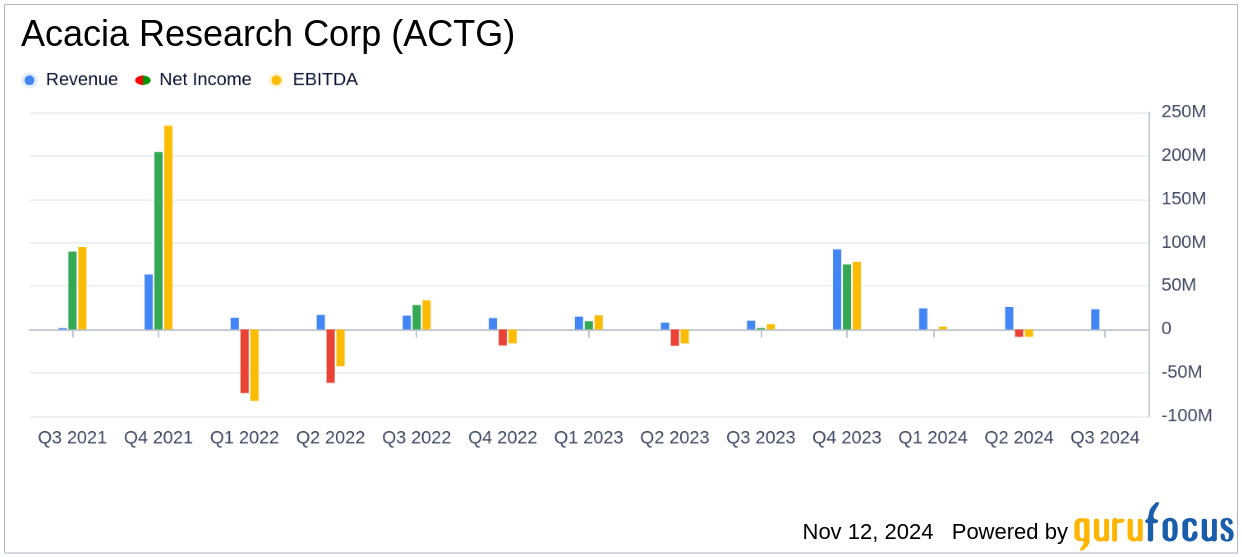

For the third quarter of 2024, Acacia Research Corp reported consolidated revenue of $23.3 million, marking a 131% increase from the same period last year. Despite this growth, the company recorded a GAAP net loss of $14.0 million, or $0.14 per diluted share, missing the analyst estimate of $0.11 loss per share. The revenue also fell short of the estimated $27.25 million.

Financial Achievements and Industry Impact

The company's energy operations generated $15.8 million in revenue, while industrial operations contributed $7.0 million. These segments showed quarter-over-quarter growth of 12% and 11%, respectively. Acacia's ability to generate $70.4 million in operating cash flow over the first nine months of 2024 underscores its operational efficiency and strategic focus.

Income Statement and Key Metrics

Acacia's total revenue for the quarter was $23.3 million, with energy operations leading the revenue generation. However, the company faced a GAAP operating loss of $10.3 million, primarily due to increased costs and expenses totaling $33.6 million. The company's book value per share stood at $5.85 as of September 30, 2024, slightly down from $5.90 at the end of 2023.

| Metric | Q3 2024 | Q3 2023 |

|---|---|---|

| Total Revenue | $23.3 million | $10.1 million |

| GAAP Net Loss | $(14.0) million | $1.6 million |

| Operating Cash Flow (9 months) | $70.4 million | N/A |

Strategic Developments

Acacia's acquisition of Deflecto Acquisition, Inc. for $103.7 million post-quarter end is a strategic move aimed at enhancing its portfolio. This acquisition is expected to contribute significantly to future revenue streams, with Deflecto projected to generate $128-$136 million in revenue for 2024.

Martin (“MJ”) D. McNulty, Jr., Chief Executive Officer, stated, “Acacia’s third quarter results reflect the Company’s unwavering focus on value creation via its core technology, energy and industrials verticals.”

Analysis and Outlook

While Acacia Research Corp has demonstrated robust revenue growth, the net loss and missed earnings estimates highlight ongoing challenges. The company's strategic acquisitions and cash flow generation capabilities position it well for future growth, but careful management of costs and integration of new assets will be crucial for improving profitability.

Investors and stakeholders will be keenly observing how Acacia leverages its recent acquisitions and manages its operational costs to enhance shareholder value in the coming quarters.

Explore the complete 8-K earnings release (here) from Acacia Research Corp for further details.