On November 12, 2024, Vroom Inc (VRM, Financial) released its 8-K filing detailing the financial results for the third quarter ending September 30, 2024. Vroom Inc, an end-to-end e-commerce platform for the used vehicles industry, is focused on maximizing the value of its remaining assets following the wind-down of its e-commerce automotive dealer business. The company operates through three segments: E-commerce, Wholesale, and Retail Financing.

Financial Performance and Challenges

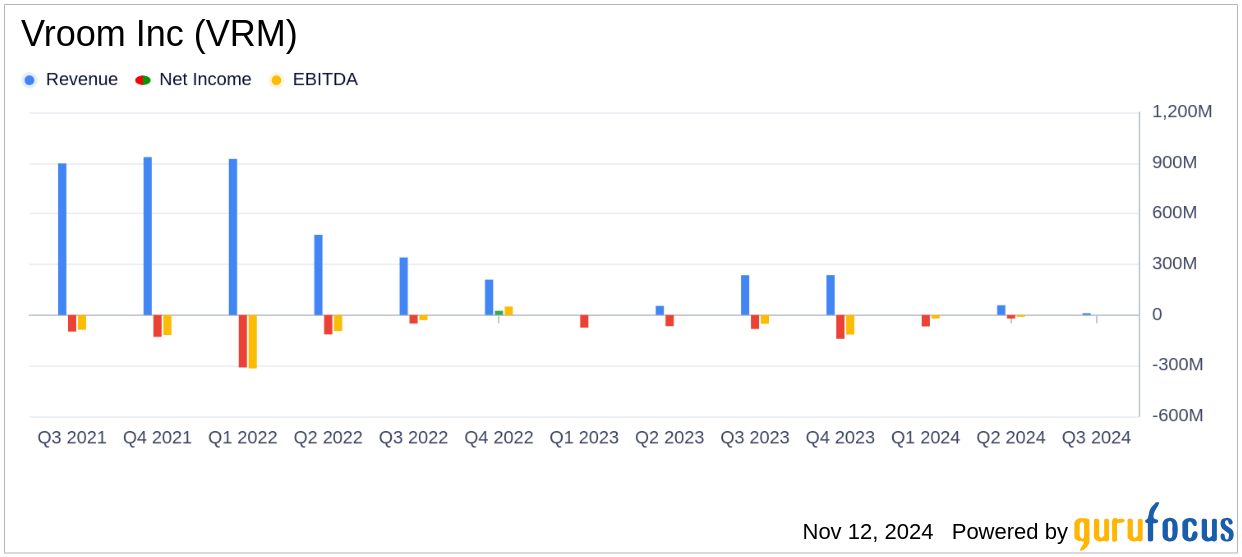

Vroom Inc reported a net loss from continuing operations of $37.7 million for the third quarter of 2024, compared to a loss of $34.7 million in the same period last year. The company also recorded an adjusted EBITDA loss of $25.5 million. These figures underscore the ongoing challenges Vroom faces as it restructures its business model and addresses its financial obligations.

The company has entered into an agreement to restructure $290 million of unsecured convertible notes into equity through a prepackaged Chapter 11 case. This strategic move is aimed at strengthening the balance sheet by eliminating unsecured notes, thereby positioning Vroom for long-term growth without long-term debt obligations.

Financial Achievements and Industry Context

Despite the challenges, Vroom Inc reported $51.1 million in cash and cash equivalents and $32.9 million of liquidity available to its subsidiary UACC under warehouse credit facilities. These financial resources are crucial for maintaining operational stability and supporting the company's strategic initiatives in the competitive Vehicles & Parts industry.

Income Statement and Key Metrics

Interest income for the quarter was $50.2 million, a slight increase from $47.6 million in the previous year. However, total interest expenses rose to $15.3 million from $11.6 million, impacting net interest income, which decreased to $34.9 million from $36.0 million. The increase in interest expenses is primarily attributed to higher costs associated with warehouse credit facilities and securitization debt.

| Metric | Q3 2024 | Q3 2023 | Change |

|---|---|---|---|

| Net Loss from Continuing Operations | $(37.7) million | $(34.7) million | $(3.0) million |

| Adjusted EBITDA | $(25.5) million | N/A | N/A |

| Cash and Cash Equivalents | $51.1 million | N/A | N/A |

Strategic Commentary

Tom Shortt, the Company’s Chief Executive Officer, stated, “Since winding down our ecommerce used automotive dealer business, we have been focused on maximizing the value of our remaining assets for our stakeholders. We believe eliminating our unsecured notes will significantly strengthen our balance sheet and allow us to emerge without any long-term debt at Vroom, Inc., while its subsidiary, UACC, will continue to be obligated to debt that is related to asset-backed securitizations and their trust preferred securities.”

Analysis and Outlook

Vroom Inc's strategic focus on debt restructuring and asset maximization is critical as it navigates the challenges of transitioning from its previous business model. The company's ability to maintain liquidity and manage interest expenses will be pivotal in achieving its long-term growth objectives. The restructuring of unsecured notes into equity is a significant step towards financial stability, potentially enhancing investor confidence and positioning Vroom for future success in the evolving automotive industry.

Explore the complete 8-K earnings release (here) from Vroom Inc for further details.